Frontier Communications 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

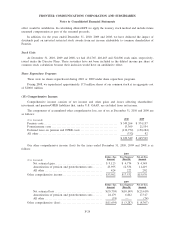

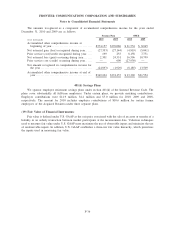

The following table provides further information regarding the redemption of the Plan’s Level 3

investments as of December 31, 2010:

($ in thousands)

Fair

Value

Redemption

Frequency

Redemption

Notice Period

Liquidation

Period

Commingled Funds

JPM Multi-Strat II C-A Ser 11-07 (a) . . . . . $37,378 Quarterly 65 Days NA

Interest in Limited Partnerships

Morgan Stanley Institutional Cayman

Fund LP (b) . . . . . . . . . . . . . . . . . . . . . . . . . . . 37,489 Quarterly 60 Days NA

RII World Timberfund, LLC (c). . . . . . . . . . . 5,146 Through liquidation of None 2 years

underlying investments

Total Interest in Limited Partnerships . . . . . . . . $42,635

(a) The fund’s investment objective is to generate long-term capital appreciation with relatively low volatility

and a low correlation with traditional equity and fixed-income markets. The fund seeks to accomplish this

objective by allocating its assets primarily among a select group of experienced portfolio managers that

invest in a variety of markets, either through the medium of investment funds or through discretionary

managed accounts.

(b) The partnership investment objective is to seek capital appreciation principally through investing in

investment funds managed by third party investment managers who employ a variety of alternative

investment strategies.

(c) The partnership’s objective is to realize substantial long-term capital appreciation by investing in

timberland properties primarily in South America, New Zealand and Australia.

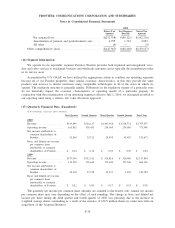

In January 2010, the FASB issued Accounting Standards Update (“ASU”) No. 2010-06, “Improving

Disclosures about Fair Value Measurements.” ASU No. 2010-06 requires entities to prepare new disclosures

surrounding amounts and reasons for significant transfers in and out of Level 1 and Level 2 fair value

measurements, as well as inputs and valuation techniques used to measure fair value for both recurring and

nonrecurring fair value measurements that fall in either Level 2 or Level 3, and information on purchases, sales,

issuances and settlements on a gross basis in the reconciliation of activity in Level 3 fair value measurements.

These new and revised disclosures are required to be implemented for fiscal years beginning after December

15, 2010. The adoption of the disclosure requirements of ASU No. 2010-06 in 2010 did not have a material

impact on our financial position, results of operations or cash flows.

The fair value of our OPEB plan assets, which are measured using Level 1 inputs, was $6.2 million and

$8.0 million as of December 31, 2010 and 2009, respectively.

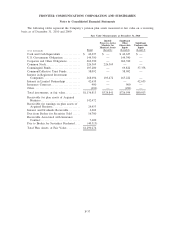

The following table summarizes the carrying amounts and estimated fair values for certain of our financial

instruments at December 31, 2010 and 2009. For the other financial instruments, representing cash, accounts

receivables, long-term debt due within one year, accounts payable and other accrued liabilities, the carrying

amounts approximate fair value due to the relatively short maturities of those instruments. Other equity method

investments, for which market values are not readily available, are carried at cost, which approximates fair

value.

($ in thousands)

Carrying

Amount Fair Value

Carrying

Amount Fair Value

2010 2009

Long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $7,983,693 $8,376,515 $4,794,129 $4,628,132

The fair value of our long-term debt is estimated based upon quoted market prices at the reporting date for

those financial instruments.

F-39

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements