Frontier Communications 2014 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2014 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

December 31, 2014, 2013 and 2012, respectively. Excluding 48,800 additional business customers

attributable to the Connecticut Acquisition in 2014, we lost approximately 14,900, 15,300 and 23,800

business customers, net, during 2014, 2013 and 2012, respectively. Average monthly business

revenue per customer (business ARPC) increased $7.11, or 1%, to $661.15 during 2014 as compared

to 2013. The overall increase in business ARPC is primarily due to declining customer counts for our

small business customers that generate a lower ARPC and the addition of certain medium and large-

sized customers acquired during the Connecticut Acquisition. On a comparable full year basis, the

Company expects the declines in voice services revenue and wireless backhaul from business

customers to continue in 2015, mitigated, in part, by increases in business data services and video

services revenue.

During 2014, the Company added approximately 507,200 net broadband subscribers. Excluding

398,600 broadband subscribers attributable to the Connecticut Acquisition, we added approximately

108,700 net broadband subscribers in 2014. During 2013 and 2012, the Company added approximately

112,250 and 23,400 net broadband subscribers, respectively. The Company had 2,373,900 broadband

subscribers at December 31, 2014. As of December 31, 2014, approximately 68% of our residential

broadband customers subscribed to a bundle of services. As of December 31, 2014, we were able to

offer broadband to approximately 7.8 million households, or 92% of the 8.5 million households in our

markets. The increase in broadband subscribers contributed to our improved data services revenue

performance. We continue to invest in network speed and capacity to support our goal of increasing

broadband penetration and market share. We expect to continue to increase broadband subscribers in

2015. We offer FiOSvideo services in three states, Frontier TV powered by U-versein Connecticut

and satellite video services through DISH throughout our territories. In addition, we gained 201,300 video

subscribers, net during 2014, including 196,400 video subscribers attributable to the Connecticut

Acquisition. At December 31, 2014, we had 586,600 video customers.

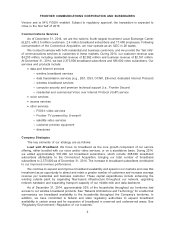

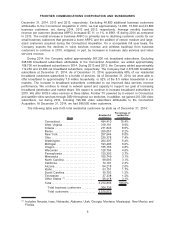

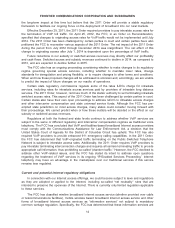

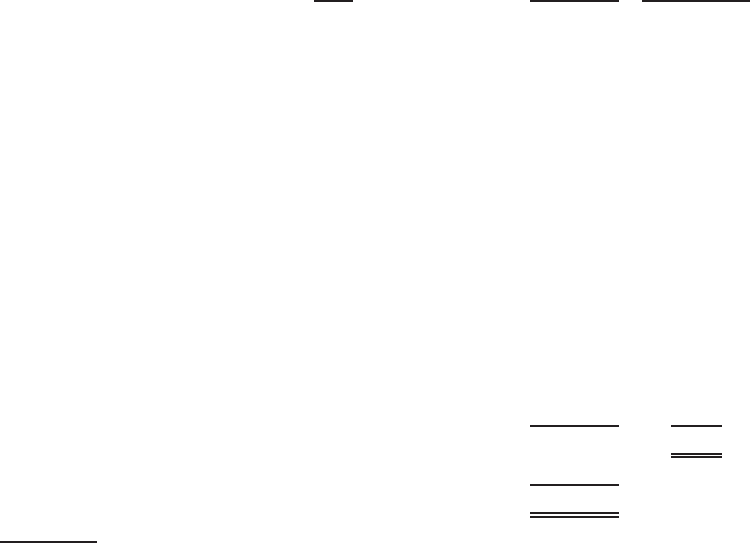

The following table sets forth total residential customers by state as of December 31, 2014:

State

Residential

customers

Percentage of

residential

customers

Connecticut. . . . . . . . . . . . . . . . . . . . . . . . . . 494,410 15.4%

West Virginia . . . . . . . . . . . . . . . . . . . . . . . . 319,191 9.9%

Indiana . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 271,843 8.5%

Illinois . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 265,057 8.2%

New York. . . . . . . . . . . . . . . . . . . . . . . . . . . . 257,944 8.0%

Ohio . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 239,378 7.4%

Washington. . . . . . . . . . . . . . . . . . . . . . . . . . 204,307 6.4%

Michigan . . . . . . . . . . . . . . . . . . . . . . . . . . . . 193,496 6.0%

Oregon . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 155,163 4.8%

Wisconsin . . . . . . . . . . . . . . . . . . . . . . . . . . . 128,794 4.0%

Pennsylvania . . . . . . . . . . . . . . . . . . . . . . . . 120,393 3.7%

Minnesota . . . . . . . . . . . . . . . . . . . . . . . . . . . 100,749 3.1%

North Carolina . . . . . . . . . . . . . . . . . . . . . . . 99,093 3.1%

California . . . . . . . . . . . . . . . . . . . . . . . . . . . . 74,101 2.3%

Arizona. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 64,218 2.0%

Idaho. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53,151 1.7%

South Carolina. . . . . . . . . . . . . . . . . . . . . . . 39,792 1.2%

Tennessee . . . . . . . . . . . . . . . . . . . . . . . . . . 37,338 1.2%

Other States (1) . . . . . . . . . . . . . . . . . . . . . . 96,418 3.1%

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,214,836 100.0%

Total business customers . . . . . . . . . . 304,736

Total customers . . . . . . . . . . . . . . . . . . . 3,519,572

(1) Includes Nevada, Iowa, Nebraska, Alabama, Utah, Georgia, Montana, Mississippi, New Mexico and

Florida.

9

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES