Frontier Communications 2010 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2010 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Risks Related to Our Business

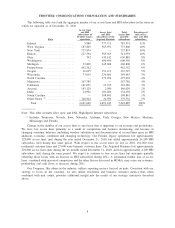

We will likely face further reductions in access lines, switched access minutes of use, long distance

revenues and federal and state subsidy revenues, which could adversely affect us.

We have experienced declining access lines, switched access minutes of use, long distance revenues,

federal and state subsidies and related revenues because of economic conditions, increasing competition,

changing consumer behavior (such as wireless displacement of wireline use, e-mail use, instant messaging and

increasing use of VOIP), technology changes and regulatory constraints. For example, Frontier’s legacy access

lines declined 6% in 2010, 6% in 2009 and 7% in 2008. In addition, Frontier’s legacy switched access minutes

of use declined 12% in 2010, 12% in 2009 and 9% in 2008 (after excluding the switched access minutes added

through acquisitions in 2007). The Acquired Business’s access lines declined 5% in the second half of 2010,

12% in 2009 and 10% in 2008. In addition, the Acquired Business’s switched access minutes of use declined

11% in the second half of 2010, and declined 15% in 2009 and 10% in 2008. The factors referred to above,

among others, are likely to cause our local network service, switched network access, long distance and subsidy

revenues to continue to decline, and these factors may cause our cash generated by operations to decrease.

We face intense competition, which could adversely affect us.

The communications industry is extremely competitive and competition is increasing. The traditional

dividing lines between local, long distance, wireless, cable and Internet service providers are becoming

increasingly blurred. Through mergers and various service expansion strategies, service providers are striving to

provide integrated solutions both within and across geographic markets. Our competitors include competitive

local exchange carriers and other providers (or potential providers) of services, such as Internet service

providers, wireless companies, VOIP providers and cable companies that may provide services competitive

with the services that we offer or intend to introduce. We cannot assure you that we will be able to compete

effectively. We also believe that wireless and cable telephony providers have increased their penetration of

various services in our markets. We expect that we will continue to lose access lines and that competition with

respect to all of our products and services will increase.

We expect competition to intensify as a result of the entrance of new competitors, penetration of existing

competitors into new markets, changing consumer behavior and the development of new technologies, products

and services that can be used in substitution for our products and services. We cannot predict which of the

many possible future technologies, products or services will be important in order to maintain our competitive

position or what expenditures will be required to develop and provide these technologies, products or services.

Our ability to compete successfully will depend on the success and cost of capital expenditure investments in

our territories, including in the acquired Territories, in addition to the cost of marketing efforts, our ability to

anticipate and respond to various competitive factors affecting the industry, including a changing regulatory

environment that may affect our business and that of our competitors differently, new services that may be

introduced (including wireless broadband offerings), changes in consumer preferences, demographic trends,

economic conditions and pricing strategies by competitors. Increasing competition may reduce our revenues

and increase our marketing and other costs as well as require us to increase our capital expenditures and

thereby decrease our cash flow.

Some of our competitors have superior resources, which may place us at a cost and price disadvantage.

Some of our competitors have market presence, engineering, technical and marketing capabilities and

financial, personnel and other resources substantially greater than ours. In addition, some of these competitors

are able to raise capital at a lower cost than we are able to. Consequently, some of these competitors may be

able to develop and expand their communications and network infrastructures more quickly, adapt more swiftly

to new or emerging technologies and changes in customer requirements, take advantage of acquisition and

other opportunities more readily and devote greater resources to the marketing and sale of their products and

services than we will be able to. Additionally, the greater brand name recognition of some competitors may

require us to price our services at lower levels in order to retain or obtain customers.

Finally, the cost advantages of some of these competitors may give them the ability to reduce their prices

for an extended period of time if they so choose.

16

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES