Express Scripts 2011 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2011 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2011 Annual Report 45

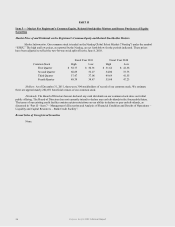

RESULTS OF OPERATIONS

We maintain a PBM segment, consisting of our domestic and Canadian PBM operations, and specialty pharmacy

operations, which includes providing fertility services to providers and patients, and an EM segment, which consists of

distribution of pharmaceuticals and medical supplies to providers and clinics and healthcare administration and

implementation of consumer-directed healthcare solutions. During the third quarter of 2011, we reorganized our

FreedomFP line of business from our EM segment into our PBM segment. Results of operations for the years presented

below have been restated for comparability. Within our EM segment, we have initiated an assessment of our strategic

options for our ConnectYourCare (―CYC‖) line of business, including whether CYC continues to be core to our future

operations.

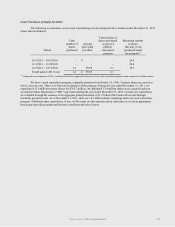

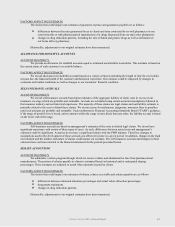

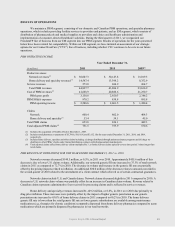

PBM OPERATING INCOME

Year Ended December 31,

(in millions)

2011

2010

2009

(1)

Product revenues:

Network revenues(2)

$ 30,007.3

$ 30,147.8

$ 15,019.3

Home delivery and specialty revenues(3)

14,547.4

13,398.2

8,352.9

Service revenues

273.0

260.9

264.7

Total PBM revenues

44,827.7

43,806.9

23,636.9

Cost of PBM revenues(2)

41,668.9

40,886.6

21,250.7

PBM gross profit

3,158.8

2,920.3

2,386.2

PBM SG&A expenses

870.2

858.8

895.8

PBM operating income

$ 2,288.6

$ 2,061.5

$ 1,490.4

Claims

Network

600.4

602.0

404.3

Home delivery and specialty(3)

53.4

54.1

45.0

Total PBM claims

653.8

656.1

449.3

Total adjusted PBM claims(4) 751.5 753.9 530.6

(1) Includes the acquisition of NextRx effective December 1, 2009.

(2) Includes retail pharmacy co-payments of $5,786.6, $6,181.4, and $3,132.1for the years ended December 31, 2011, 2010, and 2009,

respectively.

(3) Includes home delivery, specialty and other claims including: (a) drugs distributed through patient assistance programs and (b) drugs we

distribute to other PBMs’ clients under limited distribution contracts with pharmaceutical manufacturers.

(4) Total adjusted claims reflect home delivery claims multiplied by 3, as home delivery claims typically cover a time period 3 times longer than

retail claims.

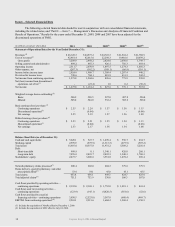

PBM RESULTS OF OPERATIONS FOR THE YEAR ENDED DECEMBER 31, 2011 vs. 2010

Network revenues decreased $140.5 million, or 0.5%, in 2011 over 2010. Approximately $455.6 million of this

decrease is due to lower U.S. claims volume. Additionally, our network generic fill rate increased to 75.3% of total network

claims in 2011 as compared to 72.7% in 2010. The decrease in volume and increase in the generic fill rate are partially

offset by the pricing impacts related to inflation. An additional $30.0 million of the decrease relates to amounts recorded in

the second quarter of 2010 related to the amendment of a client contract which relieved us of certain contractual guarantees.

Network claims include U.S. and Canada claims. Network claims decreased slightly in 2011 compared to 2010. A

decrease in U.S. network claim volume was partially offset by an increase in Canadian claim volume. Revenue related to

Canadian claims represents administrative fees received for processing claims and is reflected in service revenues.

Home delivery and specialty revenues increased $1,149.2 million, or 8.6%, in 2011 over 2010 due primarily to

drug price inflation. These increases were partially offset by the impact of higher generic penetration as our generic

penetration rate increased to 63.0% of home delivery claims in 2011 compared to 60.2% in 2010. The home delivery

generic fill rate is lower than the retail generic fill rate as fewer generic substitutions are available among maintenance

medications (e.g., therapies for chronic conditions) commonly dispensed from home delivery pharmacies compared to acute

medications which are primarily dispensed by pharmacies in our retail networks.