Frontier Communications 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

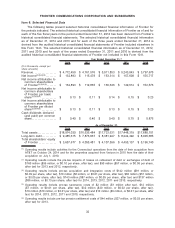

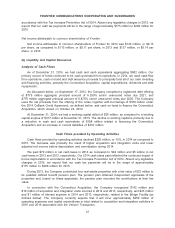

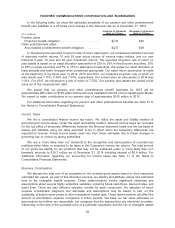

INVESTMENT AND OTHER INCOME, NET / LOSSES ON EARLY EXTINQUISHMENT OF DEBT /

INTEREST EXPENSE / INCOME TAX EXPENSE

($ in thousands) Amount

$ Increase

(Decrease)

% Increase

(Decrease) Amount

$ Increase

(Decrease)

% Increase

(Decrease) Amount

2014 2013 2012

Investment and other income, net . . . $ 38,996 $ 29,819 325% $ 9,177 $(10,955) (54)% $ 20,132

Losses on early extinguishment of

debt . . . .......................... $ — $(159,780) (100)% $159,780 $ 69,417 77% $ 90,363

Interest expense.................... $695,500 $ 28,102 4% $667,398 $(20,587) (3)% $687,985

Income tax expense . . .............. $ 30,544 $ (16,698) (35)% $ 47,242 $(28,396) (38)% $ 75,638

Investment and Other Income, Net

Investment and other income, net for 2014 increased $30 million primarily due to a $25 million

gain on the sale of our minority interest in a wireless partnership and a $12 million gain on the sale of

an intangible asset not part of our operations.

Investment and other income, net for 2013 decreased $11 million primarily due to an investment

gain of $10 million in 2012.

Losses on Early Extinguishment of Debt

During 2013, we recognized a loss of $160 million on the early extinguishment of debt in

connection with various debt tender offers, privately negotiated transactions and open market

repurchases that resulted in the retirement of $1,002 million in senior notes.

Similarly, in 2012 we recognized a loss of $90 million on the early extinguishment of $713 million

in senior notes.

Interest expense

Interest expense for 2014 increased $28 million, or 4%, primarily due to interest on the $1.9 billion

debt financing completed in September and October 2014, as well as $23 million in commitment fees

for the Bridge Facility (as defined below) related to the Connecticut Acquisition, partially offset by the

lower average debt levels during the first nine months of the year resulting from the refinancing

activities and early retirements in 2013. Our composite average borrowing rate as of December 31,

2014 was 7.62%.

Interest expense for 2013 decreased $21 million, or 3%, primarily due to lower average debt levels

resulting from the debt refinancing activities and early retirements, partially offset by the registered debt

offering of $750 million of senior unsecured notes due 2024. Our composite average borrowing rate as

of December 31, 2013 was 7.95%.

Income tax expense

Income tax expense for 2014 decreased $17 million, or 35%, and our effective tax rate was 18.7%

as compared with 29.0% for 2013 and 33.0% for 2012. The decrease was primarily due to a change in

deferred taxes arising from the inclusion of the Connecticut operations in the state unitary filings.

Income tax expense for 2013 decreased $28 million, or 38%, primarily due to lower pretax income

in 2013. Income taxes for 2013 reflect the impact of a $7 million net benefit resulting from the

adjustment of deferred tax balances, a $5 million benefit from federal research and development

credits and a $2 million benefit from the net reversal of reserves for uncertain tax positions, partially

offset by the impact of an expense of $5 million resulting from the settlement of the 2010 IRS audit, as

well as an expense of $3 million resulting from non-deductible transaction costs.

We paid $70 million, $94 million and $5 million in net cash taxes in 2014, 2013 and 2012,

respectively. Our 2014 cash taxes paid reflected the continued impact of bonus depreciation in

40

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES