Frontier Communications 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

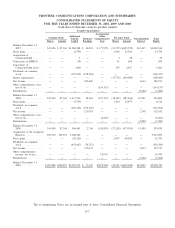

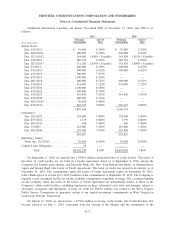

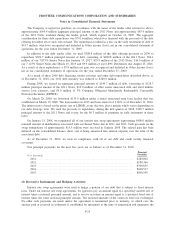

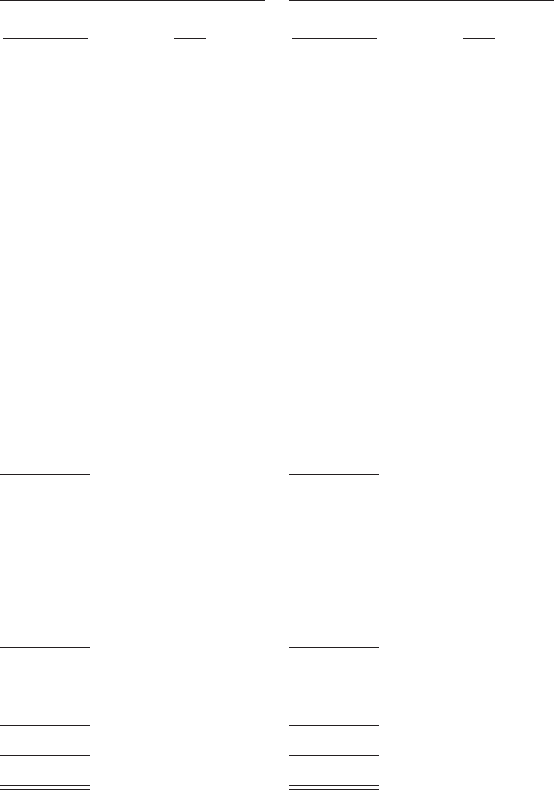

Additional information regarding our Senior Unsecured Debt at December 31, 2010 and 2009 is as

follows:

($ in thousands)

Principal

Outstanding

Interest

Rate

Principal

Outstanding

Interest

Rate

2010 2009

Senior Notes:

Due 5/15/2011. . . . . . . . . . . . . . . . . . . . . . $ 76,089 9.250% $ 76,089 9.250%

Due 10/24/2011 . . . . . . . . . . . . . . . . . . . . 200,000 6.270% 200,000 6.270%

Due 12/31/2012 . . . . . . . . . . . . . . . . . . . . 144,000 1.688% (Variable) 145,500 1.625% (Variable)

Due 1/15/2013. . . . . . . . . . . . . . . . . . . . . . 580,724 6.250% 580,724 6.250%

Due 12/31/2013 . . . . . . . . . . . . . . . . . . . . 131,288 2.063% (Variable) 132,638 2.000% (Variable)

Due 5/1/2014. . . . . . . . . . . . . . . . . . . . . . . 600,000 8.250% 600,000 8.250%

Due 3/15/2015. . . . . . . . . . . . . . . . . . . . . . 300,000 6.625% 300,000 6.625%

Due 4/15/2015. . . . . . . . . . . . . . . . . . . . . . 500,000 7.875% — —

Due 4/15/2017. . . . . . . . . . . . . . . . . . . . . . 1,100,000 8.250% — —

Due 10/1/2018. . . . . . . . . . . . . . . . . . . . . . 600,000 8.125% 600,000 8.125%

Due 3/15/2019. . . . . . . . . . . . . . . . . . . . . . 434,000 7.125% 434,000 7.125%

Due 4/15/2020. . . . . . . . . . . . . . . . . . . . . . 1,100,000 8.500% — —

Due 4/15/2022. . . . . . . . . . . . . . . . . . . . . . 500,000 8.750% — —

Due 1/15/2027. . . . . . . . . . . . . . . . . . . . . . 345,858 7.875% 345,858 7.875%

Due 2/15/2028. . . . . . . . . . . . . . . . . . . . . . 200,000 6.730% — —

Due 10/15/2029 . . . . . . . . . . . . . . . . . . . . 50,000 8.400% — —

Due 8/15/2031. . . . . . . . . . . . . . . . . . . . . . 945,325 9.000% 945,325 9.000%

7,807,284 4,360,134

Debentures:

Due 11/1/2025. . . . . . . . . . . . . . . . . . . . . . 138,000 7.000% 138,000 7.000%

Due 8/15/2026. . . . . . . . . . . . . . . . . . . . . . 1,739 6.800% 1,739 6.800%

Due 10/1/2034. . . . . . . . . . . . . . . . . . . . . . 628 7.680% 628 7.680%

Due 7/1/2035. . . . . . . . . . . . . . . . . . . . . . . 125,000 7.450% 125,000 7.450%

Due 10/1/2046. . . . . . . . . . . . . . . . . . . . . . 193,500 7.050% 193,500 7.050%

458,867 458,867

Subsidiary Senior

Notes due 12/1/2012 . . . . . . . . . . . . . . . . 36,000 8.050% 36,000 8.050%

Capital Lease Obligation . . . . . . . . . . . . . . 79 — — —

Total . . . . . . . . . . . . . . . . . . . . . . . . $8,302,230 8.04% $4,855,001 7.86%

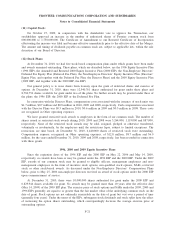

On September 8, 2010, we entered into a $190.0 million unsecured letter of credit facility. The terms of

the letter of credit facility are set forth in a Credit Agreement, dated as of September 8, 2010, among the

Company, the Lenders party thereto, and Deutsche Bank AG, New York Branch (the Bank), as Administrative

Agent and Issuing Bank (the Letter of Credit Agreement). The letter of credit was issued in its entirety as of

December 31, 2010. The commitments under the Letter of Credit Agreement expire on September 20, 2011,

with a Bank option to extend up to $100.0 million of the commitments to September 20, 2012. The Company is

required to pay an annual facility fee on the available commitment, regardless of usage. The covenants binding

on the Company under the terms of the Letter of Credit Agreement are substantially similar to those in the

Company’s other credit facilities, including limitations on liens, substantial asset sales and mergers, subject to

customary exceptions and thresholds. A letter of credit for $190.0 million was issued to the West Virginia

Public Service Commission to guarantee certain of our capital investment commitments in West Virginia in

connection with the Transaction.

On March 23, 2010, we entered into a $750.0 million revolving credit facility (the Credit Facility) that

became effective on July 1, 2010, concurrent with the closing of the Merger and the termination of the

F-17

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements