Frontier Communications 2010 Annual Report Download - page 71

Download and view the complete annual report

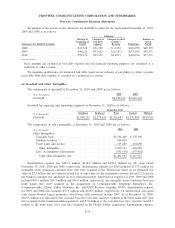

Please find page 71 of the 2010 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(k) Stock Plans:

We have various stock-based compensation plans. Awards under these plans are granted to eligible

officers, management employees, non-management employees and non-employee directors. Awards may be

made in the form of incentive stock options, non-qualified stock options, stock appreciation rights, restricted

stock, restricted stock units or other stock-based awards. We have no awards with market or performance

conditions. Our general policy is to issue shares from treasury upon the grant of restricted shares and the

exercise of options.

The compensation cost recognized is based on awards ultimately expected to vest. U.S. GAAP requires

forfeitures to be estimated and revised, if necessary, in subsequent periods if actual forfeitures differ from those

estimates.

(l) Net Income Per Common Share Attributable to Common Shareholders:

Basic net income per common share is computed using the weighted average number of common shares

outstanding during the period being reported on, excluding unvested restricted stock awards. The impact of

dividends paid on unvested restricted stock awards have been deducted in the determination of basic and

diluted net income attributable to common shareholders of Frontier. Except when the effect would be

antidilutive, diluted net income per common share reflects the dilutive effect of the assumed exercise of stock

options using the treasury stock method at the beginning of the period being reported on as well as common

shares that would result from the conversion of convertible preferred stock (EPPICS) and convertible notes. In

addition, the related interest on convertible debt (net of tax) is added back to income since it would not be paid

if the debt was converted to common stock.

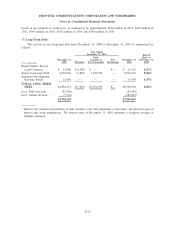

(2) Recent Accounting Literature and Changes in Accounting Principles:

Business Combinations:

Business combinations are accounted for utilizing the guidance of Accounting Standards Codification

(ASC) Topic 805, formerly Statement of Financial Accounting Standards (SFAS) No. 141R, as amended by

FSP SFAS No. 141(R)-1 which became effective on January 1, 2009. ASC Topic 805 requires an acquiring

entity in a transaction to recognize all of the assets acquired and liabilities assumed at fair value at the

acquisition date, to recognize and measure preacquisition contingencies, including contingent consideration, at

fair value (if possible), to remeasure liabilities related to contingent consideration at fair value in each

subsequent reporting period and to expense all acquisition related costs. We are accounting for our July 1, 2010

acquisition of approximately 4.0 million access lines from Verizon Communications Inc. (Verizon) (the

Transaction or the Merger) using the guidance included in ASC Topic 805. We incurred approximately $137.1

million and $28.3 million of acquisition and integration related costs in connection with the Transaction during

2010 and 2009, respectively. Such costs are required to be expensed as incurred and are reflected in

“Acquisition and integration costs” in our consolidated statements of operations.

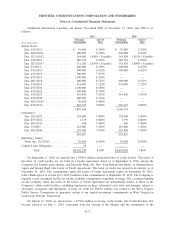

(3) Acquisitions:

The Transaction:

On July 1, 2010, Frontier acquired the defined assets and liabilities of the local exchange business and

related landline activities of Verizon in Arizona, Idaho, Illinois, Indiana, Michigan, Nevada, North Carolina,

Ohio, Oregon, South Carolina, Washington, West Virginia and Wisconsin and in portions of California

bordering Arizona, Nevada and Oregon (collectively, the Territories), including Internet access and long

distance services and broadband video provided to designated customers in the Territories (the Acquired

Business). Frontier is considered the accounting acquirer of the Acquired Business.

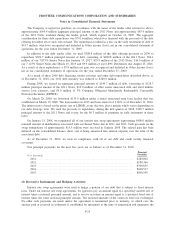

F-12

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements