Frontier Communications 2010 Annual Report Download - page 34

Download and view the complete annual report

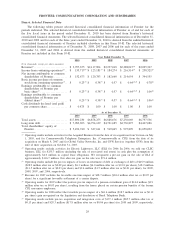

Please find page 34 of the 2010 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cash Flow provided by Operating Activities

Cash flow provided by operating activities improved $479.5 million, or 65%, in 2010 as compared to

2009. The improvement was primarily the result of incremental cash flow from the Acquired Business.

Cash paid for taxes was $19.9 million, $59.7 million and $78.9 million in 2010, 2009 and 2008,

respectively. Our 2010 cash taxes were lower than 2009 due to the impact of bonus depreciation in accordance

with the 2010 Tax Relief Act. We expect that in 2011 our cash taxes will be approximately $50 million to $75

million. Our 2011 cash tax estimate reflects the continued impact of bonus depreciation under the Tax Relief,

Unemployment Insurance Reauthorization, and Job Creation Act of 2010.

In connection with the Transaction, the Company undertook activities to plan and implement information

systems conversions and other initiatives necessary to effectuate the Merger, which occurred on July 1, 2010.

As a result, the Company incurred $137.1 million of acquisition and integration costs related to integration

activities during 2010.

Cash Flow used by Investing Activities

Acquisitions

On July 1, 2010, Frontier issued common shares with a value of $5.2 billion and made payments of $105.0

million in cash as consideration for the Acquired Business. In addition, as part of the Transaction, Frontier

assumed approximately $3.5 billion in debt.

Capital Expenditures

In 2010, 2009 and 2008, our capital expenditures were $577.9 million (including $97.0 million of

integration–related capital expenditures), $256.0 million (including $25.0 million of integration-related capital

expenditures) and $288.3 million, respectively. Capital expenditures in 2010 included $254.2 million associated

with the Acquired Business. We continue to closely scrutinize all of our capital projects, emphasize return on

investment and focus our capital expenditures on areas and services that have the greatest opportunities with

respect to revenue growth and cost reduction. We anticipate total capital expenditures of approximately $750

million to $780 million for 2011 related to our Frontier legacy properties and the Acquired Business.

In connection with the Transaction, the Company undertook activities to plan and implement systems

conversions and other initiatives necessary to effectuate the closing, which occurred on July 1, 2010. As a

result, the Company incurred $97.0 million and $25.0 million of capital expenditures related to these

integration activities in 2010 and 2009, respectively.

Cash Flow used by and provided from Financing Activities

Issuance of Debt Securities

On April 12, 2010, and in anticipation of the Merger, the Verizon subsidiary then holding the assets of the

Acquired Business completed a private offering of $3.2 billion aggregate principal amount of senior notes. The

gross proceeds of the offering, plus $125.5 million (the Transaction Escrow) contributed by Frontier, were

deposited into an escrow account. Immediately prior to the Merger, the proceeds of the notes offering (less the

initial purchasers’ discount) were released from the escrow account and used to make a special cash payment to

Verizon, as contemplated by the Transaction, with amounts in excess of the special cash payment and the initial

purchasers’ discount received by the Company (approximately $53.0 million). In addition, the $125.5 million

Transaction Escrow was returned to the Company.

Upon completion of the Merger, we entered into a supplemental indenture with The Bank of New York

Mellon, as Trustee, pursuant to which we assumed the obligations under the senior notes.

The senior notes consist of $500.0 million aggregate principal amount of Senior Notes due 2015 (the 2015

Notes), $1.1 billion aggregate principal amount of Senior Notes due 2017 (the 2017 Notes), $1.1 billion

aggregate principal amount of Senior Notes due 2020 (the 2020 Notes) and $500.0 million aggregate principal

amount of Senior Notes due 2022 (the 2022 Notes).

33

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES