Frontier Communications 2010 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2010 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MELINDA WHITE has been with Frontier since January 2005. She is currently Executive Vice President,

Revenue Development. Previously, she was Executive Vice President and General Manager, Marketing and

New Business Operations from November 2009 to December 2010. Prior to that, she was Senior Vice President

and General Manager, Marketing and New Business Operations from July 2009 to November 2009. Ms. White

was Senior Vice President and General Manager of New Business Operations from October 2007 to July 2009

and prior to that, Senior Vice President, Commercial Sales and Marketing from January 2006 to October 2007.

Ms. White was Vice President and General Manager of Electric Lightwave from January 2005 to July 2006.

Prior to joining Frontier, she was Executive Vice President, National Accounts/Business Development for Wink

Communications from 1996 to 2002.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities

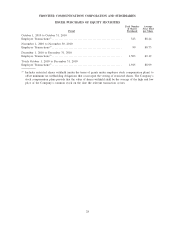

PRICE RANGE OF COMMON STOCK

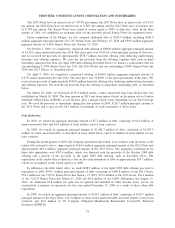

Our common stock is traded on the New York Stock Exchange under the symbol FTR. The following

table indicates the high and low intra-day sales prices, as reported by the New York Stock Exchange, per share

during the periods indicated.

High Low High Low

2010 2009

First Quarter................................................. $8.02 $7.23 $8.87 $5.32

Second Quarter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $8.38 $7.07 $8.16 $6.62

Third Quarter................................................ $8.30 $6.96 $7.60 $6.43

Fourth Quarter. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $9.78 $8.16 $8.57 $7.12

As of February 15, 2011, the approximate number of security holders of record of our common stock was

707,715. This information was obtained from our transfer agent, Computershare Inc.

DIVIDENDS

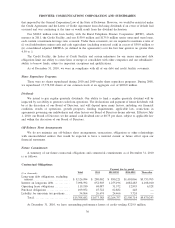

The amount and timing of dividends payable on our common stock are within the sole discretion of our

Board of Directors. From the third quarter of 2004 through the second quarter of 2010, we have paid a regular

annual cash dividend of $1.00 per share of common stock paid quarterly. As announced on May 13, 2009 and

effective July 1, 2010, the closing date of the Transaction, our Board of Directors set the annual cash dividend

rate at $0.75 per share, to be paid quarterly, subject to applicable law and within the discretion of our Board of

Directors. Cash dividends paid to shareholders were approximately $529.4 million, $312.4 million and $318.4

million in 2010, 2009 and 2008, respectively. There are no material restrictions on our ability to pay dividends.

The increase in aggregate dividends paid in 2010 reflects the increase in the number of shares outstanding as a

result of the Transaction, offset in part by the reduction in the amount of the dividend per share, as described

above. The table below sets forth dividends paid per share during the periods indicated.

2010 2009 2008

First Quarter................................................ $ 0.25 $0.25 $0.25

Second Quarter............................................. $ 0.25 $0.25 $0.25

Third Quarter............................................... $0.1875 $0.25 $0.25

Fourth Quarter.............................................. $0.1875 $0.25 $0.25

26

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES