Frontier Communications 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

assets are valued at fair value as of the measurement date. The measurement date used to determine pension

and other postretirement benefit measures for the pension plan and the postretirement benefit plan is

December 31.

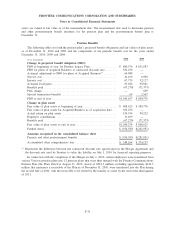

Pension Benefits

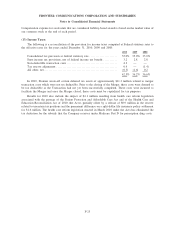

The following tables set forth the pension plan’s projected benefit obligations and fair values of plan assets

as of December 31, 2010 and 2009 and the components of net periodic benefit cost for the years ended

December 31, 2010, 2009 and 2008:

($ in thousands) 2010 2009

Change in projected benefit obligation (PBO)

PBO at beginning of year for Frontier Legacy Plan. . . . . . . . . . . . . . . . . . . . . $ 890,576 $ 831,687

PBO for plans of Acquired Business at contracted discount rate . . . . . . . . . 581,256 —

Actuarial adjustment to PBO for plans of Acquired Business(1) .......... 64,098 —

Service cost .......................................................... 21,169 6,098

Interest cost .......................................................... 67,735 52,127

Actuarial loss/(gain)................................................... 87,024 69,861

Benefits paid ......................................................... (67,270) (71,373)

Plan change .......................................................... — 609

Special termination benefits ........................................... 69 1,567

PBO at end of year................................................... $1,644,657 $ 890,576

Change in plan assets

Fair value of plan assets at beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . $ 608,625 $ 589,776

Fair value of plan assets for Acquired Business as of acquisition date . . . 581,256 —

Actual return on plan assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 154,554 90,222

Employer contributions................................................ 13,109 —

Benefits paid ......................................................... (67,270) (71,373)

Fair value of plan assets at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,290,274 $ 608,625

Funded status......................................................... $ (354,383) $(281,951)

Amounts recognized in the consolidated balance sheet

Pension and other postretirement benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (354,383) $(281,951)

Accumulated other comprehensive loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 349,264 $ 374,157

(1) Represents the difference between the contracted discount rate agreed upon in the Merger Agreement and

the discount rate used by Frontier to value the liability on July 1, 2010 for financial reporting purposes.

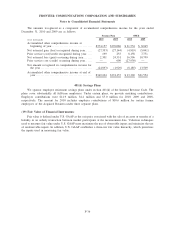

In connection with the completion of the Merger on July 1, 2010, certain employees were transferred from

various Verizon pension plans into 12 pension plans that were then merged with the Frontier Communications

Pension Plan (the Plan) effective August 31, 2010. Assets of $581.3 million, including approximately $142.5

million that represents a receivable of the Plan as of December 31, 2010, were transferred into the Plan during

the second half of 2010, with the receivable to be settled by the transfer of assets by the end of the third quarter

of 2011.

F-32

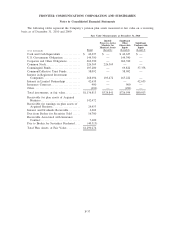

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements