Express Scripts 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2011 Annual Report 77

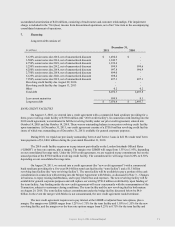

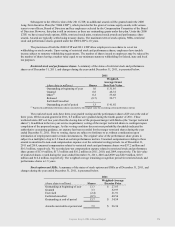

9. Common stock (reflecting the two-for-one stock split effective June 8, 2010)

On May 27, 2011, we entered into agreements to repurchase shares of our common stock for an aggregate

purchase price of $1,750.0 million under an Accelerated Share Repurchase (―ASR‖) agreement. The ASR

agreement consists of two agreements, providing for the repurchase of shares of our common stock worth $1.0

billion and $750.0 million, respectively. Upon payment of the purchase price on May 27, 2011, we received 29.4

million shares of our common stock at a price of $59.53 per share.

At the conclusion of the ASR program we may receive additional shares, or we may be required to pay

additional cash or shares (at our option), based on the daily volume-weighted average price of our common stock

over a period beginning after the effective date of the ASR agreements and ending on the settlement date. The

original settlement date of December 16, 2011 per the contract was extended to April 27, 2012 as allowed under the

terms of the contract due to limitations on repurchase activity resulting from the announcement of the Merger

Agreement. The ASR agreement is subject to an accelerated settlement provision at the option of the investment

bank. If the mean daily volume-weighted average price of our common stock, less a discount (the ―forward price‖),

during the term of the ASR program falls below $59.53 per share, the investment bank would be required to deliver

additional shares to us. If the forward price rises above $59.53 per share, we would be required to deliver cash or

shares, at our option, to the investment bank. During the third quarter of 2011, we settled the $1.0 billion portion of

the ASR agreement and received 1.9 million additional shares of our common stock at a final forward price of

$53.51 per share. During the fourth quarter of 2011, we settled $725.0 million of the $750.0 million portion of the

ASR agreement and received 2.1 million additional shares of our common stock at a weighted average final forward

price of $50.69 per share. Under the terms of the contract, the maximum number of shares that could be received or

delivered under the contracts is 58.8 million. As of December 31, 2011, based on the daily volume-weighted average

price of our common stock since the effective date of the agreements, the investment banks would be required to

deliver 0.1 million shares to us for the remaining portion of the $750.0 million portion of the ASR agreement that

has not yet been settled. These shares were not included in the calculation of diluted weighted average common

shares outstanding during the period because their effect was anti-dilutive.

The ASR agreement is accounted for as an initial treasury stock transaction and a forward stock purchase

contract. The forward stock purchase contract is classified as an equity instrument under applicable accounting

guidance and was deemed to have a fair value of zero at the effective date. The initial repurchase of shares resulted

in an immediate reduction of the outstanding shares used to calculate the weighted-average common shares

outstanding for basic and diluted net income per share on the effective date of the agreements. The 4.0 million

shares received for the portions of the ASR agreement that were settled during 2011 reduced weighted-average

common shares outstanding for the year ended December 31, 2011.

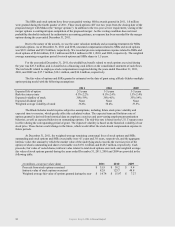

On May 5, 2010, we announced a two-for-one stock split for stockholders of record on May 21, 2010

effective June 8, 2010. The split was effected in the form of a dividend by issuance of one additional share of

common stock for each share of common stock outstanding. The earnings per share and the weighted average

number of shares outstanding for basic and diluted earnings per share for each period have been adjusted for the

stock split.

On June 10, 2009, we completed a public offering of 52.9 million shares of common stock, which includes

6.9 million shares sold as a result of the underwriters’ exercise of their overallotment option in full at closing, at a

price of $30.50 per share. The sale resulted in net proceeds of $1,569.1 million after giving effect to the

underwriting discount and issuance costs of $44.4 million. We used the net proceeds for the acquisition of

WellPoint’s NextRx PBM Business (see Note 3 – Changes in business).

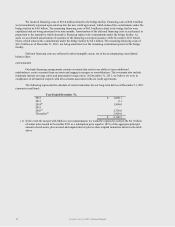

We have a stock repurchase program, originally announced on October 25, 1996. During the second quarter

of 2011, our Board of Directors approved an increase to our stock repurchase program of 50.0 million shares.

Treasury shares are carried at first in, first out cost. There is no limit on the duration of the program. In addition to

the shares repurchased through the ASR, we repurchased 13.0 million shares under our existing stock repurchase

program during the second quarter of 2011 for $765.7 million. During the year ended December 31, 2010, we

repurchased 26.9 million treasury shares for $1,276.2 million. As of December 31, 2011, there are 18.7 million

shares remaining under this program. Additional share repurchases, if any, will be made in such amounts and at such

times as we deem appropriate based upon prevailing market and business conditions and other factors.