Frontier Communications 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(1) Description of Business and Summary of Significant Accounting Policies:

(a) Description of Business:

Frontier Communications Corporation (Frontier) is a communications company providing services

predominantly to rural areas and small and medium-sized towns and cities as an incumbent local exchange

carrier, or ILEC. Frontier was incorporated in 1935, originally under the name of Citizens Utilities Company

and was known as Citizens Communications Company until July 31, 2008. Frontier and its subsidiaries are

referred to as “we,” “us,” “our” or the “Company” in this report. On July 1, 2010, Frontier completed the

Transaction for the acquisition of the Acquired Business, as described further in Note 3.

(b) Basis of Presentation and Use of Estimates:

Our consolidated financial statements have been prepared in accordance with accounting principles

generally accepted in the United States of America (U.S. GAAP). Certain reclassifications of balances

previously reported have been made to conform to the current presentation. All significant intercompany

balances and transactions have been eliminated in consolidation.

For our financial statements as of and for the periods ended December 31, 2010, we evaluated subsequent

events and transactions for potential recognition or disclosure through the date that we filed this annual report

on Form 10-K with the Securities and Exchange Commission (SEC).

The preparation of our financial statements in conformity with U.S. GAAP requires management to make

estimates and assumptions that affect (i) the reported amounts of assets and liabilities at the date of the

financial statements, (ii) the disclosure of contingent assets and liabilities, and (iii) the reported amounts of

revenue and expenses during the reporting period. Actual results may differ from those estimates. Estimates and

judgments are used when accounting for allowance for doubtful accounts, impairment of long-lived assets,

intangible assets, depreciation and amortization, income taxes, purchase price allocations, contingencies, and

pension and other postretirement benefits, among others. Certain information and footnote disclosures have

been excluded and/or condensed pursuant to SEC rules and regulations.

(c) Cash Equivalents:

We consider all highly liquid investments with an original maturity of three months or less to be cash

equivalents.

(d) Revenue Recognition:

Revenue is recognized when services are provided or when products are delivered to customers. Revenue

that is billed in advance includes: monthly recurring network access services, special access services and

monthly recurring local line and unlimited fixed long distance bundle charges. The unearned portion of these

fees is initially deferred as a component of other liabilities on our consolidated balance sheet and recognized as

revenue over the period that the services are provided. Revenue that is billed in arrears includes: non-recurring

network access services, switched access services, non-recurring local services and long-distance services. The

earned but unbilled portion of these fees is recognized as revenue in our consolidated statements of operations

and accrued in accounts receivable in the period that the services are provided. Excise taxes are recognized as a

liability when billed. Installation fees and their related direct and incremental costs are initially deferred and

recognized as revenue and expense over the average term of a customer relationship. We recognize as current

period expense the portion of installation costs that exceeds installation fee revenue.

As required by law, the Company collects various taxes from its customers and subsequently remits these

taxes to governmental authorities. Substantially all of these taxes are recorded through the consolidated balance

sheet and presented on a net basis in our consolidated statements of operations. We also collect Universal

Service Fund (USF) surcharges from customers (primarily federal USF) which we have recorded on a gross

basis in our consolidated statements of operations and included in revenue and other operating expenses at

F-10

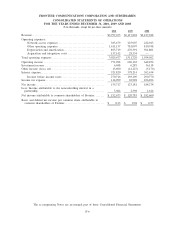

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements