Frontier Communications 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

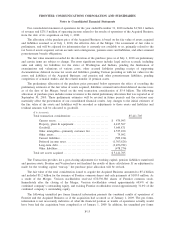

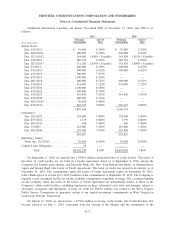

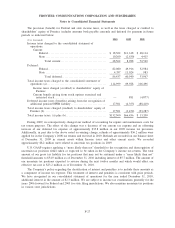

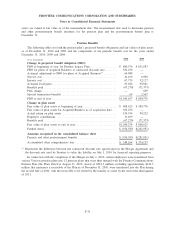

The following summary presents information regarding unvested restricted stock and changes with regard

to restricted stock under the EIP:

Number of

Shares

Weighted

Average

Grant Date

Fair Value

Aggregate

Fair Value

Balance at January 1, 2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,209,000 $14.06 $15,390,000

Restricted stock granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 887,000 $11.02 $ 7,757,000

Restricted stock vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (367,000) $13.90 $ 3,209,000

Restricted stock forfeited . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (27,000) $13.39

Balance at December 31, 2008. . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,702,000 $12.52 $14,876,000

Restricted stock granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,119,000 $ 8.42 $ 8,738,000

Restricted stock vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (557,000) $12.77 $ 4,347,000

Restricted stock forfeited . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (71,000) $11.02

Balance at December 31, 2009. . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,193,000 $10.41 $17,126,000

Restricted stock granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,264,000 $ 7.54 $31,760,000

Restricted stock vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (874,000) $10.86 $ 8,507,000

Restricted stock forfeited . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (143,000) $ 7.95

Balance at December 31, 2010. . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,440,000 $ 8.29 $43,199,000

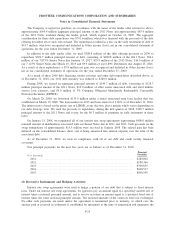

In connection with the completion of the Merger on July 1, 2010, the Company granted an aggregate of

1,911,000 shares of restricted stock with a total fair value of $14.2 million to its senior management, as a

retention and transaction bonus based on contributions that senior management made to achieve key milestones

of the Transaction, and to all employees (including senior management) as a Founder’s Stock Grant during the

third quarter of 2010. The restricted shares granted to senior management vest in three equal annual

installments commencing one year after the grant date. The Founder’s Stock granted to all employees vest

100% on the third anniversary of the grant date.

For purposes of determining compensation expense, the fair value of each restricted stock grant is

estimated based on the average of the high and low market price of a share of our common stock on the date of

grant. Total remaining unrecognized compensation cost associated with unvested restricted stock awards at

December 31, 2010 was $26.0 million and the weighted average period over which this cost is expected to be

recognized is approximately two years.

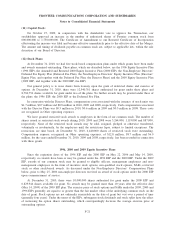

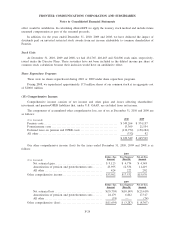

Non-Employee Directors’ Compensation Plans

Prior to October 1, 2010, upon commencement of his or her service on the Board of Directors, each non-

employee director received a grant of 10,000 stock options. These options were awarded under the Directors’

Equity Plan following effectiveness of the Directors’ Equity Plan on May 25, 2006. Prior thereto, these options

were awarded under the 2000 EIP. The exercise price of these options, which became exercisable six months

after the grant date, was the fair market value (as defined in the relevant plan) of our common stock on the date

of grant. Options granted under the Directors’ Equity Plan expire on the earlier of the tenth anniversary of the

grant date or the first anniversary of termination of service as a director. Options granted to non-employee

directors under the 2000 EIP expire on the tenth anniversary of the grant date.

Prior to October 1, 2010, each non-employee director also received an annual grant of 3,500 stock units.

These units were awarded under the Directors’ Equity Plan and prior to effectiveness of that plan, were

awarded under the Deferred Fee Plan. Since the effectiveness of the Directors’ Equity Plan, no further grants

have been made under the Deferred Fee Plan. Prior to April 20, 2004, each non-employee director received an

award of 5,000 stock options. The exercise price of such options was set at 100% of the fair market value on

the date the options were granted. The options were exercisable six months after the grant date and remain

exercisable for ten years after the grant date.

F-23

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements