Frontier Communications 2010 Annual Report Download - page 50

Download and view the complete annual report

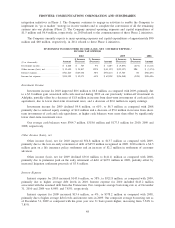

Please find page 50 of the 2010 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our average debt outstanding was $6,950.9 million, $4,867.2 million and $4,753.0 million for 2010, 2009

and 2008, respectively. Our debt levels have risen due to the $3,450.0 million of debt that was assumed by

Frontier upon consummation of the Transaction.

Income Tax Expense

Income tax expense for 2010 increased $45.1 million, or 64%, to $115.0 million as compared with 2009,

primarily due to higher taxable income as a result of the Acquired Business.

The effective tax rate for 2010 was 42.5% as compared with 36.2% for 2009 and 36.6% for 2008. In the

third quarter of 2010, Frontier wrote-off certain deferred tax assets of approximately $11.3 million related to

Merger transaction costs which were not tax deductible. Prior to the closing of the Merger, these costs were

deemed to be tax deductible as the Transaction had not yet been successfully completed. These costs were

incurred to facilitate the Merger and once the Merger closed, these costs must be capitalized for tax purposes.

The results for 2010 also include the impact of a $4.1 million charge resulting from health care reform

legislation associated with the passage of the Patient Protection and Affordable Care Act and of the Health Care

and Education Reconciliation Act of 2010 (the Acts), partially offset by a release of $0.9 million in the reserve

related to uncertain tax positions and the permanent difference on a split-dollar life insurance policy settlement

for $1.6 million. The health care reform legislation enacted in March 2010 under the Acts has eliminated the

tax deduction for the subsidy that the Company receives under Medicare Part D for prescription drug costs.

The amount of our uncertain tax positions expected to reverse during the next twelve months and which

would affect our effective tax rate is $23.2 million as of December 31, 2010.

We paid $19.9 million in cash taxes during 2010, as compared to $59.7 million and $78.9 million in cash

taxes paid in 2009 and 2008, respectively. We expect that our cash taxes for 2011 will be approximately $50

million to $75 million, which includes the impact of bonus depreciation in accordance with the Tax Relief,

Unemployment Insurance Reauthorization, and Job Creation Act of 2010.

Income tax expense for 2009 decreased $36.6 million, or 34%, to $69.9 million as compared with 2008,

primarily due to lower taxable income arising from lower operating income, lower investment income and loss

on debt repurchases. The second quarter of 2008 included a reduction in income tax expense of $7.5 million

that resulted from the expiration of certain statute of limitations on April 15, 2008.

Refunds of approximately $56.2 million were applied for in the Company’s 2008 tax returns and received

in 2010. The refunds resulted from a tax methods change applied for during the third quarter of 2009. Refunds

are recorded on our balance sheet at December 31, 2009 in current assets within Income taxes and other current

assets.

Net income attributable to common shareholders of Frontier

Net income attributable to common shareholders of Frontier for 2010 was $152.7 million, or $0.23 per

share, as compared to $120.8 million, or $0.38 per share, in 2009 and $182.7 million, or $0.57 per share, in

2008. The increase in 2010 net income is primarily the result of incremental operating income from the

Acquired Business, partially offset by increased interest expense and income tax expense. The change in basic

and diluted net income per share was primarily due to the increase in weighted average shares outstanding as a

result of the issuance of 678.5 million shares in connection with our acquisition of the Acquired Business.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

Disclosure of primary market risks and how they are managed

We are exposed to market risk in the normal course of our business operations due to ongoing investing

and funding activities, including those associated with our pension assets. Market risk refers to the potential

change in fair value of a financial instrument as a result of fluctuations in interest rates and equity prices. We

do not hold or issue derivative instruments, derivative commodity instruments or other financial instruments for

trading purposes. As a result, we do not undertake any specific actions to cover our exposure to market risks,

49

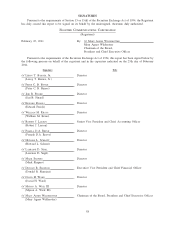

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES