Frontier Communications 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.considered to be impaired, the impairment is measured by the amount by which the carrying amount of

the assets exceeds the estimated fair value. Also, we periodically reassess the useful lives of our

tangible and intangible assets to determine whether any changes are required.

(h) Investments:

Investments in entities that we do not control, but where we have the ability to exercise significant

influence over operating and financial policies, are accounted for using the equity method of

accounting.

(i) Income Taxes and Deferred Income Taxes:

We file a consolidated federal income tax return. We utilize the asset and liability method of

accounting for income taxes. Under the asset and liability method, deferred income taxes are recorded

for the tax effect of temporary differences between the financial statement basis and the tax basis of

assets and liabilities using tax rates expected to be in effect when the temporary differences are

expected to reverse.

(j) Stock Plans:

We have various stock-based compensation plans. Awards under these plans are granted to

eligible officers, management employees, non-management employees and non-employee directors.

Awards may be made in the form of incentive stock options, non-qualified stock options, stock

appreciation rights, restricted stock, restricted stock units or other stock-based awards, including

awards with performance, market and time-vesting conditions. Our general policy is to issue shares

from treasury upon the grant of restricted shares, earning of performance shares and the exercise of

options.

The compensation cost recognized is based on awards ultimately expected to vest. U.S. GAAP

requires forfeitures to be estimated and revised, if necessary, in subsequent periods if actual forfeitures

differ from those estimates.

(k) Net Income Per Common Share Attributable to Common Shareholders:

Basic net income per common share is computed using the weighted average number of common

shares outstanding during the period being reported on, excluding unvested restricted stock awards.

The impact of dividends paid on unvested restricted stock awards have been deducted in the

determination of basic and diluted net income per common share attributable to common shareholders

of Frontier. Except when the effect would be antidilutive, diluted net income per common share reflects

the dilutive effect of certain common stock equivalents, as described further in Note 12—Net Income

Per Common Share.

(l) Disaggregation of Network Related Expenses and Selling, General and Administrative

Expenses:

Historically, the Company has included network related expenses such as facility rent, utilities,

maintenance and other costs, each related to the operation of Frontier’s communications network, as

well as salaries, wages and related benefits associated with personnel who are responsible for the

delivery of services as well as operation and maintenance of its communications network, within the

line item “Other operating expenses” in its Consolidated Statements of Income. Effective with the year

ended December 31, 2014, these network related expenses are being reported separately as “Network

related expenses” in the Consolidated Statements of Income.

F-12

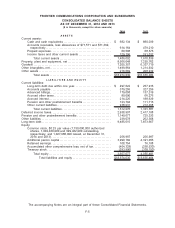

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements