Frontier Communications 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In connection with the 2010 Acquisition, the Company incurred $82 million of costs related to

integration activities during 2012. All integration activities related to the 2010 Acquisition were

completed as of the end of 2012.

Cash Flows used by Investing Activities

Capital Expenditures

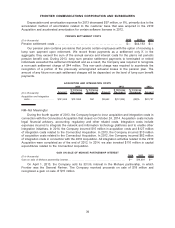

In 2014, 2013 and 2012, our capital expenditures were, respectively, $688 million, $635 million

and $803 million (including $116 million and $54 million, respectively, of integration-related capital

expenditures in 2014 for the Connecticut Acquisition and in 2012 for the 2010 Acquisition). From 2012

through 2014, Frontier received a total of $72 million from the first round of Connect America Fund

(CAF) Phase I and $61 million related to the second round of CAF Phase I to support broadband

deployment in unserved and underserved high-cost areas. In addition to the capital expenditures

mentioned above, network expansion funded by the previously received CAF funds amounted to

$56 million, $33 million and $5 million in 2014, 2013 and 2012, respectively, enabling and/or upgrading

164,000 households with broadband during that three year period. We anticipate capital expenditures

for business operations to increase in 2015 as a result of the Connecticut Acquisition to approximately

$650 million to $700 million, as compared to $572 million in 2014.

Acquisitions

On October 24, 2014, the Company acquired the wireline properties of AT&T in Connecticut for a

purchase price of $2 billion in cash, excluding adjustments for working capital. Frontier now owns and

operates the wireline business and statewide fiber network that provides services to residential,

commercial and wholesale customers in Connecticut. After including working capital adjustments of

$18 million, the total purchase price for the Connecticut Acquisition was $2,018 million.

Cash Flows used by and provided from Financing Activities

Debt Financings

Financing the Connecticut Acquisition

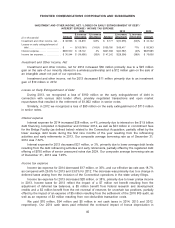

On September 17, 2014, the Company completed a registered debt offering of $775 million

aggregate principal amount of 6.250% senior unsecured notes due 2021 and $775 million aggregate

principal amount of 6.875% senior unsecured notes due 2025. We received net proceeds, after

deducting underwriting fees, of $1,519 million from the offering. The Company used the net proceeds

from the offering of the notes, together with borrowings of $350 million under the 2014 CoBank Credit

Agreement, as defined below, and cash on hand to finance the Connecticut Acquisition that closed on

October 24, 2014.

During 2014, we also entered into secured financings totaling $11 million with four year terms and

no stated interest rate for certain equipment purchases.

The 2024 Notes

On April 10, 2013, the Company completed a registered offering of $750 million aggregate

principal amount of 7.625% senior unsecured notes due 2024 (the 2024 Notes), issued at a price of

100% of their principal amount. We received net proceeds of $737 million from the offering after

deducting underwriting fees. The Company used the net proceeds from the sale of the notes, together

with cash on hand, to finance the April 2013 debt tender offers discussed below.

The 2021 Notes

On May 17, 2012, the Company completed a registered offering of $500 million aggregate

principal amount of 9.250% senior unsecured notes due 2021 (the 2021 Notes), issued at a price of

100% of their principal amount. We received net proceeds of $490 million from the offering after

42

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES