Express Scripts 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2011 Annual Report 53

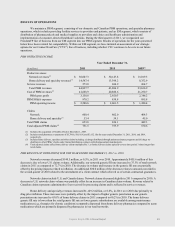

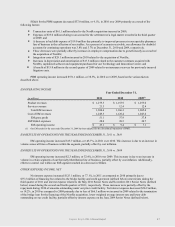

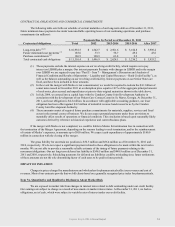

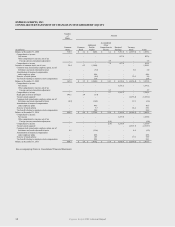

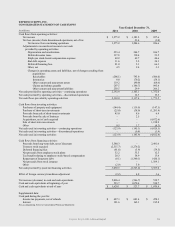

CONTRACTUAL OBLIGATIONS AND COMMERCIAL COMMITMENTS

The following table sets forth our schedule of current maturities of our long-term debt as of December 31, 2011,

future minimum lease payments due under noncancellable operating leases of our continuing operations, and purchase

commitments (in millions):

Payments Due by Period as of December 31, 2011

Contractual obligations

Total

2012

2013-2014

2015-2016

After 2017

Long-term debt (1)(2)

$ 10,938.5

$ 1,342.7

$ 2,501.6

$ 3,184.8

$ 3,909.4

Future minimum lease payments (3)

185.0

33.3

58.7

49.2

43.8

Purchase commitments (4)

186.9

120.9

63.8

2.2

-

Total contractual cash obligations

$ 11,310.4

$ 1,496.9

$ 2,624.1

$ 3,236.2

$ 3,953.2

(1) These payments exclude the interest expense on our revolving credit facility, which requires us to pay

interest on LIBOR plus a margin. Our interest payments fluctuate with changes in LIBOR and in the margin

over LIBOR we are required to pay (see ―Part II – Item 7 – Management’s Discussion and Analysis of

Financial Condition and Results of Operations – Liquidity and Capital Resources – Bank Credit Facility‖), as

well as the balance outstanding on our revolving credit facility. Interest payments on our Senior Notes are

fixed, and have been included in these amounts.

(2) In the event the merger with Medco is not consummated, we would be required to redeem the $4.1 billion of

senior notes issued in November 2011 at a redemption price equal to 101% of the aggregate principal amount

of such notes, plus accrued and unpaid interest prior to their original maturities shown in the table above.

(3) In July 2004, we entered into a capital lease with the Camden County Joint Development Authority in

association with the development of our Patient Care Contact Center in St. Marys, Georgia. At December 31,

2011, our lease obligation is $4.2 million. In accordance with applicable accounting guidance, our lease

obligation has been offset against $4.2 million of industrial revenue bonds issued to us by the Camden

County Joint Development Authority.

(4) These amounts consist of required future purchase commitments for materials, supplies, services and fixed

assets in the normal course of business. We do not expect potential payments under these provisions to

materially affect results of operations or financial condition. This conclusion is based upon reasonably likely

outcomes derived by reference to historical experience and current business plans.

If the merger with Medco is not completed, we could be liable to Medco for termination fees in connection with

the termination of the Merger Agreement, depending on the reasons leading to such termination, and/or the reimbursement

of certain of Medco’s expenses, in amounts up to $950 million. We expect cash expenditures of approximately $160.0

million in connection with the closing of the merger.

The gross liability for uncertain tax positions is $32.3 million and $56.4 million as of December 31, 2011 and

2010, respectively. We do not expect a significant payment related to these obligations to be made within the next twelve

months. We are not able to provide a reasonable reliable estimate of the timing of future payments relating to the

noncurrent obligations. Our net long-term deferred tax liability is $546.5 million and $448.9 million as of December 31,

2011 and 2010, respectively. Scheduling payments for deferred tax liabilities could be misleading since future settlements

of these amounts are not the sole determining factor of cash taxes to be paid in future periods.

IMPACT OF INFLATION

Changes in prices charged by manufacturers and wholesalers for pharmaceuticals affect our revenues and cost of

revenues. Most of our contracts provide that we bill clients based on a generally recognized price index for pharmaceuticals.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

We are exposed to market risk from changes in interest rates related to debt outstanding under our credit facility.

Our earnings are subject to change as a result of movements in market interest rates. At December 31, 2011, we had no

obligations, net of cash, which were subject to variable rates of interest under our credit facility.