Frontier Communications 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Internal Control—Integrated Framework

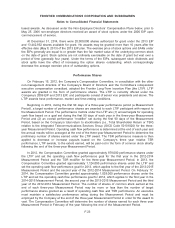

In May 2013, the Committee of Sponsoring Organizations of the Treadway Commission (COSO)

issued its updated Internal Control—Integrated Framework (the 2013 Framework) and related

illustrative documents. The original COSO Framework was published in 1992 and was recognized as

the leading guidance for designing, implementing and conducting internal controls over external

financial reporting and assessing its effectiveness. The 2013 Framework is expected to help

organizations design and implement internal control in light of many changes in business and operating

environments since the issuance of the original Framework, broaden the application of internal control

in addressing operations and reporting objectives, and clarify the requirements for determining what

constitutes effective internal control. We adopted the 2013 Framework during 2014, which did not have

a significant impact on the Company.

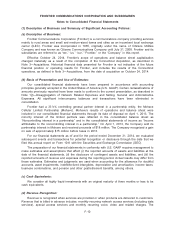

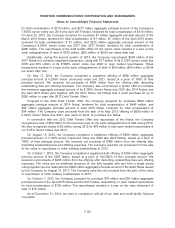

(3) Acquisitions:

The Connecticut Acquisition

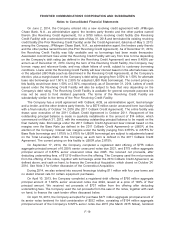

On October 24, 2014, pursuant to the stock purchase agreement dated December 16, 2013, as

amended, the Company acquired the wireline properties of AT&T Inc. (AT&T) in Connecticut (the

Connecticut Acquisition) for a purchase price of $2 billion in cash, excluding adjustments for working

capital. Following the Connecticut Acquisition, Frontier now owns and operates the wireline business

and fiber optic network servicing residential, commercial and wholesale customers in Connecticut (the

Connecticut operations). The Company also acquired the AT&T U-versevideo and DISH satellite TV

customers in Connecticut. See Note 7 for further discussion related to financing the Connecticut

Acquisition.

In connection with the Connecticut Acquisition, the Company incurred $142 million of operating

expenses, consisting of $15 million and $127 million of acquisition and integration costs, respectively,

and $116 million in capital expenditures related to the Connecticut Acquisition during 2014. The

Company incurred $10 million of acquisition costs related to the Connecticut Acquisition during the

fourth quarter of 2013.

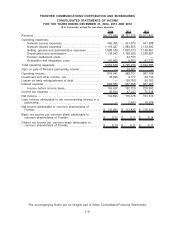

Our consolidated statement of income for the year ended December 31, 2014 includes

$216 million of revenue and $38 million of operating income related to the results of the Connecticut

operations from the date of its acquisition on October 24, 2014.

The allocation of the purchase price of the Connecticut operations was based on the fair value of

assets acquired and liabilities assumed as of October 24, 2014, the effective date of the Connecticut

Acquisition. Our assessment of fair value is preliminary, and will be adjusted for information that is

currently not available to us, primarily related to the tax basis of assets acquired, certain accruals and

contingencies, pension assets and liabilities, as well as other assumed postretirement benefit

obligations.

The fair value amounts recorded for the allocation of the purchase price as of October 24, 2014

are preliminary and certain items are subject to change. The most significant items include: legal and

tax accruals; accounts receivable; property, plant and equipment; customer list intangibles; other

working capital “true-up” adjustments; deferred income tax assets and liabilities, pending AT&T

providing us with tax values for the assets and liabilities of the Connecticut operations; and pension

and other postretirement liabilities, pending completion of actuarial studies and the related transfer of

pension assets.

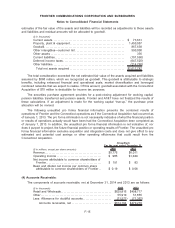

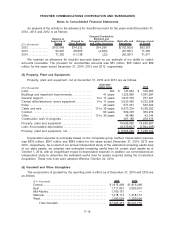

The preliminary allocation of the purchase price presented below represents the effect of recording

the preliminary estimates of the fair value of assets acquired, liabilities assumed and related deferred

income taxes as of the date of the Connecticut Acquisition, based on the total transaction consideration

of $2,018 million. These preliminary estimates will be revised in future periods and the revisions may

materially affect the presentation of our consolidated financial results. Any changes to the initial

F-14

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements