Frontier Communications 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of the systems conversion related to the 2010 Acquisition and the lower contribution factor for end user

USF in 2013, partially offset by increased fleet costs.

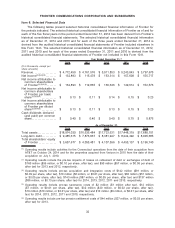

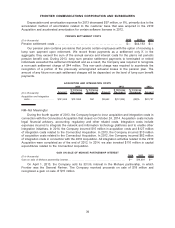

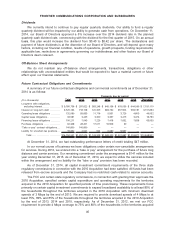

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

2014 2013 2012

($ in thousands)

Consolidated

Amount

Connecticut

Operations Amount

$ Increase

(Decrease)

%Increase

(Decrease) Amount

$ Increase

(Decrease)

% Increase

(Decrease) Amount

Frontier Legacy

Selling, general and

administrative

expenses......... $1,088,180 $29,798 $1,058,382 $869 0% $1,057,513 $(43,348) (4)% $1,100,861

Selling, general and administrative expenses (SG&A expenses) for 2014, which include the

salaries, wages and related benefits and the related costs of corporate and sales personnel, travel,

insurance, non-network related rent, advertising and other administrative expenses, increased

$1 million. This increase was primarily due to higher agent commission costs, additional compensation

costs related to our new partnership with Intuit, and an increase in certain litigation reserves in the first

quarter of 2014, mostly offset by lower allocated costs for certain benefits, including pension and

OPEB expense (as discussed below), and lower facilities costs.

SG&A expenses for 2013 decreased $43 million, or 4%, primarily due to lower costs for

compensation resulting from lower average employee headcount, lower severance costs and lower

advertising costs, partially offset by higher agent commission costs.

Pension and OPEB Costs

Pension and OPEB costs for the Company are allocated costs and included in network related

expenses and SG&A expenses. Pension and OPEB costs, excluding the impact of pension settlement

costs, for 2014, 2013 and 2012 were approximately $59 million, $78 million and $66 million,

respectively. Pension and OPEB costs include pension and OPEB expense of $74 million, $97 million

and $82 million, less amounts capitalized into the cost of capital expenditures of $15 million,

$19 million and $16 million, respectively.

Based on current assumptions and plan asset values, we estimate that our 2015 pension and

OPEB costs (which were $74 million in 2014, excluding the impact of amounts capitalized into the cost

of capital expenditures) will be approximately $85 million to $105 million, excluding the impact of

amounts capitalized into the cost of capital expenditures.

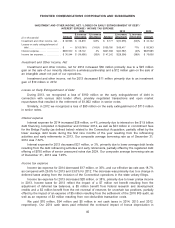

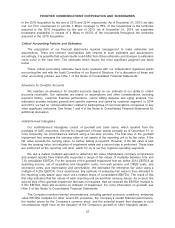

DEPRECIATION AND AMORTIZATION

2014 2013 2012

($ in thousands)

Consolidated

Amount

Connecticut

Operations Amount

$ Increase

(Decrease)

% Increase

(Decrease) Amount

$ Increase

(Decrease)

% Increase

(Decrease) Amount

Frontier Legacy

Depreciation

expense . . . . . . $ 835,470 $38,018 $ 797,452 $(44,003) (5)% $ 841,455 $ (3,186) (0)% $ 844,641

Amortization

expense . . . . . . 303,472 19,985 283,487 (44,558) (14)% 328,045 (94,121) (22)% 422,166

$1,138,942 $58,003 $1,080,939 $(88,561) (8)% $1,169,500 $(97,307) (8)% $1,266,807

Depreciation and amortization expense for 2014 decreased $89 million, or 8%, primarily due to the

accelerated method of amortization related to the customer base that was acquired in the 2010

Acquisition and changes in the remaining useful lives of certain plant assets and a lower net asset

base. We anticipate depreciation expense of approximately $960 million to $980 million and

amortization expense of approximately $345 million for 2015, including a full year associated with the

Connecticut operations.

38

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES