Frontier Communications 2014 Annual Report Download - page 48

Download and view the complete annual report

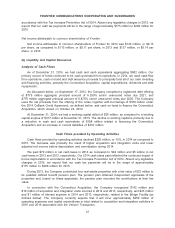

Please find page 48 of the 2014 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.in the 2010 Acquisition by the end of 2013 and 2014, respectively. As of December 31, 2013, we also

met our FCC requirement to provide 3 Mbps coverage to 85% of the households in the territories

acquired in the 2010 Acquisition by the end of 2013. As of December 31, 2014, we expanded

broadband availability in excess of 4 Mbps to 84.5% of the households throughout the territories

acquired in the 2010 Acquisition.

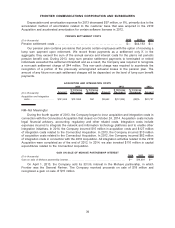

Critical Accounting Policies and Estimates

The preparation of our financial statements requires management to make estimates and

assumptions. There are inherent uncertainties with respect to such estimates and assumptions;

accordingly, it is possible that actual results could differ from those estimates and changes to estimates

could occur in the near term. The estimates which require the most significant judgment are listed

below.

These critical accounting estimates have been reviewed with our independent registered public

accounting firm and with the Audit Committee of our Board of Directors. For a discussion of these and

other accounting policies, see Note 1 of the Notes to Consolidated Financial Statements.

Allowance for Doubtful Accounts

We maintain an allowance for doubtful accounts based on our estimate of our ability to collect

accounts receivable. Our estimates are based on assumptions and other considerations, including

payment history, customer financial performance, carrier billing disputes and aging analysis. Our

estimation process includes general and specific reserves and varies by customer segment. In 2014

and 2013, we had no “critical estimates” related to bankruptcies of communications companies or any

other significant customers. See Notes 1 and 4 of the Notes to Consolidated Financial Statements for

additional discussion.

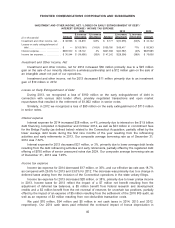

Indefinite-lived Intangibles

Our indefinite-lived intangibles consist of goodwill and trade name, which resulted from the

purchase of ILEC properties. We test for impairment of these assets annually as of December 31, or

more frequently, as circumstances warrant using a two-step process. The first step in the goodwill

impairment test compares the carrying value of net assets of the reporting unit to its fair value. If the

fair value exceeds the carrying value, no further testing is required. However, if the fair value is less

than the carrying value, an indication of impairment exists and a second step is performed. These tests

are performed at the reporting unit level, which for us is our five regional operating segments.

We use a market multiples approach to determine fair value. Marketplace company comparisons

and analyst reports have historically supported a range of fair values of multiples between 5.5x and

7.5x annualized EBITDA. For the purpose of the goodwill impairment test we define 2014 EBITDA as

operating income, net of acquisition and integration costs, non-cash pension and OPEB costs, and

severance costs, plus depreciation and amortization. We estimated the enterprise fair value using a

multiple of 6.25x EBITDA. Once determined, this estimate of enterprise fair value is then allocated to

the reporting units based upon each unit’s relative share of consolidated EBITDA. The result of this

first step indicated that fair values of each reporting unit exceed their carrying values. As a result, the

second step of the goodwill impairment test was not required. Had we reduced the EBITDA multiple to

5.75x EBITDA, there still would be no indicator of impairment. For more information on goodwill, see

Note 6 of the Notes to Consolidated Financial Statements.

The Company monitors relevant circumstances, including general economic conditions, enterprise

value EBITDA multiples for other rural ILEC properties, the Company’s overall financial performance,

the market prices for the Company’s common stock, and the potential impact that changes in such

circumstances might have on the valuation of the Company’s goodwill or other intangible assets.

47

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES