Frontier Communications 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

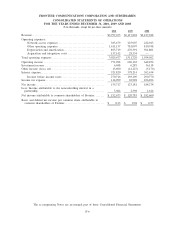

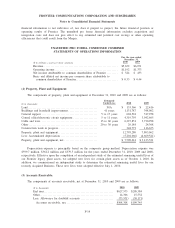

Our consolidated statement of operations for the year ended December 31, 2010 includes $1,748.1 million

of revenue and $231.5 million of operating income related to the results of operations of the Acquired Business

from the date of its acquisition on July 1, 2010.

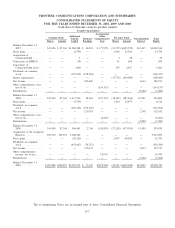

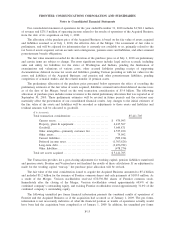

The allocation of the purchase price of the Acquired Business is based on the fair value of assets acquired

and liabilities assumed as of July 1, 2010, the effective date of the Merger. Our assessment of fair value is

preliminary, and will be adjusted for information that is currently not available to us, primarily related to the

tax basis of assets acquired, certain accruals and contingencies, pension assets and liabilities, and other assumed

postretirement benefit obligations.

The fair value amounts recorded for the allocation of the purchase price as of July 1, 2010 are preliminary

and certain items are subject to change. The most significant items include: legal and tax accruals, including

sales and utility tax liabilities for the states of Washington and Indiana, pending the finalization of

examinations and valuations of various cases; other accrued liabilities pending receipt of supporting

documentation; deferred income tax assets and liabilities, pending Verizon providing us with tax values for the

assets and liabilities of the Acquired Business; and pension and other postretirement liabilities, pending

completion of actuarial studies and the related transfer of pension assets.

The preliminary allocation of the purchase price presented below represents the effect of recording the

preliminary estimates of the fair value of assets acquired, liabilities assumed and related deferred income taxes

as of the date of the Merger, based on the total transaction consideration of $5.4 billion. The following

allocation of purchase price includes minor revisions to the initial preliminary allocation that was reported as of

September 30, 2010. These preliminary estimates will be revised in future periods and the revisions may

materially affect the presentation of our consolidated financial results. Any changes to the initial estimates of

the fair value of the assets and liabilities will be recorded as adjustments to those assets and liabilities and

residual amounts will be allocated to goodwill.

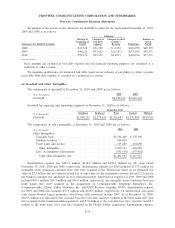

($ in thousands)

Total transaction consideration: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $5,411,705

Current assets......................................... $ 479,993

Property, plant & equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,417,567

Goodwill.............................................. 3,649,871

Other intangibles—primarily customer list . . . . . . . . . . . . . . 2,537,100

Other assets........................................... 75,092

Current liabilities...................................... (509,234)

Deferred income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,303,626)

Long-term debt........................................ (3,456,782)

Other liabilities........................................ (478,276)

Total net assets acquired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5,411,705

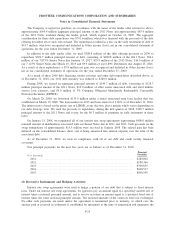

The Transaction provides for a post-closing adjustment for working capital, pension liabilities transferred

and pension assets. Frontier and Verizon have not finalized the results of these calculations. If an adjustment is

made for the working capital “true-up,” the purchase price allocation will be revised.

The fair value of the total consideration issued to acquire the Acquired Business amounted to $5.4 billion

and included $5.2 billion for the issuance of Frontier common shares and cash payments of $105.0 million. As

a result of the Merger, Verizon stockholders received 678,530,386 shares of Frontier common stock.

Immediately after the closing of the Merger, Verizon stockholders owned approximately 68.4% of the

combined company’s outstanding equity, and existing Frontier stockholders owned approximately 31.6% of the

combined company’s outstanding equity.

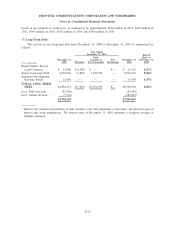

The following unaudited pro forma financial information presents the combined results of operations of

Frontier and the Acquired Business as if the acquisition had occurred as of January 1, 2009. The pro forma

information is not necessarily indicative of what the financial position or results of operations actually would

have been had the acquisition been completed as of January 1, 2009. In addition, the unaudited pro forma

F-13

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements