Express Scripts 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2011 Annual Report

52

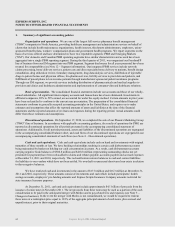

BANK CREDIT FACILITY

On August 13, 2010, we entered into a credit agreement with a commercial bank syndicate providing for a three-

year revolving credit facility of $750.0 million. In connection with entering into the credit agreement, we terminated in full

the revolving facility under our prior credit agreement, entered into October 14, 2005 and due October 14, 2010. There was

no outstanding balance in our prior revolving credit facility upon termination. At December 31, 2011, our credit agreement

consists of a $750.0 million revolving credit facility (none of which was outstanding as of December 31, 2011) available

for general corporate purposes.

During the third quarter of 2010, we repaid the Term A and Term-1 loans in full. We made total Term loan

payments of $1,340.0 million during the year ended December 31, 2010.

On August 29, 2011, we entered into a credit agreement (the ―new credit agreement‖) with a commercial bank

syndicate providing for a five-year $4.0 billion term loan facility (the ―term facility‖) and a $1.5 billion revolving loan

facility (the ―new revolving facility‖). The term facility will be available to pay a portion of the cash consideration in

connection with the Medco Transaction, to repay existing indebtedness, and to pay related fees and expenses. The new

revolving facility will be available for general corporate purposes and will replace our $750.0 million credit facility upon

funding of the term facility. Any funding under the new credit agreement will occur concurrently with the consummation of

the Transaction, subject to customary closing conditions. The term facility and new revolving facility both mature on

August 29, 2016. The term facility reduces commitments under the bridge facility discussed below by $4.0 billion. In the

event the merger with Medco is not consummated, the new credit agreement would terminate.

Our credit agreements contain covenants which limit our ability to incur additional indebtedness, create or permit

liens on assets, and engage in mergers, consolidations, or disposals. The covenants also include a minimum interest

coverage ratio and a maximum leverage ratio. At December 31, 2011, we believe we were in compliance in all material

respects with all covenants associated with our credit agreements.

See Note 7 – Financing for more information on our credit facilities.

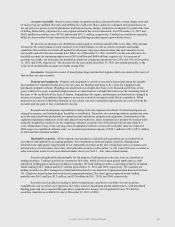

BRIDGE FACILITY

On August 5, 2011, we entered into a credit agreement with Credit Suisse AG, Cayman Islands Branch, as

administrative agent, Citibank, N.A., as syndication agent, and the other lenders and agents named within the agreement.

The credit agreement provides for a one-year unsecured $14.0 billion bridge term loan facility (the ―bridge facility‖). In the

period leading up to the closing of the merger, we may pursue other financing opportunities to replace all or portions of the

bridge facility, or, in the event that we draw upon the bridge facility, we may refinance all or a portion of the bridge facility

at a later date. The proceeds from these borrowings may be used to pay a portion of the cash consideration to be paid in the

merger and to pay related fees and expenses. The term facility and the net proceeds from the November 2011 Senior Notes,

discussed above, reduced commitments under the bridge facility by $4.0 billion and $4.1 billion, respectively. At December

31, 2011, $5.9 billion is available for borrowing under the bridge facility. The issuance of the February 2012 Senior Notes

further reduced the amount available for borrowing under the bridge facility to $2.4 billion.

The bridge facility contains covenants that restrict our ability to incur additional indebtedness, create or permit

liens on assets and engage in mergers or consolidations other than such agreed upon actions taken in connection with the

Transaction. The covenants also include a minimum interest coverage ratio and a maximum leverage ratio. At December

31, 2011, we believe we were in compliance in all material respects with all covenants associated with the bridge facility.

See Note 7 – Financing for more information on the bridge facility.