Frontier Communications 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Federal subsidies are driven by many factors, including the NACPL. Many factors may lead to further

increases in the NACPL, thereby resulting in decreases in our federal subsidy revenue in the future. The FCC

and state regulatory agencies are currently considering a number of proposals for changing the manner in which

eligibility for subsidies is determined as well as the amounts of such subsidies. In addition, some of the reform

proposals direct additional support for broadband deployment which could create an opportunity for additional

federal subsidy support.

Certain states also have their own open proceedings to address reform to intrastate access charges and

other intercarrier compensation. In addition, we have been approached by, and/or are involved in formal state

proceedings with, various carriers seeking reductions in intrastate access rates in certain states. We cannot

predict when or how these matters will be decided or the effect on our subsidy or switched access revenues.

However, future reductions in our subsidy or switched access revenues will directly affect our profitability and

cash flows as those regulatory revenues do not have an equal level of associated variable expenses.

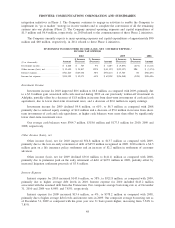

Directory Services

Directory services revenue for 2010 decreased $4.3 million, or 4%, to $102.8 million, as compared with

2009. Directory services revenue for 2010 increased $9.3 million as a result of the Acquired Business.

Directory services revenue for our Frontier legacy operations decreased $13.6 million, or 13%, as compared

with 2009, primarily due to a decline in yellow pages advertising.

Directory services revenue for 2009 decreased $6.3 million, or 6%, to $107.1 million as compared with

2008, primarily due to lower revenues from yellow pages local advertising.

Other

Other revenue for 2010 increased $98.9 million, or 152%, to $164.1 million, as compared with 2009.

Other revenue for 2010 increased $84.6 million as a result of the Acquired Business. Other revenue for our

Frontier legacy operations increased $14.3 million, or 22%, as compared with 2009, primarily due to reduced

DISH video credits and lower bad debt expenses that are charged against revenue, partially offset by decreases

in “bill and collect” fee revenue.

Other revenue for 2009 decreased $17.2 million, or 21%, to $65.2 million as compared with 2008,

primarily due to video promotional discounts of approximately $13.6 million.

OPERATING EXPENSES

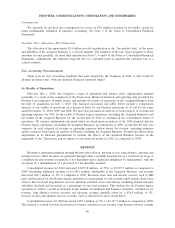

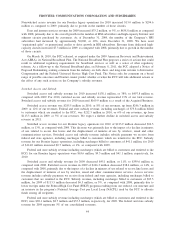

($ in thousands)

As

Reported

Acquired

Business

Frontier

Legacy

$ Increase

(Decrease)

% Increase

(Decrease) Amount

$ Increase

(Decrease)

% Increase

(Decrease) Amount

2010 2009 2008

Network access. . . . . . . . . . . . . $383,679 $173,533 $210,146 $(15,761) (7%) $225,907 $3,894 2% $222,013

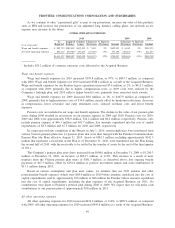

Network access expenses for 2010 increased $157.8 million, or 70%, to $383.7 million, as compared with

2009. Network access expenses for 2010 increased $173.5 million as a result of the Acquired Business.

Network access expenses for our Frontier legacy operations decreased $15.8 million, or 7%, to $210.1 million,

as compared with 2009, primarily due to lower “aspirational gift” and long distance carriage costs in 2010. In

2009, we expensed $10.0 million for the cost of new personal computers provided to customers in connection

with our “Rolling Thunder” promotion which resulted in additional DISH video and HSI subscribers.

Network access expenses for 2009 increased $3.9 million, or 2%, to $225.9 million as compared to 2008

due to higher “aspirational gift” costs (e.g., personal computers), higher long distance carriage costs and

additional data backbone costs. During 2008, we expensed $4.2 million of promotional costs for Master Card

gift cards issued to new HSI customers entering into a two-year price protection plan and to existing customers

who purchased additional services under a two-year price protection plan and $3.0 million for a flat screen

television promotion.

45

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES