Frontier Communications 2014 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2014 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Drive Revenue Performance. We tailor our services to the needs of our residential and business

customers in the markets we serve and continually evaluate the introduction of new and complimentary

products and services. We are increasing broadband market share through innovative and simplified

product packages and promotions, and we expect to improve subscription rates for broadband

services. We provide FiOSvideo services in parts of three states, Frontier TV powered by U-verse

video services in Connecticut and direct broadcast satellite services from DISH in all of our markets.

We have implemented several growth initiatives, including new products and services, such as wireless

broadband, satellite broadband, satellite video and “Frontier Secure” computer security and premium

technical support. We will continue to focus on growing those products and services, and review

opportunities to offer new ones. Our marketing strategy includes the sale of voice, data and video

services as standalone offerings and bundled packages and the selective use of promotions and

incentives to drive market share through a variety of channels. We believe these marketing strategies

yield increased revenue per customer, strong customer relationships and improved customer retention.

Keep our Customers. Our strategy includes engaging our markets at the local level to ensure

that we have a customer-driven sales and service focus that differentiates us from our competitors.

Our markets are operated by local managers responsible for the customer experience, as well as the

financial results in these markets. We invest in infrastructure improvements and enhancements each

year, recognizing that the economic livelihood of the communities we serve will affect opportunities to

grow the business. We are involved in these communities to create a competitive advantage through

long-term customer loyalty. We are committed to providing best-in-class service throughout our

markets and, by doing so, we expect to maximize retention of current customers and gain new

customers. We continue to invest to provide an optimal customer experience to include enhancing our

customer service operations, efficiently provide service to new customers, and timely service

resolutions for existing customers.

Invest in Our Network. In 2014, Frontier continued to expand the capacity and capability of its

network. Frontier is in year two of a three-year program to deploy next generation Broadband Remote

Access Servers throughout our network to facilitate the expansion of broadband and increase

broadband speeds. Frontier continued to expand and upgrade its premium Ethernet service offerings

across its network and also achieved Metro Ethernet Forum 2.0 certification. Driven by the Connecticut

Acquisition, Frontier upgraded its VoIP platform with next generation Call Control and VoIP Application

Feature servers, which Frontier intends to leverage across the entire footprint and also provide the

capability to reach customers outside its existing markets.

Improve Productivity and Operational Efficiency. We continue to engage in productivity

initiatives in order to maintain and improve our profit margins. We focus on simplifying our processes,

eliminating redundancies and further reducing our cost structure while improving our customer service

capabilities.

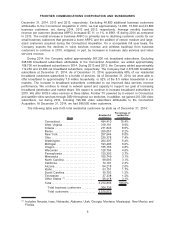

Based on current estimates and assumptions, we expect to achieve synergies with respect to the

operations acquired in the Connecticut Acquisition, principally (1) by leveraging the scalability of our

existing corporate administrative functions and information technology and network systems, (2) by

internalizing certain functions formerly provided by third-party service providers and (3) operating the

business more efficiently. We estimate that our annualized synergies resulting from our operation of

the Connecticut operations versus its historical results will reach approximately $200 million by the end

of 2017 as we implement our targeted list of initiatives. As of December 31, 2014, we estimated that

approximately $165 million of expected annualized synergies had been realized.

These future synergies are based on our current estimates and assumptions that, although we

consider them reasonable, are inherently uncertain. Significant business, economic, competitive and

regulatory uncertainties and contingencies, all of which are difficult to predict and many of which are

beyond our control, may affect these expected synergies.

Evaluate Strategic Initiatives. We selectively evaluate and may pursue strategic acquisitions that

would enhance shareholder value. On October 24, 2014, the Company acquired the wireline properties

of AT&T in Connecticut. On February 5, 2015, the Company entered into an agreement with Verizon to

5

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES