Express Scripts 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2011 Annual Report

68

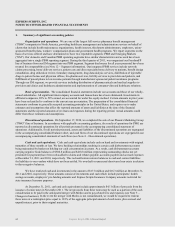

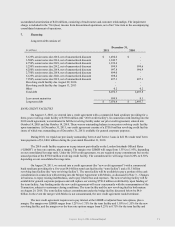

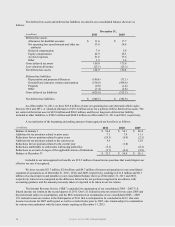

which will benefit our customers and stockholders. The purchase price was primarily funded through a $2.5 billion

underwritten public offering of senior notes completed on June 9, 2009, resulting in net proceeds of

$2,478.3 million, and a public offering of 52.9 million shares of common stock completed June 10, 2009, resulting

in net proceeds of $1,569.1 million. This acquisition is reported as part of our PBM segment. For the year ended

December 31, 2009, we incurred transaction costs of $61.1 million related to the acquisition which are included in

selling, general and administrative expense. In accordance with the accounting guidance for business combinations

that became effective in 2009, the transaction costs were expensed as incurred. Our PBM operating results include

those of the NextRx PBM Business beginning on December 1, 2009, the date of acquisition.

At the closing of the acquisition, we entered into the 10-year PBM agreement under which we provide

pharmacy benefits management services to WellPoint and its designated affiliates which were previously provided

by NextRx. The services provided under the PBM agreement include retail network pharmacy management, home

delivery and specialty pharmacy services, drug formulary management, claims adjudication and other services

consistent with those provided to other PBM clients. These services are provided to HMOs, health insurers, third-

party administrators, employers, union-sponsored benefit plans, workers’ compensation plans and government

health programs, which is consistent with our current customer base.

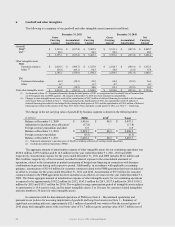

The purchase price has been allocated based upon the estimated fair value of net assets acquired and

liabilities assumed at the date of the acquisition. A portion of the excess of purchase price over tangible net assets

acquired has been allocated to intangible assets consisting of customer contracts in the amount of $1,585.0 million.

Of this amount, $65.0 million related to external customers is being amortized using the straight-line method over an

estimated useful life of 10 years. An additional $1,520.0 million related to the PBM agreement with WellPoint is

being amortized using a pattern of benefit method over an estimated useful life of 15 years, with a greater portion of

the expense recorded in the first five years. The amortization of the value ascribed to the PBM agreement is

reflected as a reduction of revenue. These assets are included in other intangible assets on the consolidated balance

sheet. The acquired intangible assets were valued using an income approach.

The excess of purchase price over tangible net assets and identified intangible assets acquired has been

allocated to goodwill in the amount of $2,668.9 million. The goodwill is the residual value after identified assets are

separately valued and represents the result of expected buyer-specific synergies derived from our ability to drive

growth in generic and mail order utilization, supply chain savings from both drug manufacturers and the retail

network, and the tax benefits derived from the Section 338(h)(10) election under the Internal Revenue Code. All

goodwill recognized as part of the NextRx acquisition is reported under our PBM segment.

During the second quarter of 2010, we recorded a pre-tax benefit of $30.0 million related to the amendment

of a client contract which relieved us of certain contractual guarantees. This amount was originally accrued in the

NextRx opening balance sheet. In accordance with business combination accounting guidance, the reversal of the

accrual was recorded in revenue, since it relates to client guarantees, upon amendment of the contract during the

second quarter of 2010.

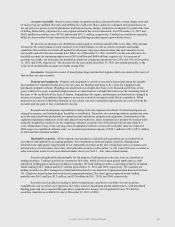

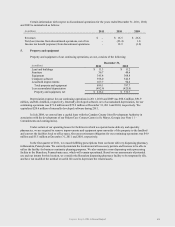

4. Discontinued operations

On September 17, 2010, we completed the sale of our PMG line of business. Upon classification as a

discontinued operation in the second quarter of 2010, an impairment charge of $28.2 million was recorded to reflect

goodwill and intangible asset impairment and the subsequent write-down of PMG assets to fair market value. The

loss on the sale as well as other charges related to discontinued operations during the third quarter of 2010 totaled

$8.3 million. These charges are included in the ―Net (loss) income from discontinued operations, net of tax‖ line

item in the accompanying statement of operations for the year ended December 31, 2010.

Prior to being classified as a discontinued operation, PMG was included in our EM segment. PMG was

headquartered in Lincoln Park, New Jersey and provided outsourced distribution and verification services to

pharmaceutical manufacturers.

The results of operations for PMG are reported as discontinued operations for all periods presented in the

accompanying consolidated statements of operations in accordance with applicable accounting guidance.

Additionally, for all periods presented, cash flows of our discontinued operations are segregated in our

accompanying consolidated statement of cash flows. No assets or liabilities of discontinued operations were held at

December 31, 2011 or 2010.