Frontier Communications 2014 Annual Report Download - page 71

Download and view the complete annual report

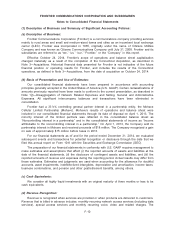

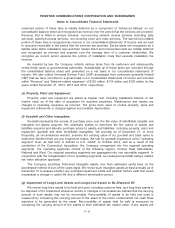

Please find page 71 of the 2014 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(1) Description of Business and Summary of Significant Accounting Policies:

(a) Description of Business:

Frontier Communications Corporation (Frontier) is a communications company providing services

mainly to rural areas and small and medium-sized towns and cities as an incumbent local exchange

carrier (ILEC). Frontier was incorporated in 1935, originally under the name of Citizens Utilities

Company and was known as Citizens Communications Company until July 31, 2008. Frontier and its

subsidiaries are referred to as “we,” “us,” “our,” “Frontier,” or the “Company” in this report.

Effective October 24, 2014, Frontier’s scope of operations and balance sheet capitalization

changed materially as a result of the completion of the Connecticut Acquisition, as described in

Note 3—Acquisitions. Historical financial data presented for Frontier is not indicative of the future

financial position or operating results for Frontier, and includes the results of the Connecticut

operations, as defined in Note 3—Acquisitions, from the date of acquisition on October 24, 2014.

(b) Basis of Presentation and Use of Estimates:

Our consolidated financial statements have been prepared in accordance with accounting

principles generally accepted in the United States of America (U.S. GAAP). Certain reclassifications of

amounts previously reported have been made to conform to the current presentation, as described in

Note 1(l)—Disaggregation of Network Related Expenses and Selling, General and Administrative

Expenses. All significant intercompany balances and transactions have been eliminated in

consolidation.

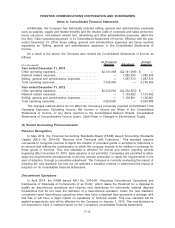

Frontier had a 33

1

⁄

3

% controlling general partner interest in a partnership entity, the Mohave

Cellular Limited Partnership (Mohave). Mohave’s results of operations and balance sheet were

included in our consolidated financial statements through its date of disposal on April 1, 2013. The

minority interest of the limited partners was reflected in the consolidated balance sheet as

“Noncontrolling interest in a partnership” and in the consolidated statements of income as “Income

attributable to the noncontrolling interest in a partnership.” On April 1, 2013, the Company sold its

partnership interest in Mohave and received proceeds of $18 million. The Company recognized a gain

on sale of approximately $15 million before taxes in 2013.

For our financial statements as of and for the period ended December 31, 2014, we evaluated

subsequent events and transactions for potential recognition or disclosure through the date that we

filed this annual report on Form 10-K with the Securities and Exchange Commission (SEC).

The preparation of our financial statements in conformity with U.S. GAAP requires management to

make estimates and assumptions that affect (i) the reported amounts of assets and liabilities at the

date of the financial statements, (ii) the disclosure of contingent assets and liabilities, and (iii) the

reported amounts of revenue and expenses during the reporting period. Actual results may differ from

those estimates. Estimates and judgments are used when accounting for the allowance for doubtful

accounts, asset impairments, indefinite-lived intangibles, depreciation and amortization, income taxes,

business combinations, and pension and other postretirement benefits, among others.

(c) Cash Equivalents:

We consider all highly liquid investments with an original maturity of three months or less to be

cash equivalents.

(d) Revenue Recognition:

Revenue is recognized when services are provided or when products are delivered to customers.

Revenue that is billed in advance includes: monthly recurring network access services (including data

services), special access services and monthly recurring voice, video and related charges. The

F-10

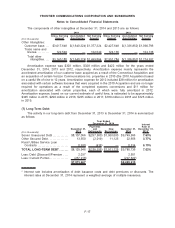

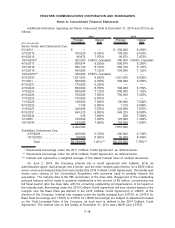

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements