Frontier Communications 2010 Annual Report Download - page 20

Download and view the complete annual report

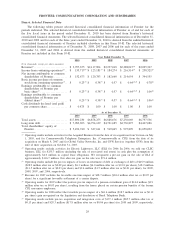

Please find page 20 of the 2010 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$187.5 million. The aggregate amounts of these escrow accounts and the letter of credit will decrease over time

as we incur the defined capital expenditures in the respective states.

In addition, in certain states, we are subject to operating restrictions such as rate caps (including

maintenance of the rates on residential and business products and the prices and terms of interconnection

agreements with competitive local exchange carriers and arrangements with carriers that, in each case, existed

as of the time of the acquisition), continuation of product bundle offerings that we offered before the

Transaction, waiver of certain customer early termination fees and restrictions on others, restrictions on caps on

usage of broadband capacity, and certain minimum service quality standards for a defined period of time (the

failure of which to meet, in one state, will result in penalties, including cash management limitations on certain

of our subsidiaries in that one state). In one other state, our subsidiaries are subject to restrictions on the

amount of dividends up to the parent company for a period of approximately four years. We are also required

to report certain financial information and adhere for a period of time to certain conditions regulating

competition and consumer protection.

The foregoing conditions may restrict our ability to expend cash for other uses and to modify the

operations of our business in response to changing circumstances for a period of time.

Most of the Acquired Business operates on systems acquired from Verizon, which are not as flexible as

our legacy systems.

Effective with the closing of the Transaction, the Acquired Business (other than in West Virginia) has

been operating on Verizon replicated information systems, which are not as flexible as ours and restrict our

ability to quickly react to our customers needs. Until such systems are converted, which is currently scheduled

to be completed by the end of 2012, our ability to launch new products and promotions in the acquired

Territories on a timely basis may be limited, which may have an adverse impact on our results of operations.

If the Transaction does not qualify as tax-free under Section 355 of the Internal Revenue Code (the

Code), including as a result of subsequent acquisitions of stock of Frontier, then Verizon or Verizon

stockholders may be required to pay substantial U.S. federal income taxes, and we may be obligated to

indemnify Verizon for such taxes imposed on Verizon or Verizon stockholders.

The Transaction would be taxable to Verizon pursuant to Section 355(e) of the Code if there is a 50% or

more change in ownership of the Acquired Business, directly or indirectly, as part of a plan or series of related

transactions that include the Transaction. Because Verizon stockholders collectively owned more than 50% of

the Frontier common stock following the Merger, the Merger alone did not cause the Transaction to be taxable

to Verizon under Section 355(e). However, Section 355(e) might apply if other acquisitions of stock of Frontier

after the Merger are considered to be part of a plan or series of related transactions that include the spin-off. If

Section 355(e) applies, Verizon might recognize a substantial amount of taxable gain.

Under a tax sharing agreement, in certain circumstances, and subject to certain limitations, we are required

to indemnify Verizon against taxes on the Transaction that arise as a result of actions or failures to act by us, or

as a result of changes in ownership of our stock after the merger. See “The Company will be unable to take

certain actions until July 2012 because such actions could jeopardize the tax-free status of the Merger, and such

restrictions could be significant.”

We will be unable to take certain actions until July 2012 because such actions could jeopardize the tax-

free status of the Merger, and such restrictions could be significant.

The tax sharing agreement prohibits us from taking actions that could reasonably be expected to cause the

Merger to be taxable or to jeopardize the conclusions of the IRS ruling or opinions of counsel received by

Verizon or Frontier. In particular, for two years after the spin-off, or until July 2012, we may not:

•enter into any agreement, understanding or arrangement or engage in any substantial negotiations with

respect to any transaction involving the acquisition, issuance, repurchase or change of ownership of

Frontier capital stock, or options or other rights in respect of Frontier capital stock, subject to certain

exceptions relating to employee compensation arrangements, stock splits, open market stock repurchases

and stockholder rights plans;

19

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES