Frontier Communications 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

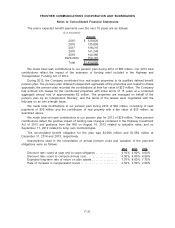

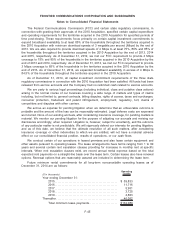

At December 31, 2014, we have outstanding performance letters of credit as follows:

($ in thousands) Amount

CNA Financial Corporation (CNA) . . . $45,659

All other. . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,186

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $46,845

CNA serves as our agent with respect to general liability claims (auto, workers compensation and

other insured perils of the Company). As our agent, they administer all claims and make payments for

claims on our behalf. We reimburse CNA for such services upon presentation of their invoice. To serve

as our agent and make payments on our behalf, CNA requires that we establish a letter of credit in

their favor. CNA could potentially draw against this letter of credit if we failed to reimburse CNA in

accordance with the terms of our agreement. The amount of the letter of credit is reviewed annually

and adjusted based on claims history.

None of the above letters of credit restrict our cash balances.

(19) Subsequent Events:

On February 5, 2015, we entered into an agreement with Verizon Communications Inc. (Verizon)

to acquire Verizon’s wireline operations that provide services to residential, commercial and wholesale

customers in California, Florida and Texas for a purchase price of $10.54 billion in cash (the Verizon

Transaction), with adjustments for working capital. Upon completion of the Verizon Transaction,

Frontier will operate Verizon properties which included 3.7 million voice connections, 2.2 million

broadband connections, and 1.2 million FiOSvideo connections. Subject to regulatory approval, the

transaction is expected to close in the first half of 2016.

Frontier has received a commitment for bridge financing from J.P. Morgan, Bank of America Merrill

Lynch and Citibank for 100 percent of the purchase price. The transaction is not subject to a financing

condition.

F-47

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements