Express Scripts 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2011 Annual Report

74

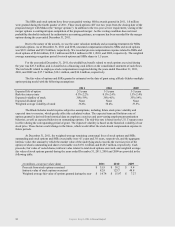

We incurred financing costs of $91.0 million related to the bridge facility. Financing costs of $26.0 million

were immediately expensed upon entering into the new credit agreement, which reduced the commitments under the

bridge facility by $4.0 billion. The remaining financing costs of $65.0 million related to the bridge facility were

capitalized and are being amortized over nine months. Amortization of the deferred financing costs is accelerated in

proportion to the amount by which alternative financing replaces the commitments under the bridge facility. As

such, we accelerated amortization of a portion of the financing costs upon issuance of the November 2011 Senior

Notes, which reduced the commitments under the bridge facility by $4.1 billion. The remaining financing costs of

$16.2 million as of December 31, 2011, are being amortized over the remaining commitment period of the bridge

facility.

Deferred financing costs are reflected in other intangible assets, net in the accompanying consolidated

balance sheet.

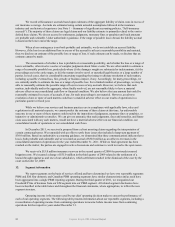

COVENANTS

Our bank financing arrangements contain covenants that restrict our ability to incur additional

indebtedness, create or permit liens on assets and engage in mergers or consolidations. The covenants also include

minimum interest coverage ratios and maximum leverage ratios. At December 31, 2011, we believe we were in

compliance in all material respects with all covenants associated with our credit agreements.

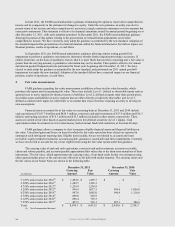

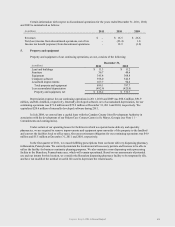

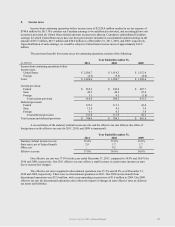

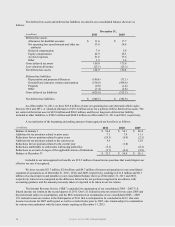

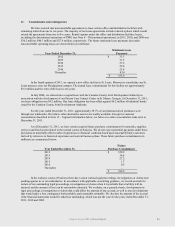

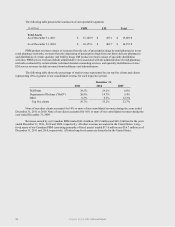

The following represents the schedule of current maturities for our long-term debt as of December 31, 2011

(amounts in millions):

Year Ended December 31,

2012

$ 1,000.1

2013

0.1

2014(1)

1,900.0

2015

-

2016(1)

2,750.0

Thereafter(1)

2,450.0

$ 8,100.2

(1) In the event the merger with Medco is not consummated, we would be required to redeem the $4.1 billion

of senior notes issued in November 2011 at a redemption price equal to 101% of the aggregate principal

amount of such notes, plus accrued and unpaid interest prior to their original maturities shown in the table

above.