Frontier Communications 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As we continue to offer “aspirational gifts” as part of our promotions, increase our sales of data products

such as HSI and increase the penetration of our unlimited long distance calling plans, our network access

expense may increase in the future.

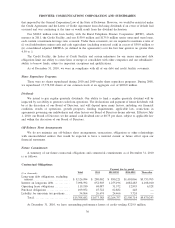

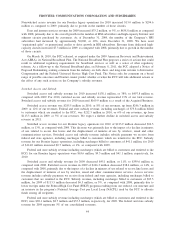

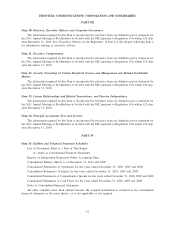

OTHER OPERATING EXPENSES

($ in thousands)

As

Reported

Acquired

Business

Frontier

Legacy

$ Increase

(Decrease)

% Increase

(Decrease) Amount

$ Increase

(Decrease)

% Increase

(Decrease) Amount

2010 2009 2008

Wage and benefit expenses. . . . . $ 803,723 $388,418 $415,305 $ 7,402 2% $407,903 $ 8,630 2% $399,273

All other operating expenses . . . 807,414 459,769* 347,645 (25,549) (7%) 373,194 (38,281) (9%) 411,475

$1,611,137 $848,187 $762,950 $(18,147) (2%) $781,097 $(29,651) (4%) $810,748

*Includes $29.2 million of common corporate costs allocated to the Acquired Business.

Wage and benefit expenses

Wage and benefit expenses for 2010 increased $395.8 million, or 97%, to $803.7 million, as compared

with 2009. Wage and benefit expenses for 2010 increased $388.4 million as a result of the Acquired Business.

Wage and benefit expenses for our Frontier legacy operations increased $7.4 million, or 2%, to $415.3 million,

as compared with 2009, primarily due to higher compensation costs, as 2009 costs were reduced by the

Company’s furlough plan, and 2010 reflects higher benefit costs, primarily from restricted stock awards.

Wage and benefit expenses for 2009 increased $8.6 million, or 2%, to $407.9 million as compared to

2008, primarily due to higher pension costs of $34.0 million, mostly offset by headcount reductions, decreases

in compensation, lower severance and early retirement costs, reduced overtime costs and lower benefit

expenses.

Pension costs are included in our wage and benefit expenses. The decline in the value of our pension plan

assets during 2008 resulted in an increase in our pension expense in 2009 and 2010. Pension costs for 2010,

2009 and 2008 were approximately $38.0 million, $34.2 million and $0.2 million, respectively. Pension costs

include pension expense of $46.3 million and $41.7 million, less amounts capitalized into the cost of capital

expenditures of $8.3 million and $7.5 million for 2010 and 2009, respectively.

In connection with the completion of the Merger on July 1, 2010, certain employees were transferred from

various Verizon pension plans into 12 pension plans that were then merged with the Frontier Communications

Pension Plan (the Plan) effective August 31, 2010. Assets of $581.3 million, including approximately $142.5

million that represents a receivable of the Plan as of December 31, 2010, were transferred into the Plan during

the second half of 2010, with the receivable to be settled by the transfer of assets by the end of the third quarter

of 2011.

The Company’s pension plan assets have increased from $608.6 million at December 31, 2009 to $1,290.3

million at December 31, 2010, an increase of $681.7 million, or 112%. This increase is a result of asset

transfers from the Verizon pension plan trusts of $581.3 million, as described above, less ongoing benefit

payments of $67.3 million, offset by $154.6 million of positive investment returns and cash contributions of

$13.1 million during 2010.

Based on current assumptions and plan asset values, we estimate that our 2011 pension and other

postretirement benefit expenses (which were $68.4 million in 2010 before amounts capitalized into the cost of

capital expenditures) will be approximately $70 million to $80 million for Frontier before amounts capitalized

into the cost of capital expenditures, including the plan expenses of the Acquired Business for 2011. No

contributions were made to Frontier’s pension plan during 2008 or 2009. We expect that we will make cash

contributions to our pension plan of approximately $50 million in 2011.

All other operating expenses

All other operating expenses for 2010 increased $434.2 million, or 116%, to $807.4 million, as compared

with 2009. All other operating expenses for 2010 increased $459.8 million as a result of the Acquired Business.

46

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES