Express Scripts 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2011 Annual Report 69

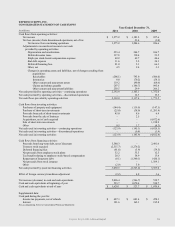

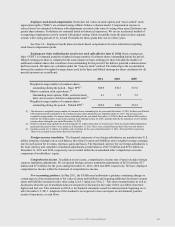

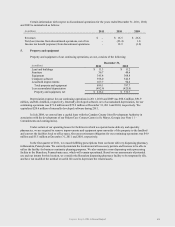

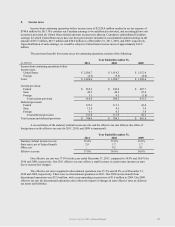

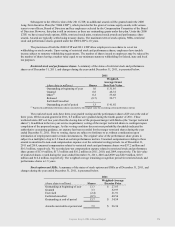

Certain information with respect to discontinued operations for the years ended December 31, 2011, 2010,

and 2009 is summarized as follows:

(in millions)

2011

2010

2009

Revenues

$ -

$ 16.5

$ 26.6

Net (loss) income from discontinued operations, net of tax

-

(23.4)

1.0

Income tax benefit (expense) from discontinued operations

-

12.9

(1.8)

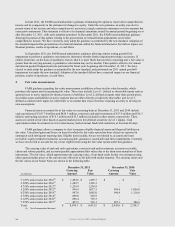

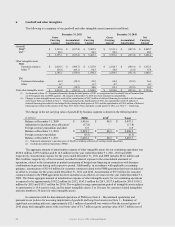

5. Property and equipment

Property and equipment of our continuing operations, at cost, consists of the following:

December 31,

(in millions)

2011

2010

Land and buildings

$ 11.3

$ 11.2

Furniture

36.7

40.6

Equipment

345.4

308.8

Computer software

398.0

342.5

Leasehold improvements

107.7

94.6

Total property and equipment

899.1

797.7

Less accumulated depreciation

(482.9)

(425.0)

Property and equipment, net

$ 416.2

$ 372.7

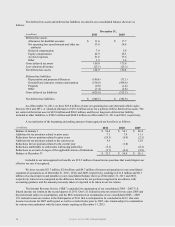

Depreciation expense for our continuing operations in 2011, 2010 and 2009 was $98.6 million, $91.9

million, and $62.4 million, respectively. Internally developed software, net of accumulated depreciation, for our

continuing operations was $71.4 million and $72.9 million at December 31, 2011 and 2010, respectively. We

capitalized $20.6 million of internally developed software during 2011.

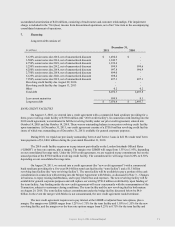

In July 2004, we entered into a capital lease with the Camden County Joint Development Authority in

association with the development of our Patient Care Contact Center in St. Marys, Georgia (see Note 11 –

Commitments and contingencies).

Under certain of our operating leases for facilities in which we operate home delivery and specialty

pharmacies, we are required to remove improvements and equipment upon surrender of the property to the landlord

and convert the facilities back to office space. Our asset retirement obligation for our continuing operations was $4.9

million and $5.5 million at December 31, 2011 and 2010, respectively.

In the first quarter of 2011, we ceased fulfilling prescriptions from our home delivery dispensing pharmacy

in Bensalem, Pennsylvania. We currently maintain the location and all necessary permits and licenses to be able to

utilize the facility for business continuity planning purposes. We also maintain a non-dispensing order processing

facility in the Bensalem, Pennsylvania area, which will remain operational. Based on our assessments of potential

use and our intents for this location, we consider the Bensalem dispensing pharmacy facility to be temporarily idle,

and have not modified the method or useful life used to depreciate the related assets.