Frontier Communications 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

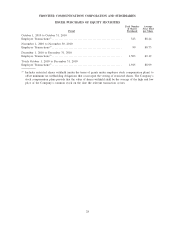

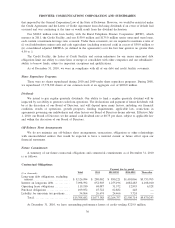

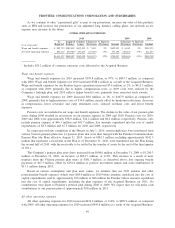

Goodwill by reporting unit (operating segment) at December 31, 2010 is as follows:

($ in thousands) Northeast Southeast West Central Midwest

Reporting Units

Goodwill . . . . . . . . . . . . . . . . . . . . . $1,098,211 $1,275,633 $1,525,687 $1,576,898 $815,765

Prior to the Transaction, and the related increase in operating segments, we reorganized our management

and operating structure during the first quarter of 2009 to include our Rochester market with our existing New

York State properties and the rest of the East Region. At that time, we determined that no impairment was

indicated at both December 31, 2008 and March 31, 2009 for either the East or Rochester reporting units and

combining them did not alter the conclusion at either date.

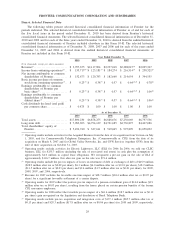

We estimate fair value in two ways: (1) marketplace company comparison based and (2) equity based

utilizing our share price. Enterprise values for rural ILEC properties are typically quoted as a multiple of cash

flow or EBITDA. Marketplace company comparisons and analyst reports support a range of values around a

multiple of 6 to 6.5 times annualized EBITDA. For the purpose of the goodwill impairment test we define

EBITDA as operating income plus depreciation and amortization. We determined the fair value estimates using

6.5 times EBITDA but also used lower EBITDA multiples to gauge the sensitivity of the estimate and its effect

on the margin of excess of fair value over the carrying values of the reporting units. Additionally, a second test

was performed using our public market equity value or market capitalization. Market capitalization (current

market stock price times total shares outstanding) is a public market indicator of equity value and is useful in

corroborating the 6.5 times EBITDA valuation because we are singularly engaged in rural ILEC operating

activities. Our stock price on December 31, 2010 was $9.73 and when compared to the fair value using the

EBITDA multiple obtained above, exceeded such value before consideration of any applicable control

premium. We also used lower per share stock prices to gauge the sensitivity of the estimate and its effect on the

margin of excess fair value over the carrying value. Total market capitalization determined in this manner is

then allocated to the reporting units based upon each unit’s relative share of consolidated EBITDA. Our method

of determining fair value has been consistently applied for the three years ending December 31, 2010.

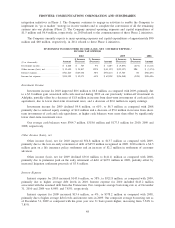

Depreciation and Amortization

The calculation of depreciation and amortization expense is based on the estimated economic useful lives

of the underlying property, plant and equipment and identifiable intangible assets. An independent study

updating the estimated remaining useful lives of our property, plant and equipment assets is performed

annually. We revised our useful lives for Frontier legacy plant assets, and the plant assets of the Acquired

Business, based on the study effective October 1, 2010. For the plant assets of the Acquired Business, an

independent study was performed to develop the appropriate depreciation rates based on Frontier’s existing

rates, while also incorporating factors unique to the plant assets of the Acquired Business. The “composite

depreciation rate” for our plant assets is 7.6% as a result of the study.

Intangible assets acquired in the Transaction were recorded based on an estimated fair value of $2.5 billion

and an estimated useful life of nine years for the residential customer list, as distinguished from the 12 years

used for the business customer list. For both classes of assets, the “sum of the years digits” method was used to

amortize the intangible assets, which tracks more closely with the projected revenue stream of each asset class.

Our Frontier legacy customer list intangible assets do not distinguish between residential and business classes

and the amortization period is five years on the straight-line method. We periodically reassess the useful life of

our intangible assets to determine whether any changes to those lives are required.

We anticipate depreciation expense of approximately $820.0 million to $840.0 million and amortization

expense of approximately $510.0 million for 2011.

Pension and Other Postretirement Benefits

Our estimates of pension expense, other postretirement benefits including retiree medical benefits and

related liabilities are “critical accounting estimates.” In connection with the completion of the Merger on July

1, 2010, certain employees were transferred from various Verizon pension plans into 12 pension plans that were

then merged with the Frontier Communications Pension Plan (the Plan) effective August 31, 2010. Assets of

38

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES