Frontier Communications 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART I

Item 1. Business

Frontier Communications Corporation (Frontier) is a communications company providing services

predominantly to rural areas and small and medium-sized towns and cities. Frontier and its subsidiaries are

referred to as the “Company,” “we,” “us” or “our” throughout this report. Frontier was incorporated in the state

of Delaware in 1935, originally under the name of Citizens Utilities Company, and was known as Citizens

Communications Company from 2000 until July 31, 2008.

Our mission is to be the leader in providing communications services to residential and business customers

in our markets. We are committed to delivering innovative and reliable products and solutions with an

emphasis on convenience, service and customer satisfaction. We offer a variety of voice, data, internet, and

television services and products, some that are available ‘a la carte, and others that are available as bundled or

packaged solutions. We believe that our local management structure, superior 100% U.S.-based customer

service and innovative product positioning will continue to differentiate us from our competitors in the markets

in which we compete.

Highlights for 2010

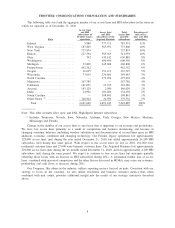

•The Transaction

On July 1, 2010, Frontier acquired the defined assets and liabilities of the local exchange business and

related landline activities of Verizon Communications Inc. (Verizon) in Arizona, Idaho, Illinois, Indiana,

Michigan, Nevada, North Carolina, Ohio, Oregon, South Carolina, Washington, West Virginia and

Wisconsin and in portions of California bordering Arizona, Nevada and Oregon (collectively, the

Territories), including Internet access and long distance services and broadband video provided to

designated customers in the Territories (which we refer to as the Acquired Business). This transaction

(the Transaction or the Merger) was financed with approximately $5.2 billion of common stock

(Verizon shareholders received 678.5 million shares of Frontier common stock) plus the assumption of

approximately $3.5 billion principal amount of debt.

Frontier acquired approximately 4.0 million access lines in the Transaction. As a result, the Company is

the nation’s largest communications services provider focused on rural areas and small and medium-

sized towns and cities in 27 states, and the nation’s fifth largest Incumbent Local Exchange Carrier

(ILEC), with approximately 5.7 million access lines, 1.7 million broadband connections and 14,800

employees as of December 31, 2010.

Revenue was $3.8 billion in 2010. On a pro forma basis, assuming the Transaction had occurred on

January 1, 2010, our revenues would have been approximately $5.7 billion for the year ended December

31, 2010.

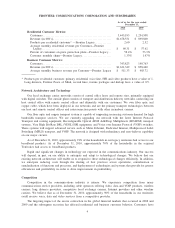

Based on the level of debt incurred and the additional cash flows resulting from the Transaction, our

capacity to service our debt has been significantly enhanced as compared to our capacity immediately

prior to the Merger, although our overall debt increased. At December 31, 2010, the ratio of our net debt

to adjusted operating cash flow (“leverage ratio”) was 2.98 times.

•Issuance of Debt Securities, Letter of Credit Facility and Credit Facility

On March 23, 2010, we entered into a $750.0 million revolving credit facility (the Credit Facility) that

became effective on July 1, 2010, concurrently with the closing of the Merger and the termination of the

Company’s previously existing revolving credit facility.

On April 12, 2010, and in anticipation of the Merger, the Verizon subsidiary then holding the assets of

the Acquired Business completed a private offering of $3.2 billion aggregate principal amount of senior

notes. Upon completion of the Merger on July 1, 2010, we entered into a supplemental indenture with

The Bank of New York Mellon, as Trustee, pursuant to which we assumed the obligations under the

senior notes. The senior notes consist of $500.0 million aggregate principal amount of Senior Notes due

2015, $1.1 billion aggregate principal amount of Senior Notes due 2017, $1.1 billion aggregate principal

3

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES