Express Scripts 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2011 Annual Report

48

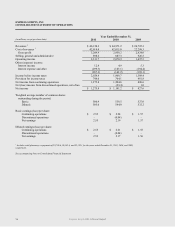

PROVISION FOR INCOME TAXES

Our effective tax rate was 37.0% for the year ended December 31, 2011, as compared to 36.9% and 36.8% for

2010 and 2009, respectively. Our 2011 effective tax rate reflects a slight increase in certain state income tax rates due to

enacted law changes.

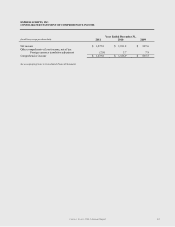

NET (LOSS) INCOME FROM DISCONTINUED OPERATIONS, NET OF TAX

There were no charges for discontinued operations in 2011. The loss from discontinued operations for the year

ended December 31, 2010 is due primarily to the impairment charge (pre-tax) of $28.2 million related to the discontinued

operations of PMG.

Net income from discontinued operations, net of tax, decreased $24.4 million from net income of $1.0 million in

2009 to a net loss of $23.4 million in 2010. This decrease is primarily attributable to the impairment charge of $28.2 million

recorded in the second quarter of 2010 in addition to the charges recorded upon the sale of PMG in the third quarter of

2010.

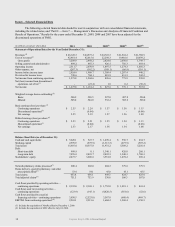

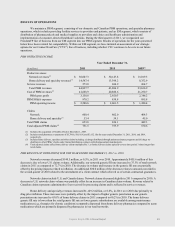

NET INCOME AND EARNINGS PER SHARE

Net income increased $94.6 million, or 8.0%, for the year ended December 31, 2011 over 2010 and increased

$353.6 million, or 42.7%, for the year ended December 31, 2010 over 2009.

On May 5, 2010, we announced a two-for-one stock split for stockholders of record on May 21, 2010 effective

June 8, 2010. The split was effected in the form of a dividend by issuance of one additional share of common stock for each

share of common stock outstanding. The earnings per share and the weighted average number of shares outstanding for

basic and diluted earnings per share for each period have been adjusted for the stock split.

Basic and diluted earnings per share increased 16.4% and 16.6%, respectively, for the year ended December 31,

2011 over 2010. The increase is primarily due to operating results, as well as the repurchase of 46.4 million treasury shares

during 2011. Basic and diluted earnings per share increased 39.5% and 39.1%, respectively for the year ended December

31, 2010 over 2009 primarily due to improved operating results, as well as the repurchase of 26.9 million treasury shares

during 2010. The impact of the treasury share repurchases is offset by an increase in shares outstanding as a result of the

public offering in June 2009 (see Note 9 – Common stock).

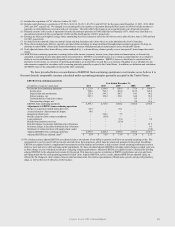

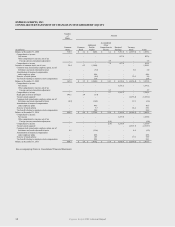

LIQUIDITY AND CAPITAL RESOURCES

OPERATING CASH FLOW AND CAPITAL EXPENDITURES

In 2011, net cash provided by continuing operations increased $86.9 million to $2,192.0 million. Changes in

operating cash flows from continuing operations in 2011 were impacted by the following factors:

Net income from continuing operations increased $71.2 million in 2011 over 2010. This increase was partially

reduced by the expensing of deferred financing fees in 2011, which included charges of $81.0 million related

primarily to the bridge loan for the financing of the Medco merger. These charges have been added back to cash

flows from operating activities to reconcile net income to net cash provided.

The deferred tax provision increased $27.4 million in 2011 compared to 2010 reflecting a net change in taxable

temporary differences primarily attributable to tax deductible goodwill associated with the NextRx acquisition.

Changes in working capital resulted in cash inflows of $379.1 million in 2011 compared to cash inflows of

$476.0 million over the same period of 2010, resulting in a total decrease of $96.9 million. The cash flow decrease

was primarily related to the strong cash flow in 2010 as a result of the collection of receivables from

pharmaceutical manufacturers and clients due to the acquisition of NextRx.

Net cash provided by operating activities also includes outflows related to transaction fees incurred in connection

with the proposed merger with Medco.