Express Scripts 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2011 Annual Report

66

61

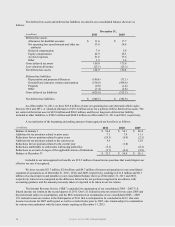

In June 2011, the FASB issued authoritative guidance eliminating the option to report other comprehensive

income and its components in the statement of changes in equity. Under the new guidance, an entity can elect to

present items of net income and other comprehensive income in a single continuous statement or in two separate but

consecutive statements. This statement is effective for financial statements issued for annual periods beginning on or

after December 15, 2011, with early adoption permitted. In December 2011, the FASB issued additional guidance

delaying the portion of this update relating to the presentation of reclassification adjustments out of other

comprehensive income. We have elected to early adopt the guidance as permitted by the new standard. Adoption of

the standard impacted the presentation of certain information within the financial statements, but did not impact our

financial position, results of operations, or cash flows.

In September 2011, the FASB issued authoritative guidance allowing entities testing goodwill for

impairment to perform a qualitative assessment to determine whether further impairment testing is necessary. If

entities determine, on the basis of qualitative factors, that it is more likely than not that a reporting unit’s fair value is

greater than the carrying amount, a quantitative calculation may not be needed. This update is effective for annual

and interim goodwill impairment tests performed for fiscal years beginning after December 15, 2011. We have

elected to early adopt the guidance as permitted by the new standard, and performed our 2011 annual goodwill

impairment test under the new standard. Adoption of the standard did not have a material impact on our financial

position, results of operations, or cash flows.

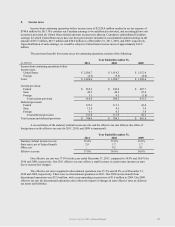

2. Fair value measurements

FASB guidance regarding fair value measurement establishes a three-tier fair value hierarchy, which

prioritizes the inputs used in measuring fair value. These tiers include: Level 1, defined as observable inputs such as

quoted prices in active markets for identical assets or liabilities; Level 2, defined as inputs other than quoted prices

for similar assets and liabilities in active markets that are either directly or indirectly observable; and Level 3,

defined as unobservable inputs for which little or no market data exists, therefore requiring an entity to develop its

own assumptions.

Financial assets accounted for at fair value on a recurring basis at December 31, 2011 and 2010 include

cash equivalents of $1,817.4 million and $426.3 million, restricted cash and investments of $17.8 million and $16.3

million, and trading securities of $14.1 million and $13.5 million (included in other assets), respectively. These

assets are carried at fair value based on quoted market prices for identical securities (Level 1 inputs). Cash

equivalents include investments in AAA-rated money market mutual funds with maturities of less than 90 days.

FASB guidance allows a company to elect to measure eligible financial assets and financial liabilities at

fair value. Unrealized gains and losses on items for which the fair value option has been elected are reported in

earnings at each subsequent reporting date. Eligible items include, but are not limited to, accounts and loans

receivable, equity method investments, accounts payable, guarantees, issued debt and firm commitments. Currently,

we have not elected to account for any of our eligible items using the fair value option under this guidance.

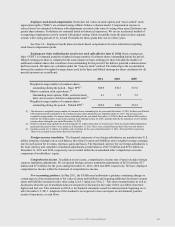

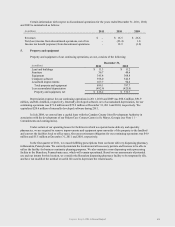

The carrying value of cash and cash equivalents, restricted cash and investments, accounts receivable,

claims and rebates payable, and accounts payable approximated fair values due to the short-term maturities of these

instruments. The fair value, which approximates the carrying value, of our bank credit facility was estimated using

either quoted market prices or the current rates offered to us for debt with similar maturity. The carrying values and

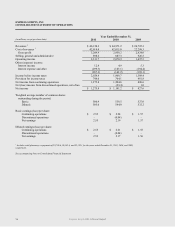

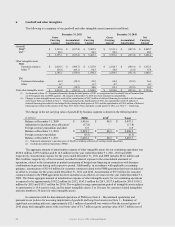

the fair values of our Senior Notes are shown in the following table:

December 31, 2011

December 31, 2010

(in millions)

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

3.125% senior notes due 2016(1)

$

1,494.6

$

1,493.7

$

-

$

-

3.500% senior notes due 2016(1)

1,249.7

1,265.3

-

-

4.750% senior notes due 2021(1)

1,239.4

1,295.8

-

-

5.250% senior notes due 2012(1)

999.9

1,017.5

999.6

1,056.0

6.250% senior notes due 2014(1)

997.8

1,085.0

996.9

1,116.0

2.750% senior notes due 2014(1)

899.0

907.8

-

-

6.125% senior notes due 2041(1)

698.4

755.3

-

-

7.250% senior notes due 2019

(1)

497.3

593.1

497.1

586.3

Total

$

8,076.1

$

8,413.5

$

2,493.6

$

2,758.3

(1) Net of unamortized discount