Express Scripts 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2011 Annual Report 65

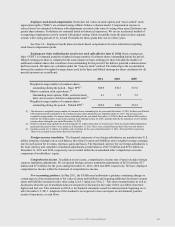

Employee stock-based compensation. Grant-date fair values of stock options and ―stock-settled‖ stock

appreciation rights (―SSRs‖) are estimated using a Black-Scholes valuation model. Compensation expense is

reduced based on estimated forfeitures with adjustments recorded at the time of vesting when actual forfeitures are

greater than estimates. Forfeitures are estimated based on historical experience. We use an accelerated method of

recognizing compensation cost for awards with graded vesting, which essentially treats the grant as three separate

awards, with vesting periods of 12, 24 and 36 months for those grants that vest over three years.

See Note 10 – Employee benefit plans and stock-based compensation for more information regarding

stock-based compensation plans.

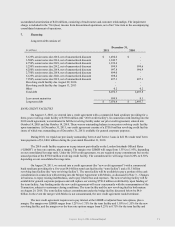

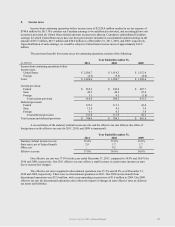

Earnings per share (reflecting the two-for-one stock split effective June 8, 2010). Basic earnings per

share (―EPS‖) is computed using the weighted average number of common shares outstanding during the period.

Diluted earnings per share is computed in the same manner as basic earnings per share but adds the number of

additional common shares that would have been outstanding for the period if the dilutive potential common shares

had been issued. All shares are calculated under the ―treasury stock‖ method. The following is the reconciliation

between the number of weighted average shares used in the basic and diluted earnings per share calculation for all

periods (amounts are in millions):

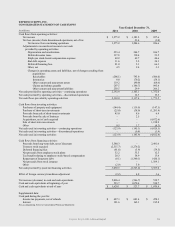

2011 2010 2009

Weighted average number of common shares

outstanding during the period – Basic EPS(1)

500.9

538.5

527.0

Dilutive common stock equivalents: (2)

Outstanding stock options, SSRs, restricted stock

units, and executive deferred compensation units

(3)

4.1

5.5

5.2

Weighted average number of common shares

outstanding during the period – Diluted EPS(1)

505.0

544.0

532.2

(1) The decrease in weighted average number of common shares outstanding for the year ended December 31, 2011 for Basic and Diluted

EPS resulted from the repurchase of 46.4 million treasury shares during the year ended December 31, 2011. The increase in the

weighted average number of common shares outstanding for the year ended December 31, 2010 for Basic and Diluted EPS resulted

from the 52.9 million shares issued in the common stock offering on June 10, 2009, partially offset by the repurchase of 26.9 million

treasury shares during the year ended December 31, 2010.

(2) Dilutive common stock equivalents do not include the 0.1 million shares that we would receive if the Accelerated Share Repurchase

agreement discussed in Note 9 were settled as of December 31, 2011. These were excluded because their effect was anti-dilutive.

(3) Excludes awards of 3.3 million, 2.8 million, and 1.6 million for the years ended December 31, 2011, 2010 and 2009, respectively.

These were excluded because their effect was anti-dilutive.

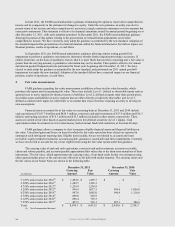

Foreign currency translation. The financial statements of our foreign subsidiaries are translated into U.S.

dollars using the exchange rate at each balance sheet date for assets and liabilities and a weighted average exchange

rate for each period for revenues, expenses, gains and losses. The functional currency for our foreign subsidiaries is

the local currency and cumulative translation adjustments (credit balances of $17.0 million and $19.8 million at

December 31, 2011 and 2010, respectively) are recorded within the accumulated other comprehensive income

component of stockholders’ equity.

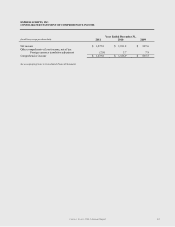

Comprehensive income. In addition to net income, comprehensive income (net of taxes) includes foreign

currency translation adjustments. We recognized foreign currency translation adjustments of $(2.8) million, $5.7

million and $7.9 million for the years ending December 31, 2011, 2010 and 2009, respectively. We have displayed

comprehensive income within the statement of comprehensive income.

New accounting guidance. In May 2011, the FASB issued authoritative guidance containing changes to

certain aspects of the measurement of fair value of assets and liabilities and requiring additional disclosures around

assets and liabilities measured at fair value using Level 3 inputs (see Note 2 – Fair value measurements) as well as

disclosures about the use of nonfinancial assets measured or disclosed at fair value if their use differs from their

highest and best use. This statement is effective for financial statements issued for annual periods beginning on or

after December 15, 2011. Adoption of the standard is not expected to have an impact on our financial position,

results of operations, or cash flows.