Frontier Communications 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

All other operating expenses for our Frontier legacy operations decreased $25.5 million, or 7%, to $347.6

million, as compared with 2009, primarily due to $29.2 million in corporate costs allocated to the Acquired

Business, partially offset by higher USF surcharges, higher electricity and fuel costs, and higher travel costs

incurred in connection with the Acquired Business.

All other operating expenses for 2009 decreased $38.3 million, or 9%, to $373.2 million as compared to

2008, due to reduced costs for outside contractors and other vendors, as well as lower fuel, travel and USF

surcharges, partially offset by slightly higher marketing expenses.

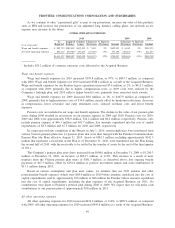

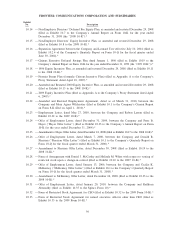

DEPRECIATION AND AMORTIZATION EXPENSE

($ in thousands)

As

Reported

Acquired

Business

Frontier

Legacy

$ Increase

(Decrease)

% Increase

(Decrease) Amount

$ Increase

(Decrease)

% Increase

(Decrease) Amount

2010 2009 2008

Depreciation expense. . . . . . . . . . . . $599,662 $257,020 $342,642 $(19,586) (5%) $362,228 $(17,262) (5%) $379,490

Amortization expense . . . . . . . . . . . 294,057 237,847* 56,210 (57,953) (51%) 114,163 (68,148) (37%) 182,311

$893,719 $494,867 $398,852 $(77,539) (16%) $476,391 $(85,410) (15%) $561,801

*Represents amortization expense primarily related to the customer base acquired in the Transaction.

Depreciation and amortization expense for 2010 increased $417.3 million, or 88%, to $893.7 million, as

compared with 2009. Depreciation and amortization expense for 2010 increased $495.0 million as a result of

the Acquired Business. Depreciation and amortization expense for our Frontier legacy operations decreased

$77.5 million, or 16%, to $398.9 million, as compared with 2009, primarily due to reduced amortization

expense, as discussed below, and a declining net asset base, partially offset by changes in the remaining useful

lives of certain assets. We annually commission an independent study to update the estimated remaining useful

lives of our plant assets. We revised our useful lives for Frontier legacy plant assets, and the plant assets of the

Acquired Business, based on the study effective October 1, 2010. The “composite depreciation rate” for our

plant assets is 7.6% as a result of the study. We anticipate depreciation expense of approximately $820 million

to $840 million and amortization expense of approximately $510 million for 2011 for Frontier, including the

Acquired Business.

Amortization expense for 2010 included $237.8 million for intangible assets (primarily customer base) that

were acquired in the Transaction based on an estimated fair value of $2.5 billion and an estimated useful life of

nine years for the residential customer list and 12 years for the business customer list, amortized on an

accelerated method.

Depreciation and amortization expense for 2009 decreased $85.4 million, or 15%, to $476.4 million as

compared to 2008. The decrease is primarily due to reduced amortization expense, as discussed below, and a

declining net asset base, partially offset by changes in the remaining useful lives of certain assets.

Amortization expense for 2009 is comprised of $57.9 million for amortization associated with certain

Frontier legacy properties, which were fully amortized in June 2009, and $56.3 million for intangible assets

(customer base and trade name) that were acquired in the acquisitions of Commonwealth Telephone

Enterprises, Inc., Global Valley Networks, Inc. and GVN Services. Amortization expense for certain other

Frontier legacy properties was $126.4 million for 2008.

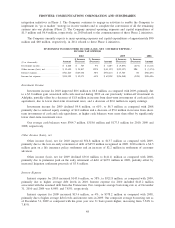

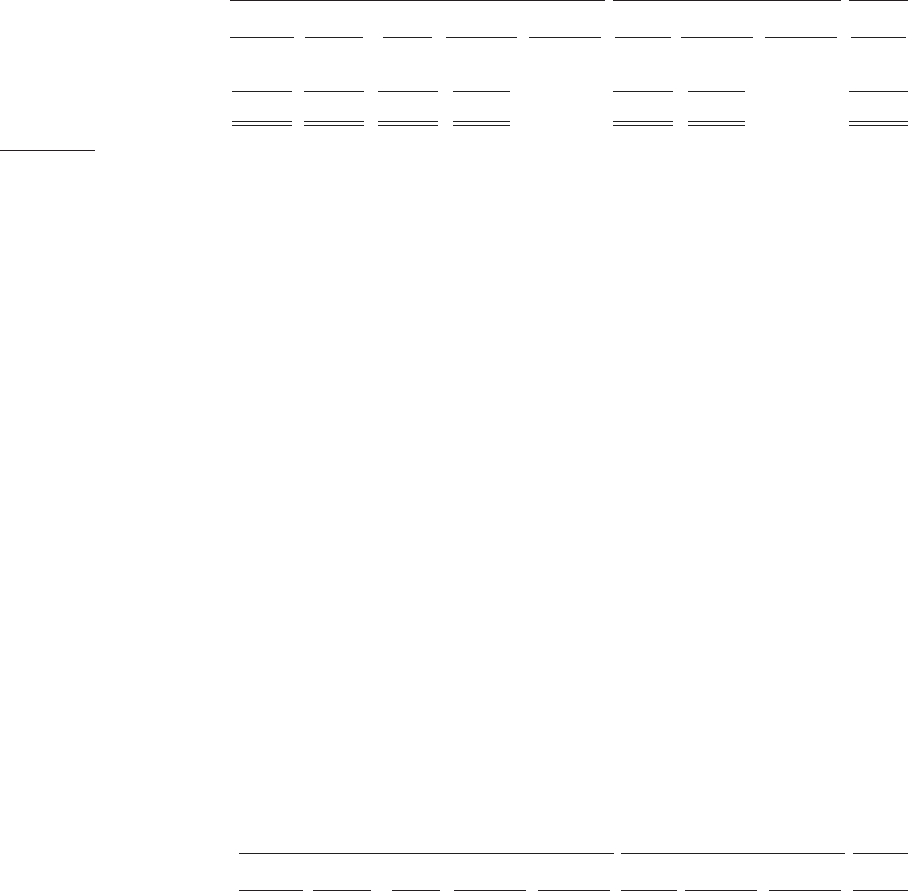

ACQUISITION AND INTEGRATION COSTS

($ in thousands)

As

Reported

Acquired

Business

Frontier

Legacy

$ Increase

(Decrease)

% Increase

(Decrease) Amount

$ Increase

(Decrease)

% Increase

(Decrease) Amount

2010 2009 2008

Acquisition and integration costs $137,142 $ — $137,142 $108,808 384% $28,334 $28,334 NM $ —

Acquisition and integration costs represent expenses incurred to close the Transaction (legal, financial

advisory, accounting, regulatory and other related costs) and integrate the network and information technology

platforms by closing (Phase 1). The Company incurred operating expenses, including deal costs, of

approximately $135.6 million and capital expenditures of approximately $90.6 million in 2010 related to these

47

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES