Express Scripts 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2011 Annual Report 49

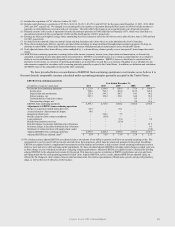

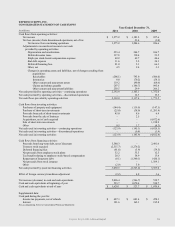

In 2010, net cash provided by continuing operations increased $353.1 million to $2,105.1 million. Changes in

operating cash flows from continuing operations in 2010 were impacted by the following factors:

Net income from continuing operations increased $378.0 million in 2010 over 2009.

Depreciation and amortization included in net income in 2010 is $138.0 million higher than 2009 due primarily to

amortization of the customer contracts related to the PBM agreement with WellPoint.

The deferred tax provision increased $58.9 million in 2010 compared to 2009 reflecting a net change in taxable

temporary differences primarily attributable to tax deductible goodwill associated with the NextRx acquisition.

These increases were partially offset by lower cash inflows from working capital. Changes in working capital

decreased $152.9 million from cash inflows of $628.9 million in the year ended December 31, 2009 to

$476.0 million in the year ended December 31, 2010. The decrease was primarily related to net cash outflows for

claims and rebates payable due to payments to clients and pharmacies for obligations acquired with NextRx,

partially offset by collection of receivables from pharmaceutical manufacturers and clients due to the acquisition

of NextRx.

Deferred financing fees in 2009 included a charge of $66.3 million related to the termination of the bridge loan for

the financing of the NextRx acquisition.

In 2010, cash flows from discontinued operations decreased $7.2 million from cash provided of $19.5 million in

2009 to cash provided of $12.3 million in 2010. This was primarily due to a decrease in PMG net income and the 2009

collection of receivables as the IP balances wound down.

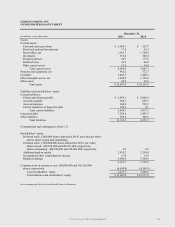

As a percent of accounts receivable, our allowance for doubtful accounts for continuing operations was 2.9% and

3.8% at December 31, 2011 and 2010, respectively. The decrease for the year ended December 31, 2011 was related

primarily to the write off of uncollectible accounts receivable during 2011.

In 2011, net cash used in investing activities decreased $22.0 million over 2010 primarily due to a net increase in

cash flows from short term investments of $49.4 million primarily related to our Express Scripts Insurance Company line of

business, partially offset by an increase in capital expenditures of $24.5 million. Capital expenditures for the year ended

December 31, 2011 include primarily infrastructure and technology upgrades. In the fourth quarter of 2011, we opened a

new office facility in St. Louis, Missouri to consolidate our St. Louis presence onto our Headquarters campus. Capital

expenditures of approximately $32.0 million and other costs of approximately $1.3 million related to this facility were

incurred in 2011. Additionally, the Company accelerated spending on certain projects to complete them in 2011, in order to

create additional capacity to successfully complete integration activities for the proposed merger with Medco in 2012.

Capital expenditures for the year ended December 31, 2010 include $35.7 million related to our Technology & Innovation

Center, which opened in the second quarter of 2010. We intend to continue to invest in infrastructure and technology,

which we believe will provide efficiencies in operations, facilitate growth and enhance the service we provide to our

clients. We expect future capital expenditures will be funded primarily from operating cash flow or, to the extent necessary,

with borrowings under our revolving credit facility, discussed below.

Net cash provided by financing activities increased $5,553.5 million from outflows of $2,523.0 million for the

year ended December 31, 2010 to inflows of $3,030.5 million for the year ended December 31, 2011. Cash inflows for

2011 include $1,494.0 million related to the issuance of our May 2011 Senior Notes (defined below) and $4,086.3 million

related to the issuance of our November 2011 Senior Notes (defined below). Cash outflows during 2011 were primarily due

to repurchases of treasury shares of $2,515.7 million during 2011 compared to $1,276.2 million during 2010. Cash outflows

also include $91.6 million of deferred financing fees related to the issuance of our May 2011 Senior Notes, November 2011

Senior Notes, bridge facility and credit agreements entered into during 2011. During 2010, we repaid in full our Term 1 and

Term A loans, resulting in total repayments on long term debt of $1,340.1 million.

At December 31, 2011, our sources of capital included a $750 million revolving credit facility (none of which was

outstanding at December 31, 2011), $4.1 billion of cash received from the issuance of senior notes in November 2011, the

ability to draw $4.0 billion on a term facility (at which time the $750 million revolving facility would be replaced by a new

$1.5 billion revolving facility), and the ability to draw up to $5.9 billion under a bridge financing facility, all of which are

described in further detail in Note 7 – Financing. The $750 million revolving facility is available for general corporate

purposes. The remaining funds have been secured to finance, in part, the transactions contemplated under the Merger

Agreement with Medco. In the event the merger with Medco is not consummated, the $4.0 billion term facility and the

bridge facility would terminate, and we would be required to redeem the $4.1 billion of senior notes issued in November

2011 at a redemption price equal to 101% of the aggregate principal amount of such notes, plus accrued and unpaid interest.