Express Scripts 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2011 Annual Report

72

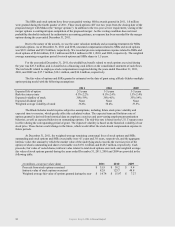

0.10% to 0.55% for the new revolving facility, depending on our consolidated leverage ratio. Under the new credit

agreement, we are required to pay commitment fees on the unused portion of the $1.5 billion new revolving facility.

The commitment fee ranges from 0.15% to 0.20% depending on our consolidated leverage ratio. Until the funding

date, we will also pay a ticking fee on the commitments under the term facility.

BRIDGE FACILITY

On August 5, 2011, we entered into a credit agreement with Credit Suisse AG, Cayman Islands Branch, as

administrative agent, Citibank, N.A., as syndication agent, and the other lenders and agents named within the

agreement. The credit agreement provides for a one-year unsecured $14.0 billion bridge term loan facility (the

―bridge facility‖). In the period leading up to the closing of the Medco merger, we may pursue other financing

opportunities to replace all or portions of the bridge facility, or, in the event that we draw upon the bridge facility,

we may refinance all or a portion of the bridge facility at a later date. The proceeds from these borrowings may be

used to pay a portion of the cash consideration to be paid in the merger and to pay related fees and expenses (see

Note 3 – Changes in business). The term facility discussed above reduced commitments under the bridge facility by

$4.0 billion. The net proceeds from the November 2011 Senior Notes discussed below reduced the commitments

under the bridge facility by $4.1 billion. At December 31, 2011, $5.9 billion is available for borrowing under the

bridge facility. See Note 15 – Subsequent event for discussion of additional reduction due to financing transactions

subsequent to December 31, 2011.

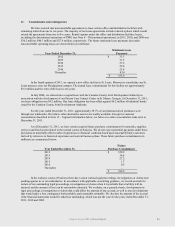

The bridge facility requires us to pay interest at the greater of LIBOR or adjusted base rate options, plus a

margin. The margin over LIBOR ranges from 1.25% to 1.75%, and the margin over the adjusted base rate options

ranges from 0.25% to 0.75%, depending on our consolidated leverage ratio. The margin will increase by 0.25% on

the 90th day after the funding date of the facility and by an additional 0.25% every 90 days thereafter. Until the

funding date, we will also pay a ticking fee on the commitments under the bridge facility.

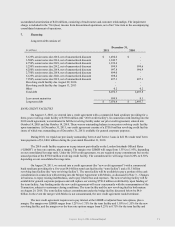

SENIOR NOTES

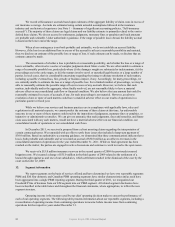

On June 9, 2009, we issued $2.5 billion of Senior Notes (the ―June 2009 Senior Notes‖), including:

$1.0 billion aggregate principal amount of 5.250% Senior Notes due 2012

$1.0 billion aggregate principal amount of 6.250% Senior Notes due 2014

$500 million aggregate principal amount of 7.250% Senior Notes due 2019

The June 2009 Senior Notes require interest to be paid semi-annually on June 15 and December 15. We

may redeem some or all of each series of June 2009 Senior Notes prior to maturity at a price equal to the greater of

(1) 100% of the aggregate principal amount of any notes being redeemed, plus accrued and unpaid interest; or (2)

the sum of the present values of the remaining scheduled payments of principal and interest on the notes being

redeemed, not including unpaid interest accrued to the redemption date, discounted to the redemption date on a

semiannual basis at the treasury rate plus 50 basis points with respect to any notes being redeemed, plus in each

case, unpaid interest on the notes being redeemed accrued to the redemption date. The June 2009 Senior Notes are

jointly and severally and fully and unconditionally (subject to certain customary release provisions, including sale,

exchange, transfer or liquidation of the guarantor subsidiary) guaranteed on a senior unsecured basis by most of our

current and future 100% owned domestic subsidiaries. We used the net proceeds for the acquisition of WellPoint’s

NextRx PBM Business.

On May 2, 2011, we issued $1.5 billion aggregate principal amount of 3.125% Senior Notes due 2016 (the

―May 2011 Senior Notes‖). The May 2011 Senior Notes require interest to be paid semi-annually on May 15 and

November 15. We may redeem some or all of the May 2011 Senior Notes prior to maturity at a price equal to the

greater of (1) 100% of the aggregate principal amount of any notes being redeemed, plus accrued and unpaid

interest; or (2) the sum of the present values of the remaining scheduled payments of principal and interest on the

notes being redeemed, not including unpaid interest accrued to the redemption date, discounted to the redemption

date on a semiannual basis (assuming a 360-day year consisting of twelve 30-day months) at the treasury rate plus

20 basis points with respect to any May 2011 Senior Notes being redeemed, plus in each case, unpaid interest on the

notes being redeemed accrued to the redemption date. The May 2011 Senior Notes are jointly and severally and

fully and unconditionally (subject to certain customary release provisions, including sale, exchange, transfer or

liquidation of the guarantor subsidiary) guaranteed on a senior basis by most of our current and future 100% owned

domestic subsidiaries. We used the net proceeds to repurchase treasury shares.