Express Scripts 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2011 Annual Report

60

EXPRESS SCRIPTS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

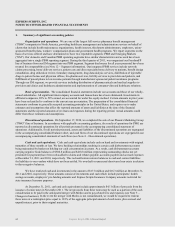

1. Summary of significant accounting policies

Organization and operations. We are one of the largest full-service pharmacy benefit management

(―PBM‖) companies in North America, providing healthcare management and administration services on behalf of

clients that include health maintenance organizations, health insurers, third-party administrators, employers, union-

sponsored benefit plans, workers’ compensation plans and government health programs. We report segments on the

basis of services offered and have determined we have two reportable segments: PBM and Emerging Markets

(―EM‖). Our domestic and Canadian PBM operating segments have similar characteristics and as such have been

aggregated into a single PBM reporting segment. During the third quarter of 2011, we reorganized our FreedomFP

line of business from our EM segment into our PBM segment. Segment disclosures for all years presented have been

restated for comparability (see Note 12 – Segment information). Our integrated PBM services include network

claims processing, home delivery services, patient care and direct specialty home delivery to patients, benefit design

consultation, drug utilization review, formulary management, drug data analysis services, distribution of injectable

drugs to patient homes and physician offices, bio-pharma services, fertility services to providers and patients, and

fulfillment of prescriptions to low-income patients through manufacturer-sponsored patient assistance programs.

Through our EM segment, we provide services including distribution of pharmaceuticals and medical supplies to

providers and clinics and healthcare administration and implementation of consumer-directed healthcare solutions.

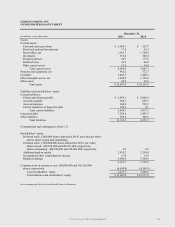

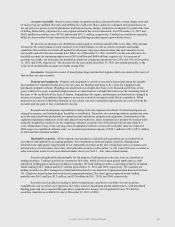

Basis of presentation. The consolidated financial statements include our accounts and those of our wholly-

owned subsidiaries. All significant intercompany accounts and transactions have been eliminated. Investments in

affiliated companies, 20% to 50% owned, are accounted for under the equity method. Certain amounts in prior years

have been reclassified to conform to the current year presentation. The preparation of the consolidated financial

statements conforms to generally accepted accounting principles in the United States, and requires us to make

estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during the reporting period. Actual amounts could

differ from those estimates and assumptions.

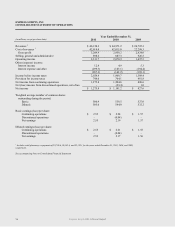

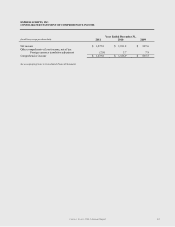

Discontinued operations. On September 17, 2010, we completed the sale of our Phoenix Marketing Group

(―PMG‖) line of business. In accordance with applicable accounting guidance, the results of operations for PMG are

reported as discontinued operations for all periods presented in the accompanying consolidated statement of

operations. Additionally, for all periods presented, assets and liabilities of the discontinued operations are segregated

in the accompanying consolidated balance sheet, and cash flows of our discontinued operations are segregated in our

accompanying consolidated statement of cash flows (see Note 4 – Discontinued operations).

Cash and cash equivalents. Cash and cash equivalents include cash on hand and investments with original

maturities of three months or less. We have banking relationships resulting in certain cash disbursement accounts

being maintained by banks not holding our cash concentration accounts. As a result, cash disbursement accounts

carrying negative book balances of $506.8 million and $418.8 million (representing outstanding checks not yet

presented for payment) have been reclassified to claims and rebates payable, accounts payable and accrued expenses

at December 31, 2011 and 2010, respectively. This reclassification restores balances to cash and current liabilities

for liabilities to our vendors which have not been settled. No overdraft or unsecured short-term loan exists in relation

to these negative balances.

We have restricted cash and investments in the amount of $17.8 million and $16.3 million at December 31,

2011 and 2010, respectively. These amounts consist of investments and cash which include participants’ health

savings accounts, employers’ pre-funding amounts and Express Scripts Insurance Company amounts restricted for

state insurance licensure purposes.

At December 31, 2011, cash and cash equivalents include approximately $4.1 billion of proceeds from the

issuance of senior notes in November 2011. The net proceeds from these notes may be used as a portion of the cash

consideration to be paid in the anticipated merger with Medco and to pay related fees and expenses (see Note 3 –

Changes in business). In the event the merger with Medco is not consummated, we would be required to redeem

these notes at a redemption price equal to 101% of the aggregate principal amount of such notes, plus accrued and

unpaid interest, prior to their original maturities.