Frontier Communications 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

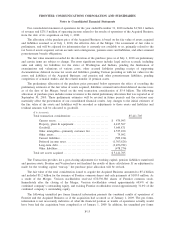

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Explanatory Note

Effective July 1, 2010, Frontier’s scope of operations and balance sheet capitalization changed materially

as a result of the completion of the Transaction, as described in Note 3 of the Notes to Consolidated Financial

Statements. Historical financial data presented for Frontier is not indicative of the future financial position or

operating results for Frontier, and includes the results of operations of the Acquired Business, as defined in

Note 3 of the Notes to Consolidated Financial Statements, from the date of acquisition on July 1, 2010.

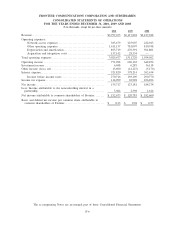

CONSOLIDATED BALANCE SHEETS

AS OF DECEMBER 31, 2010 AND 2009

($ in thousands)

2010 2009

ASSETS

Current assets:

Cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 251,263 $ 358,693

Accounts receivable, less allowances of $73,571 and $30,171,

respectively........................................................ 568,308 190,745

Prepaid expenses..................................................... 100,603 28,081

Income taxes and other current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 208,245 102,561

Total current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,128,419 680,080

Restricted cash............................................................ 187,489 —

Property, plant and equipment, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,590,614 3,133,521

Goodwill................................................................. 6,292,194 2,642,323

Other intangibles, net ..................................................... 2,491,195 247,527

Other assets .............................................................. 200,319 174,804

Total assets $17,890,230 $6,878,255

LIABILITIES AND EQUITY

Current liabilities:

Long-term debt due within one year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 280,002 $ 7,236

Accounts payable..................................................... 436,886 139,556

Advanced billings .................................................... 171,602 49,589

Accrued other taxes .................................................. 167,857 28,750

Accrued interest...................................................... 170,228 107,119

Other current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 212,782 60,427

Total current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,439,357 392,677

Deferred income taxes .................................................... 2,220,677 722,192

Pension and other postretirement benefits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 816,588 454,161

Other liabilities........................................................... 220,172 176,026

Long-term debt........................................................... 7,983,693 4,794,129

Equity:

Shareholders’ equity of Frontier:

Common stock, $0.25 par value (1,750,000,000 and 600,000,000

authorized shares, respectively, 993,855,000 and 312,328,000

outstanding, respectively, and 1,027,986,000 and 349,456,000 issued,

respectively, at December 31, 2010 and 2009) . . . . . . . . . . . . . . . . . . . . . . . 256,997 87,364

Additional paid-in capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,525,471 956,401

Retained earnings .................................................... 77,107 2,756

Accumulated other comprehensive loss, net of tax. . . . . . . . . . . . . . . . . . . . . . (229,549) (245,519)

Treasury stock ....................................................... (433,286) (473,391)

Total shareholders’ equity of Frontier . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,196,740 327,611

Noncontrolling interest in a partnership . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,003 11,459

Total equity ..................................................... 5,209,743 339,070

Total liabilities and equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $17,890,230 $6,878,255

The accompanying Notes are an integral part of these Consolidated Financial Statements

F-5