Express Scripts 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2011 Annual Report 71

66

accumulated amortization of $4.0 million), consisting of trade names and customer relationships. The impairment

charge is included in the ―Net (loss) income from discontinued operations, net of tax‖ line item in the accompanying

consolidated statement of operations.

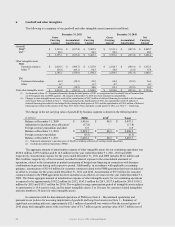

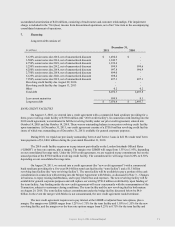

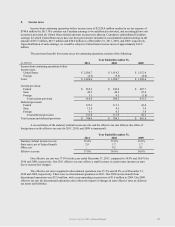

7. Financing

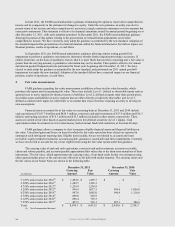

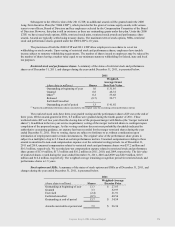

Long-term debt consists of:

December 31,

(in millions)

2011

2010

3.125% senior notes due 2016, net of unamortized discount

$ 1,494.6

$ -

3.500% senior notes due 2016, net of unamortized discount

1,249.7

-

4.750% senior notes due 2021, net of unamortized discount

1,239.4

-

5.250% senior notes due 2012, net of unamortized discount

999.9

999.6

6.250% senior notes due 2014, net of unamortized discount

997.8

996.9

2.750% senior notes due 2014, net of unamortized discount

899.0

-

6.125% senior notes due 2041, net of unamortized discount

698.4

-

7.250% senior notes due 2019, net of unamortized discount

497.3

497.1

Revolving credit facility due August 29, 2016

-

-

Revolving credit facility due August 13, 2013

-

-

Other

0.2

0.2

Total debt

8,076.3

2,493.8

Less current maturities

999.9

0.1

Long-term debt

$ 7,076.4

$ 2,493.7

BANK CREDIT FACILITIES

On August 13, 2010, we entered into a credit agreement with a commercial bank syndicate providing for a

three-year revolving credit facility of $750.0 million (the ―2010 credit facility‖). In connection with entering into the

2010 credit agreement, we terminated in full the revolving facility under our prior credit agreement, entered into

October 14, 2005 and due October 14, 2010. There was no outstanding balance in our prior revolving credit facility

upon termination. At December 31, 2011, our credit agreement consists of a $750.0 million revolving credit facility

(none of which was outstanding as of December 31, 2011) available for general corporate purposes.

During 2010, we repaid our previously outstanding Term A and Term-1 loans in full. We made total Term

loan payments of $1,340.0 million during the year ended December 31, 2010.

The 2010 credit facility requires us to pay interest periodically on the London Interbank Offered Rates

(―LIBOR‖) or base rate options, plus a margin. The margin over LIBOR will range from 1.55% to 1.95%, depending

on our consolidated leverage ratio. Under the 2010 credit agreement, we are required to pay commitment fees on the

unused portion of the $750.0 million revolving credit facility. The commitment fee will range from 0.20% to 0.30%

depending on our consolidated leverage ratio.

On August 29, 2011, we entered into a credit agreement (the ―new credit agreement‖) with a commercial

bank syndicate providing for a five-year $4.0 billion term loan facility (the ―term facility‖) and a $1.5 billion

revolving loan facility (the ―new revolving facility‖). The term facility will be available to pay a portion of the cash

consideration in connection with entering into the Merger Agreement with Medco, as discussed in Note 3 – Changes

in business, to repay existing indebtedness, and to pay related fees and expenses. The new revolving facility will be

available for general corporate purposes and will replace our existing $750.0 million credit facility upon funding of

the term facility. Any funding under the new credit agreement will occur concurrently with the consummation of the

Transaction, subject to customary closing conditions. The term facility and the new revolving facility both mature

on August 29, 2016. The term facility reduces commitments under the bridge facility discussed below by $4.0

billion. In the event the merger with Medco is not consummated, the new credit agreement would terminate.

The new credit agreement requires us to pay interest at the LIBOR or adjusted base rate options, plus a

margin. The margin over LIBOR ranges from 1.25% to 1.75% for the term facility and 1.10% to 1.55% for the new

revolving facility, and the margin over the base rate options ranges from 0.25% to 0.75% for the term facility and