Frontier Communications 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

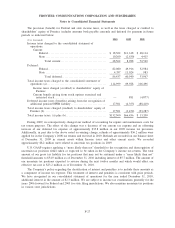

Compensation expense for stock units that are considered liability-based awards is based on the market value of

our common stock at the end of each period.

(13) Income Taxes:

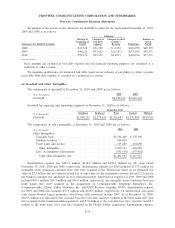

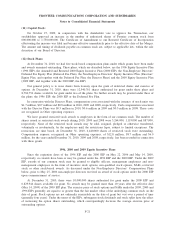

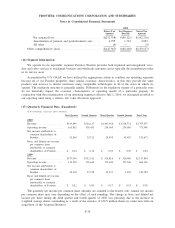

The following is a reconciliation of the provision for income taxes computed at Federal statutory rates to

the effective rates for the years ended December 31, 2010, 2009 and 2008:

2010 2009 2008

Consolidated tax provision at federal statutory rate . . . . . . . . . . . . . . . . . . . . . . 35.0% 35.0% 35.0%

State income tax provisions, net of federal income tax benefit . . . . . . . . . . . 3.2 2.8 2.8

Non-deductible transaction costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.2 — —

Tax reserve adjustment ................................................ 0.4 — (1.4)

All other, net.......................................................... (0.3) (1.6) 0.2

42.5% 36.2% 36.6%

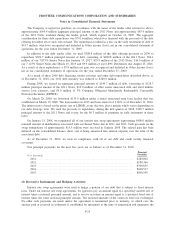

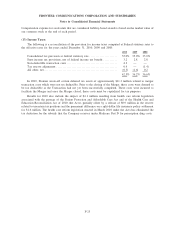

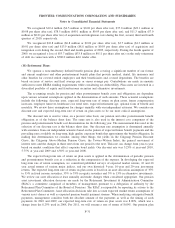

In 2010, Frontier wrote-off certain deferred tax assets of approximately $11.3 million related to merger

transaction costs which were not tax deductible. Prior to the closing of the Merger, these costs were deemed to

be tax deductible as the Transaction had not yet been successfully completed. These costs were incurred to

facilitate the Merger and once the Merger closed, these costs must be capitalized for tax purposes.

Results for 2010 also include the impact of $4.1 million resulting from health care reform legislation

associated with the passage of the Patient Protection and Affordable Care Act and of the Health Care and

Education Reconciliation Act of 2010 (the Acts), partially offset by a release of $0.9 million in the reserve

related to uncertain tax positions and the permanent difference on a split-dollar life insurance policy settlement

for $1.6 million. The health care reform legislation enacted in March 2010 under the Acts has eliminated the

tax deduction for the subsidy that the Company receives under Medicare Part D for prescription drug costs.

F-25

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements