Frontier Communications 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark one)

嘺ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

OR

䡺TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER 001-11001

FRONTIER COMMUNICATIONS CORPORATION

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of

incorporation or organization)

06-0619596

(I.R.S. Employer Identification No.)

3 High Ridge Park

Stamford, Connecticut

(Address of principal executive offices)

06905

(Zip Code)

(203) 614-5600

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

Title of each class

Name of each exchange

on which registered

Common Stock, par value $.25 per share

Series A Participating Preferred Stock Purchase Rights

The NASDAQ Stock Market LLC

The NASDAQ Stock Market LLC

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes 嘺No 䡺

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes 䡺No 嘺

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes 嘺No 䡺

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any,

every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes 嘺No 䡺

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained

herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. 䡺

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer

or a smaller reporting company. See definition of “accelerated filer”, “large accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer 嘺Accelerated Filer 䡺Non-Accelerated Filer 䡺Smaller Reporting Company 䡺

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes 䡺No 嘺

The aggregate market value of common stock held by non-affiliates of the registrant on June 30, 2014 was $5,808,440,000

based on the closing price of $5.84 per share on such date.

The number of shares outstanding of the registrant’s common stock as of February 13, 2015 was 1,002,469,000.

DOCUMENT INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the Company’s 2015 Annual Meeting of Stockholders are incorporated by

reference into Part III of this Form 10-K.

Table of contents

-

Page 1

... FRONTIER COMMUNICATIONS CORPORATION (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) 06-0619596 (I.R.S. Employer Identification No.) 06905 (Zip Code) (203) 614-5600 3 High Ridge Park Stamford, Connecticut (Address... -

Page 2

... Data ...Changes in and Disagreements with Accountants on Accounting and Financial Disclosure ...Controls and Procedures ...Other Information ...PART III Directors, Executive Officers and Corporate Governance ...Executive Compensation...Security Ownership of Certain Beneficial Owners and Management... -

Page 3

..., Frontier now owns and operates the wireline broadband, voice and video business and statewide fiber network that provides services to residential, commercial and wholesale customers in Connecticut, making Connecticut our largest market. We also acquired AT&T's U-verse® video and DISH satellite TV... -

Page 4

... the Connecticut operations, total residential revenue declined 3% as compared with 2013. Our average monthly residential revenue per customer during 2014 improved by 3% as compared to the prior year. Total business revenue for 2014 decreased 1% as compared to 2013. Total business revenue for 2014... -

Page 5

... and premium technical support (i.e., Frontier Secure) - residential and commercial Voice over Internet Protocol (VoIP) service • voice services • access services • other services - FiOS® video services - Frontier TV powered by U-verse® - satellite video services - customer premise equipment... -

Page 6

... broadband speeds. Frontier continued to expand and upgrade its premium Ethernet service offerings across its network and also achieved Metro Ethernet Forum 2.0 certification. Driven by the Connecticut Acquisition, Frontier upgraded its VoIP platform with next generation Call Control and VoIP... -

Page 7

... technical support and customer service to other companies on a contract basis. We offer wireless broadband services (using unlicensed WiFi spectrum) in select markets utilizing networks that we own or operate. Long-term contracts are generally billed in advance on an annual or semi-annual basis... -

Page 8

... number of minutes in advance or on a per minute-of-use basis. We also offer packages of communications services. These packages permit customers to bundle their voice service with their choice of video and Internet services, and other product offerings. Access services. Our switched access services... -

Page 9

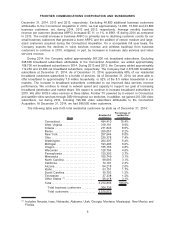

...in data services revenue. We had approximately 3,214,800, 2,803,500 and 2,887,100 total residential customers as of December 31, 2014, 2013 and 2012, respectively. Excluding 478,100 additional residential customers attributable to the Connecticut Acquisition in 2014, we lost approximately 66,800, 83... -

Page 10

...2014: State Residential customers Percentage of residential customers Connecticut ...West Virginia ...Indiana ...Illinois ...New York...Ohio ...Washington ...Michigan ...Oregon ...Wisconsin ...Pennsylvania ...Minnesota ...North Carolina ...California ...Arizona ...Idaho...South Carolina...Tennessee... -

Page 11

...of host central office and remote sites, primarily equipped with digital and Internet Protocol switches. The outside plant consists of transport and distribution delivery networks connecting our host central office with remote central offices and ultimately with our customers. We own fiber optic and... -

Page 12

... achieve our customer retention goals by offering attractive packages of value-added services. Our bundled services include broadband, voice, and video offerings, including simplified messaging services, higher speed products and digital security products. We are also focused on increasing sales of... -

Page 13

.... In other states in which we operate, we are subject to rate of return regulation that limits levels of earnings and returns on investments. Approximately 15% of our total access lines at December 31, 2014 are in state jurisdictions under the rate of return regulatory model. We will continue to... -

Page 14

...the broadband speed obligation to 10 Mbps download, extending the term of funding to six years, and providing flexibility in meeting deployment obligations. In the 2014 Order, the FCC indicated that it will provide the CAF II offer of support to the price cap carriers by state in early 2015. At that... -

Page 15

... results of operations. Certain state regulatory commissions regulate some of the rates ILECs charge for intrastate services, including rates for intrastate access services paid by providers of intrastate long distance services. The 2011 Order, however, removes much of the states' authority to set... -

Page 16

... renewals and transfers; the manner in which program packages are marketed to subscribers; and program access requirements. We provide video programming in certain of our markets in Oregon, Washington, Indiana and Connecticut pursuant to franchises, permits and similar authorizations issued by... -

Page 17

...NE, Washington, D.C. 20549 or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements and other information regarding the Company and other issuers that file electronically. We make available, free of... -

Page 18

... in the communications industry, including the effects of technological changes and competition on our capital expenditures, products and service offerings; • reductions in the number of our voice customers that we cannot offset with increases in broadband subscribers and sales of other products... -

Page 19

... cash management practices that could limit our ability to transfer cash among our subsidiaries or dividend funds up to the parent company; • the effects of severe weather events or other natural or man-made disasters, which may increase our operating expenses or adversely impact customer revenue... -

Page 20

... activities in California, Florida and Texas, including video, broadband internet and switched long distance services provided to designated customers located in those states. However, the contributed assets may not be sufficient to operate all aspects of the acquired business and the Company may... -

Page 21

... approximately $450 million of operating expenses and capital expenditures in total related to acquisition and integration activities in 2015 and 2016 associated with the Verizon Transaction; • significant interest expense and dividend costs will be incurred if Frontier completes the financing of... -

Page 22

... are able to raise capital at a lower cost than we are able to. Consequently, some of these competitors may be able to develop and expand their communications and network infrastructures more quickly, adapt more swiftly to new or emerging technologies and changes in customer requirements, take... -

Page 23

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES obligations and pay dividends pursuant to our dividend policy. We have experienced revenue declines in 2014 and 2013 as compared to prior years for our Frontier legacy operations, and our recently acquired Connecticut operations have experienced ... -

Page 24

... to its pension plan in 2014, and expects to make contributions of approximately $100 million in 2015. Volatility in our asset values, liability calculations, or returns may require us to make additional contributions in future years. Substantial debt and debt service obligations may adversely... -

Page 25

...access to capital. We cannot assure that we will be able to continue paying dividends. On December 11, 2014, our Board of Directors approved a 5% increase over the 2014 dividend rate in the planned quarterly cash dividend rate, commencing with the dividend for the first quarter of 2015. On an annual... -

Page 26

... CORPORATION AND SUBSIDIARIES a near zero rate by 2017. Frontier is permitted to recover a significant portion of those revenues through end user rates and other replacement support mechanisms. Additionally, the 2011 Order requires VoIP providers to pay interstate terminating interconnection charges... -

Page 27

... our service offerings. In addition, changes to the regulations that govern our business (including any implementation of the 2011 Order or the 2013 Order) may have an adverse effect on our business by reducing the allowable fees that we may charge, imposing additional compliance costs, reducing... -

Page 28

... of viruses, worms and other destructive or disruptive software. These activities could adversely affect our network, result in excessive call volume at our call centers and damage our or our customers' equipment and data. The Company maintains security measures, disaster recovery plans and business... -

Page 29

... and call center support offices with over 200 employees are currently located in the following leased or owned premises: • 1398 South Woodland Blvd., DeLand, Florida 32720 (Leased) • 805 Central Expressway South, Allen, Texas 75013 (Leased) • 8001 W. Jefferson Blvd., Fort Wayne, Indiana 46804... -

Page 30

... the dividends is classified as total ordinary dividends and represents qualified dividends, and a portion of the dividends is classified as non-dividend distributions and represents a return of capital. The following table indicates the high and low intra-day sales prices per share, as reported by... -

Page 31

... Stock Index and to the S&P Telecommunication Services Index for the five-year period commencing December 31, 2009. COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN Among Frontier Communications Corporation, the S&P 500 index, and the S&P Telecommunication Services Index $250 $200 $150 $100 $50... -

Page 32

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES ISSUER PURCHASES OF EQUITY SECURITIES Period Total Number of Shares Purchased Average Price Paid per Share October 1, 2014 to October 31, 2014 Employee Transactions (1) ...November 1, 2014 to November 30, 2014 Employee Transactions (1) ...... -

Page 33

... 2012, 2011 and 2010 and for each of the years ended December 31, 2011 and 2010 is derived from the audited historical consolidated financial statements of Frontier not included in this Form 10-K. 2014 ($ in thousands, except per share amounts) 2013 Year Ended December 31,(1) 2012 2011 2010 Revenue... -

Page 34

..., general and administrative expenses. There has been no change to total operating expense as a result of this reclassification. REVENUE Revenue is generated primarily through the provision of voice services, data services, video services, network access, carrier services and other Internet services... -

Page 35

... for our Frontier legacy operations declined $113 million, or 5%, as compared with 2013, principally as a result of decreases in our voice services revenue and wireless backhaul revenue. We had approximately 304,700, 270,800 and 286,100 total business customers as of December 31, 2014, 2013 and 2012... -

Page 36

...,100 residential customers, 48,800 business customers and 526,900 total customers attributable to the Connecticut Acquisition as of October 24, 2014. Calculation excludes the operations of Mohave Cellular Limited Partnership (Mohave), which was sold to Verizon Wireless on April 1, 2013. Reflects 398... -

Page 37

... 2011 Order. Long distance services revenue decreased $60 million, or 14%, primarily due to lower minutes of use driven by fewer customers and the migration to bundled packages. Data and Internet Services Data and Internet services revenues for 2014 decreased $7 million as compared with 2013. Data... -

Page 38

... to fewer FiOS® video service customers and a reduction in costs for our originating traffic associated with the implementation of the 2011 Order effective with the second half of 2012. NETWORK RELATED EXPENSES 2014 2013 2012 Frontier Legacy Consolidated Connecticut $ Increase % Increase $ Increase... -

Page 39

...057,513 $(43,348) (4)% $1,100,861 Selling, general and administrative expenses (SG&A expenses) for 2014, which include the salaries, wages and related benefits and the related costs of corporate and sales personnel, travel, insurance, non-network related rent, advertising and other administrative... -

Page 40

... certain software licenses in 2012. PENSION SETTLEMENT COSTS ($ in thousands) 2014 2013 2012 Pension settlement costs ... $- $44,163 $- Our pension plan contains provisions that provide certain employees with the option of receiving a lump sum payment upon retirement. We record these payments as... -

Page 41

... 7.95%. Income tax expense Income tax expense for 2014 decreased $17 million, or 35%, and our effective tax rate was 18.7% as compared with 29.0% for 2013 and 33.0% for 2012. The decrease was primarily due to a change in deferred taxes arising from the inclusion of the Connecticut operations in the... -

Page 42

... in 2014 and 2013, respectively, related to the Bridge Facility (as defined below). The Company currently expects that it will incur approximately $450 million of operating expenses and capital expenditures in total related to acquisition and integration activities in 2015 and 2016 associated with... -

Page 43

... adjustments for working capital. Frontier now owns and operates the wireline business and statewide fiber network that provides services to residential, commercial and wholesale customers in Connecticut. After including working capital adjustments of $18 million, the total purchase price for the... -

Page 44

... amount of April 2015 Notes, tendered for total consideration of $54 million. The Company used proceeds from the sale of its May 2012 offering of $500 million of the 2021 Notes, plus cash on hand, to purchase the Notes. The repurchases in the 2012 Debt Tender Offer for the 2014 Notes resulted in... -

Page 45

...taxes, pay dividends to our stockholders, and support our short-term and long-term operating strategies for the next twelve months. However, a number of factors, including but not limited to, losses of customers, pricing pressure from increased competition, lower subsidy and switched access revenues... -

Page 46

... the Revolving Credit Facility will also be subject to fees that vary depending on the Company's debt rating. The Revolving Credit Facility is available for general corporate purposes but may not be used to fund dividend payments. Covenants The terms and conditions contained in our indentures, the... -

Page 47

...At December 31, 2014, we had outstanding performance letters of credit totaling $47 million. In our normal course of business we have obligations under certain non-cancelable arrangements for services. During 2012, we entered into a "take or pay" arrangement for the purchase of future long distance... -

Page 48

..., including payment history, customer financial performance, carrier billing disputes and aging analysis. Our estimation process includes general and specific reserves and varies by customer segment. In 2014 and 2013, we had no "critical estimates" related to bankruptcies of communications companies... -

Page 49

... the discount rate and the expected long-term rate of return on plan assets. Our discount rate assumption is determined annually with assistance from our actuaries based on the pattern of expected future benefit payments and the prevailing rates available on long-term, high quality corporate bonds... -

Page 50

... and make changes when considered appropriate. Our asset return assumption is made at the beginning of our fiscal year. In 2012, 2013 and 2014, our expected long-term rate of return on plan assets was 7.75%, 8.00% and 7.75%, respectively. Our actual return on plan assets in 2014 was 11.9%. For 2015... -

Page 51

... course of our business operations due to ongoing investing and funding activities, including those associated with our pension plan assets. Market risk refers to the potential change in fair value of a financial instrument as a result of fluctuations in interest rates and equity prices. We do not... -

Page 52

... offset by benefit payments of $110 million. Our 2014 total contributions reflect the impact of the extension of funding relief included in the Highway and Transportation Funding Act of 2014. We expect that we will make contributions to our pension plan of approximately $100 million in 2015. Item... -

Page 53

.... The 2013 Framework is expected to help organizations design and implement internal control in light of many changes in business and operating environments since the issuance of the original Framework, broaden the application of internal control in addressing operations and reporting objectives... -

Page 54

... elected and qualified. KATHLEEN Q. ABERNATHY joined Frontier's management team in March 2010, after serving as a member of Frontier's Board of Directors from April 2006 to March 2010. She is currently Executive Vice President, External Affairs. Previously, she was Chief Legal Officer and Executive... -

Page 55

... Human Resources from 2000 to 2004. MARK D. NIELSEN joined Frontier in March 2014 as Senior Vice President, General Counsel, and Secretary. Prior to this, he was Associate General Counsel and Chief Compliance Office for Praxair Inc. From 2007 to 2009, he was Vice President and Assistant General... -

Page 56

... AT&T Inc. and the Company (filed as Exhibit 2.1 to the Company's Current Report on Form 8-K filed on December 17, 2013).* 2.2 - Securities Purchase Agreement, dated as of February 5, 2015, by and between Verizon Communications Inc. and the Company (filed as Exhibit 2.1 to the Company's Current... -

Page 57

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES Exhibit No. Description 4.3 - Fifth Supplemental...Current Report on Form 8-K filed on October 1, 2009).* 4.13 - Third Supplemental Indenture to the April 2009 Indenture, dated as of May 22, 2012, between the Company and The Bank of New York Mellon,... -

Page 58

... (filed as Exhibit 4.1 to the Company's Current Report on Form 8-K filed on April 10, 2013 (the "April 10, 2013 8-K").* 4.19 - Sixth Supplemental Indenture dated as of September 17, 2014 between Frontier Communications Corporation and The Bank of New York Mellon, as Trustee (including the form of... -

Page 59

...6, 2009).* 10.13 - 2013 Equity Incentive Plan (filed as Appendix B to the 2013 Proxy Statement).* 10.14 - Offer of Employment Letter, dated January 20, 2010, between the Company and Kathleen Abernathy (filed as Exhibit 10.35 to the Spinco Form 10).* 10.15 - Amendment, dated May 31, 2012, to Offer of... -

Page 60

... Form of LTIP Agreement for named executive officers other than CEO (filed as exhibit 10.33 to the 2012 10-K).* 10.27 - Summary of Non-Employee Directors' Compensation Arrangements Outside of Formal Plans. 12.1 - Computation of ratio of earnings to fixed charges (this item is included herein for the... -

Page 61

... has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. FRONTIER COMMUNICATIONS CORPORATION (Registrant) February 24, 2015 By: /S/ MARY AGNES WILDEROTTER Mary Agnes Wilderotter Chairman of the Board and Chief Executive Officer Pursuant to the... -

Page 62

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES Index to Consolidated Financial Statements Item Page Management's Report on Internal Control Over Financial Reporting ...Reports of Independent Registered Public Accounting Firm ...Consolidated Balance Sheets as of December 31, 2014 and 2013 ...... -

Page 63

... REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING The Board of Directors and Shareholders Frontier Communications Corporation: The management of Frontier Communications Corporation and subsidiaries is responsible for establishing and maintaining adequate internal control over financial reporting... -

Page 64

... position of Frontier Communications Corporation and subsidiaries as of December 31, 2014 and 2013, and the results of their operations and their cash flows for each of the years in the three-year period ended December 31, 2014, in conformity with U.S. generally accepted accounting principles... -

Page 65

..., or that the degree of compliance with the policies or procedures may deteriorate. In our opinion, Frontier Communications Corporation and subsidiaries maintained, in all material respects, effective internal control over financial reporting as of December 31, 2014, based on criteria established in... -

Page 66

...,000,000 authorized shares, 1,002,469,000 and 999,462,000 outstanding, respectively, and 1,027,986,000 issued, at December 31, 2014 and 2013) ...Additional paid-in capital ...Retained earnings ...Accumulated other comprehensive loss, net of tax ...Treasury stock ...Total equity ...Total liabilities... -

Page 67

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME FOR THE YEARS ENDED DECEMBER 31, 2014, 2013 AND 2012 ($ in thousands, except for per-share amounts) 2014 2013 2012 Revenue ...Operating expenses: Network access expenses ...Network related expenses ...Selling, ... -

Page 68

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) FOR THE YEARS ENDED DECEMBER 31, 2014, 2013 AND 2012 ($ in thousands) 2014 2013 2012 Net income...$ 132,893 $115,478 $153,314 Pension settlement costs, net of tax (see Notes 13 and 16) ...- ... -

Page 69

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF EQUITY FOR THE YEARS ENDED DECEMBER 31, 2014, 2013 AND 2012 ($ and shares in thousands) Equity of Frontier Accumulated Additional Other Common Stock Paid-In Retained Comprehensive Treasury Stock Noncontrolling Capital ... -

Page 70

... activities: Cash paid for the Connecticut Acquisition ...Capital expenditures-Business operations ...Capital expenditures-Integration activities ...Network expansion funded by Connect America Fund ...Grant funds received for network expansion from Connect America Fund ...Proceeds on sale of assets... -

Page 71

...: Revenue is recognized when services are provided or when products are delivered to customers. Revenue that is billed in advance includes: monthly recurring network access services (including data services), special access services and monthly recurring voice, video and related charges. The... -

Page 72

... balance sheet and recognized as revenue over the period that the services are provided. Revenue that is billed in arrears includes: non-recurring network access services (including data services), switched access services, non-recurring voice and video services. The earned but unbilled portion... -

Page 73

... to the operation of Frontier's communications network, as well as salaries, wages and related benefits associated with personnel who are responsible for the delivery of services as well as operation and maintenance of its communications network, within the line item "Other operating expenses" in... -

Page 74

... included selling, general and administrative expenses such as salaries, wages and related benefits and the related costs of corporate and sales personnel, travel, insurance, non-network related rent, advertising and other administrative expenses, within the line item "Other operating expenses" in... -

Page 75

... Acquisition, Frontier now owns and operates the wireline business and fiber optic network servicing residential, commercial and wholesale customers in Connecticut (the Connecticut operations). The Company also acquired the AT&T U-verse® video and DISH satellite TV customers in Connecticut. See... -

Page 76

.... Of this amount, goodwill associated with the Connecticut Acquisition of $75 million is deductible for income tax purposes. The securities purchase agreement provides for a post-closing adjustment for working capital, pension liabilities transferred and pension assets. Frontier and AT&T have not... -

Page 77

... 31, 2014, 2013 and 2012, respectively. (5) Property, Plant and Equipment: Property, plant and equipment, net at December 31, 2014 and 2013 are as follows: ($ in thousands) Estimated Useful Lives 2014 2013 Land ...Buildings and leasehold improvements...General support ...Central office/electronic... -

Page 78

..., 2014, 2013 and 2012, respectively. Amortization expense mainly represents the accelerated amortization of our customer base acquired as a result of the Connecticut Acquisition and an acquisition of certain Verizon Communications Inc. properties in 2010 (the 2010 Acquisition) based on a useful life... -

Page 79

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES Notes to Consolidated Financial Statements Additional information regarding our Senior Unsecured Debt at December 31, 2014 and 2013 is as follows: 2014 ($ in thousands) Principal Outstanding Interest Rate Principal Outstanding 2013 Interest Rate ... -

Page 80

...Credit Facility will also be subject to fees that vary depending on the Company's debt rating. The Revolving Credit Facility is available for general corporate purposes but may not be used to fund dividend payments. The terms of the Revolving Credit Facility are substantially similar to the terms of... -

Page 81

... for purchase $400 million aggregate principal amount of 2014 Notes, tendered for total consideration of $446 million, and $50 million aggregate principal amount of April 2015 Notes, tendered for total consideration of $54 million. The Company used proceeds from the sale of its May 2012 offering of... -

Page 82

... 31, 2014: ($ in thousands) Principal Payments 2015...2016...2017...2018...2019...Thereafter ...Other Obligations $ 297,622 $ 383,248 $ 645,156 $ 619,035 $ 644,565 $7,191,110 During 2013, the Company contributed four real estate properties to its qualified defined benefit pension plan. The... -

Page 83

...for grant under the 2013 Equity Incentive Plan (the 2013 EIP and together with the 1996 EIP, the 2000 EIP and the 2009 EIP, the EIPs) and the Non-Employee Directors' Equity Incentive Plan (the Directors' Equity Plan, and together with the Deferred Fee Plan, the Director Plans). Our general policy is... -

Page 84

...discussed under the Non-Employee Directors' Compensation Plans below, prior to May 25, 2006 non-employee directors received an award of stock options under the 2000 EIP upon commencement of service. At December 31, 2014, there were 20,000,000 shares authorized for grant under the 2013 EIP and 13,442... -

Page 85

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES Notes to Consolidated Financial Statements The following summary presents information regarding LTIP target performance shares as of December 31, 2014 and changes with regard to LTIP shares awarded under the 2009 EIP and the 2013 EIP: Number of ... -

Page 86

... were no stock options granted or exercised during 2014, 2013 and 2012. There is no remaining unrecognized compensation cost associated with unvested stock options at December 31, 2014. Non-Employee Directors' Compensation Plans Prior to October 1, 2010, non-employee directors received stock options... -

Page 87

... Directors' Equity Plan. At December 31, 2014, there were 811,002 shares available for grant. There were 12 directors participating in the Directors' Plans during all or part of 2014. The total plan units earned were 237,607, 374,383 and 306,634 in 2014, 2013 and 2012, respectively. Options granted... -

Page 88

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES Notes to Consolidated Financial Statements (11) Income Taxes: The following is a reconciliation of the provision for income taxes computed at federal statutory rates to the effective rates for the years ended December 31, 2014, 2013 and 2012: 2014... -

Page 89

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES Notes to Consolidated Financial Statements The components of the net deferred income tax liability (asset) at December 31 are as follows: ($ in thousands) 2014 2013 Deferred income tax liabilities: Property, plant and equipment basis differences ... -

Page 90

...deferred for payment in future periods as indicated below: ($ in thousands) 2014 2013 2012 Income tax expense: Current: Federal ...State ...Total Current ...Deferred: Federal ...State ...Total Deferred ...Total income tax expense ...Income taxes charged (credited) to equity of Frontier: Utilization... -

Page 91

... 31, 2014, 2013 and 2012, options to purchase 83,000, 83,000 and 540,000 shares, respectively, issuable under employee compensation plans were excluded from the computation of diluted earnings per share (EPS) for those periods because the exercise prices were greater than the average market price of... -

Page 92

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES Notes to Consolidated Financial Statements The components of accumulated other comprehensive loss, net of tax at December 31, 2014, 2013 and 2012, and changes for the years then ended, are as follows: Pension Costs OPEB Costs Deferred taxes on ... -

Page 93

...and OPEB costs (see Note 16-Retirement Plans for additional details). (14) Segment Information: We operate in one reportable segment. Frontier provides both regulated and unregulated voice, data and video services to residential, business and wholesale customers and is typically the incumbent voice... -

Page 94

... benefit plans that provide medical, dental, life insurance and other benefits for covered retired employees and their beneficiaries and covered dependents. The benefits are based on years of service and final average pay or career average pay. Contributions are made in amounts sufficient to meet... -

Page 95

... anticipated benefit payments, management considers both the absolute amount of the payments as well as the timing of such payments. In 2014, 2013 and 2012, our expected long-term rate of return on plan assets was 7.75%, 8.00% and 7.75%, respectively. For 2015, we will assume a rate of return of... -

Page 96

... 31, 2014, 2013 and 2012: ($ in thousands) 2014 2013 Change in projected benefit obligation (PBO) PBO at beginning of year ...PBO for plans of the Connecticut operations at contracted discount rate...Actuarial adjustment to PBO for plans of the Connecticut operations ...Service cost ...Interest... -

Page 97

... employees were transferred to the Frontier Communications Pension Plan (the Plan) effective October 24, 2014. Assets of $343 million, including a receivable of $35 million, were transferred into the Plan during the fourth quarter of 2014. ($ in thousands) Expected in 2015 2014 2013 2012 Components... -

Page 98

... and valuation of the year-end obligations were as follows: 2014 2013 2012 Discount rate-used at year end to value obligation ...Discount rate-used to compute annual cost ...Expected long-term rate of return on plan assets ...Rate of increase in compensation levels ... 4.10% 4.90% 7.75% 2.50% 4.90... -

Page 99

... net periodic postretirement benefit cost for the years ended December 31, 2014, 2013 and 2012. ($ in thousands) 2014 2013 Change in benefit obligation Benefit obligation at beginning of year...Benefit obligation for the Connecticut operations as of acquisition date ...Service cost ...Interest cost... -

Page 100

...: 2014 2013 2012 Discount rate-used at year end to value obligation ...4.10%-4.20% 4.90%-5.20% Discount rate-used to compute annual cost...4.90%-5.20% 4.00%-4.20% Expected long-term rate of return on plan assets ...3.00%-4.00% 3.00%-4.00% ($ in thousands) Gross Benefit Medicare Part D Subsidy Total... -

Page 101

... We sponsor employee retirement savings plans under section 401(k) of the Internal Revenue Code. The plans cover substantially all full-time employees. Under certain plans, we provide matching contributions. Employer contributions were $21 million, $21 million and $23 million for 2014, 2013 and 2012... -

Page 102

...Partnerships and Limited Liability Corporations ...Insurance Contracts ...Other ...Total investments at fair value ...Interest and Dividend Receivable ...Due from Broker for Securities Sold...Receivable Associated with Insurance Contract ...Due to Broker for Securities Purchased ...Total Plan Assets... -

Page 103

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES Notes to Consolidated Financial Statements The tables below set forth a summary of changes in the fair value of the Plan's Level 3 assets for the years ended December 31, 2014 and 2013: 2014 Interest in Limited Partnerships and Limited Liability ... -

Page 104

... West Jefferson, LLC(d) ...1500 MacCorkle Ave SE, LLC(d) ...400 S. Pike Road West, LLC(d) ...601 N US 131, LLC(d) ... 306 2,010 1,091 6,056 8,689 6,942 24,953 29,553 16,219 1,093 1,062 9260 E. Stockton Blvd., LLC(d) ...5,222 Total Interest in Limited Partnerships and Limited Liability Corporations... -

Page 105

... S. Pike Road West, LLC $1,093 Discounted Cash Flow Direct Capitalization 601 N US 131, LLC $1,062 Discounted Cash Flow Direct Capitalization 9260 E. Stockton Blvd., LLC $5,222 Discounted Cash Flow Capitalization Rate Discount Rate Duration (years) Capitalization Rate Discount Rate Duration (years... -

Page 106

... types of claims including, but not limited to, general contracts, billing disputes, rights of access, taxes and surcharges, consumer protection, trademark and patent infringement, employment, regulatory, tort, claims of competitors and disputes with other carriers. We accrue an expense for pending... -

Page 107

... ended December 31, 2014, 2013 and 2012 was $100 million, $84 million and $79 million, respectively. In our normal course of business, we have obligations under certain non-cancelable arrangements for services. During 2012, we entered into a "take or pay" arrangement for the purchase of future long... -

Page 108

...Subsequent Events: On February 5, 2015, we entered into an agreement with Verizon Communications Inc. (Verizon) to acquire Verizon's wireline operations that provide services to residential, commercial and wholesale customers in California, Florida and Texas for a purchase price of $10.54 billion in...