Frontier Communications 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

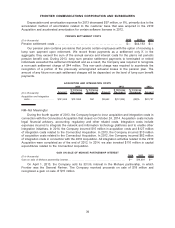

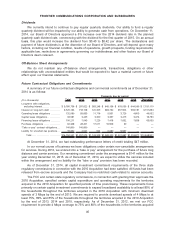

In the following table, we show the estimated sensitivity of our pension and other postretirement

benefit plan liabilities to a 25 basis point change in the discount rate as of December 31, 2014:

($ in millions)

Increase in Discount

Rate of 25 bps

Decrease in Discount

Rate of 25 bps

Pension plans

Projected benefit obligation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(79) $84

Other postretirement plans

Accumulated postretirement benefit obligation . . . . . . . . . . . $(27) $29

In developing the expected long-term rate of return assumption, we considered published surveys

of expected market returns, 10 and 20 year actual returns of various major indices, and our own

historical 5 year, 10 year and 20 year investment returns. The expected long-term rate of return on

plan assets is based on an asset allocation assumption of 35% to 55% in fixed income securities, 35%

to 55% in equity securities and 5% to 15% in alternative investments. We review our asset allocation at

least annually and make changes when considered appropriate. Our asset return assumption is made

at the beginning of our fiscal year. In 2012, 2013 and 2014, our expected long-term rate of return on

plan assets was 7.75%, 8.00% and 7.75%, respectively. Our actual return on plan assets in 2014 was

11.9%. For 2015, we will assume a rate of return of 7.75%. Our pension plan assets are valued at fair

value as of the measurement date.

We expect that our pension and other postretirement benefit expenses for 2015 will be

approximately $85 million to $105 million before amounts capitalized into the cost of capital expenditures.

We expect to make contributions to our pension plan of approximately $100 million in 2015.

For additional information regarding our pension and other postretirement benefits see Note 16 to

the Notes to Consolidated Financial Statements.

Income Taxes

We file a consolidated federal income tax return. We utilize the asset and liability method of

accounting for income taxes. Under the asset and liability method, deferred income taxes are recorded

for the tax effect of temporary differences between the financial statement basis and the tax basis of

assets and liabilities using tax rates expected to be in effect when the temporary differences are

expected to reverse. Actual income taxes could vary from these estimates due to future changes in

governing law or review by taxing authorities.

We use a “more likely than not” threshold to the recognition and derecognition of uncertain tax

positions either taken or expected to be taken in the Company’s income tax returns. The total amount

of our gross tax liability for tax positions that may not be sustained under a “more likely than not”

threshold amounts to $19.7 million as of December 31, 2014 including interest of $0.4 million. For

additional information regarding our accounting for income taxes see Note 11 of the Notes to

Consolidated Financial Statements.

Business Combinations

We allocate the total cost of an acquisition to the underlying net assets based on their respective

estimated fair values. As part of this allocation process, we identify and attribute values and estimated

lives to the intangible assets acquired. These determinations involve significant estimates and

assumptions about several highly subjective variables, including future cash flows, discount rates, and

asset lives. There are also different valuation models for each component, the selection of which

requires considerable judgment. Our estimates and assumptions may be based, in part, on the

availability of listed market prices or other transparent market data. These determinations will affect the

amount of amortization expense recognized in future periods. We base our fair value estimates on

assumptions we believe are reasonable, but recognize that the assumptions are inherently uncertain.

Depending on the size of the purchase price of a particular acquisition and the mix of intangible assets

49

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES