Express Scripts 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2011 Annual Report

40

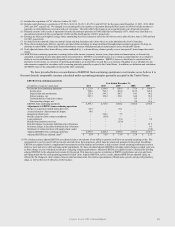

Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations

OVERVIEW

As one of the largest full-service pharmacy benefit management (―PBM‖) companies in North America, we

provide healthcare management and administration services on behalf of our clients, which include health maintenance

organizations, health insurers, third-party administrators, employers, union-sponsored benefit plans, workers’ compensation

plans, and government health programs. We report segments on the basis of services offered and have determined we have

two reportable segments: PBM and Emerging Markets (―EM‖). During the third quarter of 2011 we reorganized our

FreedomFP line of business from our EM segment into our PBM segment. Our integrated PBM services include network

claims processing, home delivery services, patient care and direct specialty home delivery to patients, benefit plan design

consultation, drug utilization review, formulary management, drug data analysis services, distribution of injectable drugs to

patient homes and physician offices, bio-pharma services, fertility services to providers and patients, and fulfillment of

prescriptions to low-income patients through manufacturer-sponsored patient assistance programs.

Through our EM segment, we provide services including distribution of pharmaceuticals and medical supplies to

providers and clinics and healthcare administration and implementation of consumer-directed healthcare solutions.

Revenue generated by our segments can be classified as either tangible product revenue or service revenue. We

earn tangible product revenue from the sale of prescription drugs by retail pharmacies in our retail pharmacy networks and

from dispensing prescription drugs from our home delivery and specialty pharmacies. Service revenue includes

administrative fees associated with the administration of retail pharmacy networks contracted by certain clients, medication

counseling services, and certain specialty distribution services. Tangible product revenue generated by our PBM and EM

segments represented 99.4% of revenues for the year ended December 31, 2011 as compared to 99.4% and 98.9% for the

years ended December 31, 2010 and 2009, respectively.

PROPOSED MERGER TRANSACTION

On July 20, 2011, we entered into a definitive merger agreement (the ―Merger Agreement‖) with Medco Health

Solutions, Inc. (―Medco‖) , which was amended by Amendment No. 1 thereto on November 7, 2011, providing for the

combination of Express Scripts and Medco under a new holding company named Aristotle Holding, Inc. (which we refer to

as ―New Express Scripts‖). It is expected that Aristotle Holding, Inc. will be renamed Express Scripts Holding Company

after the consummation of the mergers. As a result of the transactions contemplated by the Merger Agreement (―the

Transaction‖), Medco and Express Scripts will each become wholly owned subsidiaries of New Express Scripts and former

Medco and Express Scripts stockholders will own stock in New Express Scripts, which is expected to be listed for trading

on the NASDAQ. Upon closing of the Transaction, our shareholders are expected to own approximately 59% of New

Express Scripts and Medco shareholders are expected to own approximately 41%. The Merger Agreement provides that,

upon the terms and subject to the conditions set forth in the Merger Agreement upon closing of the Transaction, each share

of Medco common stock will be converted into (i) the right to receive $28.80 in cash, without interest and (ii) 0.81 shares

of New Express Scripts stock. Based on the closing price of our stock on December 31, 2011, this payment would be in an

aggregate amount of approximately $25.9 billion, composed of per share payments equal to $65.00 in cash and stock of

New Express Scripts. We anticipate the Transaction will close in the first half of 2012. The Merger Agreement was adopted

by the affirmative vote of the stockholders of each of Express Scripts and Medco in December 2011. The consummation of

the Transaction is subject to regulatory clearance and other customary closing conditions, and will be accounted for under

the authoritative guidance for business combinations. Refer to Note 3 – Changes in business for further discussion of the

proposed merger.

RECENT DEVELOPMENTS

As previously noted in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2011, Walgreen

Co. (―Walgreens‖), a member of certain of our pharmacy provider networks, announced on June 21, 2011, its intention to

no longer participate in such networks following the expiration of our contract at the end of 2011. Contract negotiations

with network pharmacy providers are part of the normal course of our business; however, we were not able to agree on

terms, conditions and rates that were fair for our clients and members. As a result, the contract with Walgreens expired on

December 31, 2011. Excluding Walgreens, our retail network consists of approximately 55,000 pharmacy locations and

satisfies all client guarantees for access. We received strong support from our clients and more than 95% of our clients’

volume moved forward into 2012 without Walgreens in the network. Express Scripts provided a full array of tools and

resources to help members efficiently transfer prescriptions to another conveniently located pharmacy. We remain open to

negotiations with Walgreens in the future.