Express Scripts 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

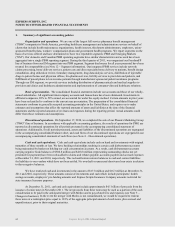

Express Scripts 2011 Annual Report 67

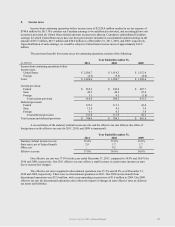

The fair values of our senior notes were estimated based on quoted prices in active markets for identical

securities (Level 1 inputs). In determining the fair value of liabilities, we took into consideration the risk of

nonperformance. Nonperformance risk refers to the risk that the obligation will not be fulfilled and affects the value

at which the liability would be transferred to a market participant. This risk did not have a material impact on the

fair value of our liabilities.

3. Changes in business

Proposed merger transaction. On July 20, 2011, we entered into a definitive merger agreement (the

―Merger Agreement‖) with Medco Health Solutions, Inc. (―Medco‖), which was amended by Amendment No. 1

thereto on November 7, 2011, providing for the combination of Express Scripts and Medco under a new holding

company named Aristotle Holding, Inc. (which we refer to as ―New Express Scripts‖). It is expected that Aristotle

Holding, Inc. will be renamed Express Scripts Holding Company after the consummation of the mergers. As a result

of the transactions contemplated by the Merger Agreement (―the Transaction‖), Medco and Express Scripts will

each become wholly owned subsidiaries of New Express Scripts and former Medco and Express Scripts

stockholders will own stock in New Express Scripts, which is expected to be listed for trading on the NASDAQ.

Upon closing of the Transaction, our shareholders are expected to own approximately 59% of New Express Scripts

and Medco shareholders are expected to own approximately 41%. The Merger Agreement provides that, upon the

terms and subject to the conditions set forth in the Merger Agreement upon closing of the Transaction, each share of

Medco common stock will be converted into (i) the right to receive $28.80 in cash, without interest and (ii) 0.81

shares of New Express Scripts stock. Based on the closing price of our stock on December 31, 2011, this payment

would be in an aggregate amount of approximately $25.9 billion, composed of per share payments equal to $65.00

in cash and stock of New Express Scripts. The merger will combine the expertise of two complementary pharmacy

benefit managers to accelerate efforts to lower the cost of prescription drugs and improve the quality of care. As

previously disclosed by Medco and Express Scripts, the Merger Agreement was adopted by the affirmative vote of

the stockholders of each of Express Scripts and Medco in December 2011. The consummation of the Transaction is

subject to regulatory clearance and other customary closing conditions, and will be accounted for under the

authoritative guidance for business combinations.

Consummation of the Transaction is subject to the expiration or termination of the waiting period under the

United States Hart-Scott-Rodino Antitrust Improvements Act of 1976 (the ―HSR Act‖) and other customary

conditions, including (i) the approval for listing on the Nasdaq Stock Market of the common stock of a New Express

Scripts (ii) the absence of any order prohibiting or restraining the merger, (iii) the receipt of certain regulatory

consents, (iv) subject to certain exceptions, the accuracy of Medco’s and Express Scripts’ representations and

warranties in the Merger Agreement, (v) performance by Medco and Express Scripts of their respective obligations

in the Merger Agreement, (vi) the absence of certain governmental appeals, and (vii) the delivery of customary

opinions from counsel to Medco and Express Scripts to the effect that the Transaction will qualify as a tax-free

exchange for federal income tax purposes.

If the Transaction is not completed we could be liable to Medco for termination fees in connection with the

termination of the Merger Agreement, depending on the reasons leading to such termination, and/or the

reimbursement of certain of Medco’s expenses, in amounts up to $950 million.

On September 2, 2011, Express Scripts and Medco each received a request for additional information (a

―second request‖) from the U.S. Federal Trade Commission (the ―FTC‖) in connection with the FTC’s review of the

merger. A second request was anticipated by the parties to the mergers at the time of signing of the Merger

Agreement. The companies have been cooperating with the FTC staff since shortly after the announcement of the

merger and intend to continue to work cooperatively with the FTC staff in the review of the merger. On

February 10, 2012, each of Express Scripts and Medco certified as to its substantial compliance with the second

request. Completion of the merger remains subject to the expiration or termination of the waiting period under the

HSR Act and other customary closing conditions. We continue to anticipate that the merger will be completed in the

first half of 2012.

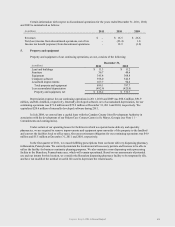

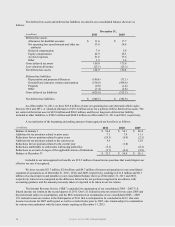

Acquisitions. On December 1, 2009, we completed the purchase of 100% of the shares and equity interests

of certain subsidiaries of WellPoint that provide pharmacy benefit management services the ―NextRx PBM

Business‖) in exchange for total consideration of $4,675.0 million paid in cash. The working capital adjustment was

finalized during the second quarter of 2010 and reduced the purchase price by $8.3 million, resulting in a final

purchase price of $4,666.7 million. The NextRx PBM Business is a national provider of PBM services, and we

believe the acquisition will enhance our ability to achieve cost savings, innovations, and operational efficiencies