Frontier Communications 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.amount of Senior Notes due 2020 and $500.0 million aggregate principal amount of Senior Notes due

2022.

On September 8, 2010, we entered into a $190.0 million unsecured letter of credit facility.

•Dividend Policy

During the first half of 2010, we continued to pay cash dividends at an annual rate of $1.00 per common

share. Effective July 1, 2010, our Board of Directors set the annual cash dividend rate at $0.75 per

share. Dividends are subject to applicable law and within the discretion of our Board of Directors.

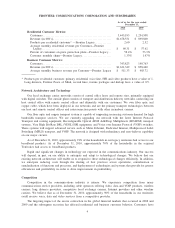

•Product Growth

During 2010, we added approximately 1,061,200 new High-Speed Internet (HSI) subscribers, including

1,045,000 as a result of the Transaction. At December 31, 2010, we had approximately 1,697,200 HSI

customers. Throughout our properties, we offer a video product through DISH Network (DISH) and

DirecTV and, in addition, we offer fiber optic video services in three states. We added approximately

358,500 video subscribers during 2010, including 345,900 as a result of the Transaction. At December

31, 2010, we had approximately 531,400 video customers.

•Customer Revenue

During 2010, our customer revenue from both residential and business customers for our Frontier legacy

operations was $1,721.7 million, and our average monthly customer revenue per access line improved

by $2.86, or 4%, to $69.89.

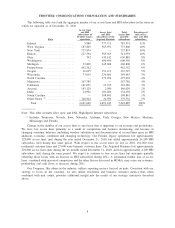

•Access Lines

During 2010, our rate of access line loss for our Frontier legacy operations improved from the prior

year, and the rate of access line loss for the acquired Territories improved sequentially from the third

quarter to the fourth quarter of 2010. We believe this is primarily attributable to customer recognition of

the value of our products, services and bundled options, fewer residential moves out of territory, fewer

moves by businesses to competitors and our ability to compete with cable telephony in a maturing

market place.

Communications Services

As of December 31, 2010, we operated as an incumbent local exchange carrier (ILEC) in 27 states.

Our business is with both residential and business customers. Our services include:

•local and long distance voice services;

•data and internet services;

•access services;

•directory services; and

•video services.

Frontier is the incumbent local exchange carrier in almost all of the markets we serve and provides the

“last mile” of telecommunications services to residential and business customers in these markets.

Competitive Strengths

We believe that we are distinguished by the following competitive strengths:

Enhanced scale and scope. Our increased scale and scope following the Transaction allows us to leverage

our common support functions and systems (such as corporate administrative functions, information technology

and network systems) for both operating expense and capital expenditure synergies. See “Management’s

Discussion and Analysis of Financial Condition and Results of Operations—Expected cost savings resulting

from the Merger.”

Broader footprint and greater revenue opportunities. Although prior to the Merger, we operated in 11 of

the 14 states in which the Acquired Business operated, the ILEC footprints of our Frontier legacy business and

the Acquired Business do not overlap. In addition, the customers of the Acquired Business generally have a

4

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES