Frontier Communications 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

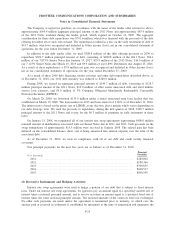

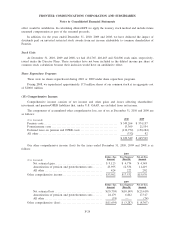

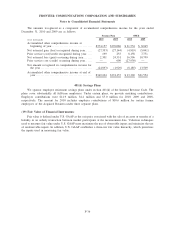

The following table sets forth the changes in the Company’s balance of unrecognized tax benefits for the

years ended December 31, 2010 and 2009:

($ in thousands) 2010 2009

Unrecognized tax benefits—beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $56,860 $48,711

Gross decreases—prior year tax positions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5,442) (3,133)

Gross increases—current year tax positions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,216 12,412

Gross decreases—expired statute of limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,454) (1,130)

Unrecognized tax benefits—end of year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $49,180 $56,860

The amounts above exclude $5.7 million and $5.0 million of accrued interest as of December 31, 2010 and

2009, respectively, that we have recorded and would be payable should the Company’s tax positions not be

sustained.

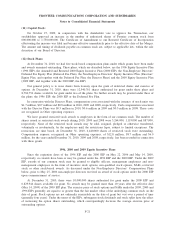

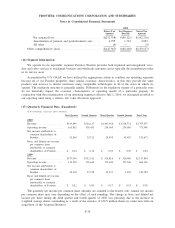

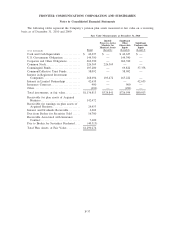

(14) Net Income Per Common Share:

The reconciliation of the net income per common share calculation for the years ended December 31,

2010, 2009 and 2008 is as follows:

($ and shares in thousands, except per-share amounts) 2010 2009 2008

Net income used for basic and diluted earnings per

common share:

Net income attributable to common shareholders of Frontier. . . . $152,673 $120,783 $182,660

Less: Dividends allocated to unvested restricted stock awards. . . (3,072) (2,248) (1,744)

Total basic net income attributable to common shareholders of

Frontier ................................................... 149,601 118,535 180,916

Effect of conversion of preferred securities—EPPICS . . . . . . . . . . — — 130

Total diluted net income attributable to common shareholders

of Frontier ................................................ $149,601 $118,535 $181,046

Basic earnings per common share:

Total weighted-average shares and unvested restricted stock

awards outstanding—basic. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 653,248 312,183 319,161

Less: Weighted-average unvested restricted stock awards . . . . . . . (3,420) (2,162) (1,660)

Total weighted-average shares outstanding—basic. . . . . . . . . . . . . . 649,828 310,021 317,501

Net income per share attributable to common shareholders of

Frontier ................................................... $ 0.23 $ 0.38 $ 0.57

Diluted earnings per common share:

Total weighted-average shares outstanding—basic. . . . . . . . . . . . . . 649,828 310,021 317,501

Effect of dilutive shares . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,163 92 435

Effect of conversion of preferred securities—EPPICS . . . . . . . . . . — — 306

Total weighted-average shares outstanding—diluted . . . . . . . . . . . . 650,991 310,113 318,242

Net income per share attributable to common shareholders of

Frontier ................................................... $ 0.23 $ 0.38 $ 0.57

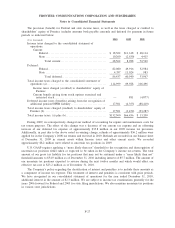

Stock Options

For the years ended December 31, 2010, 2009 and 2008, options to purchase 1,116,000 shares (at exercise

prices ranging from $10.44 to $13.95), 3,551,000 shares (at exercise prices ranging from $8.19 to $18.46) and

2,647,000 shares (at exercise prices ranging from $11.15 to $18.46), respectively, issuable under employee

compensation plans were excluded from the computation of diluted earnings per share (EPS) for those periods

because the exercise prices were greater than the average market price of our common stock and, therefore, the

F-28

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements