Express Scripts 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2011 Annual Report

50

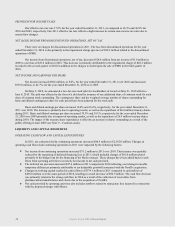

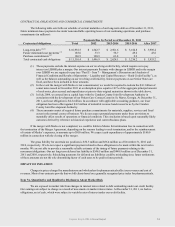

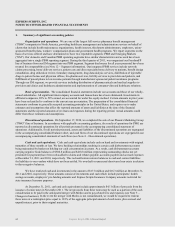

In February 2012, we issued $3.5 billion of Senior Notes (the ―February 2012 Senior Notes‖) in a private

placement with registration rights, including:

$1.0 billion aggregate principal amount of 2.100% Senior Notes due 2015

$1.5 billion aggregate principal amount of 2.650% Senior Notes due 2017

$1.0 billion aggregate principal amount of 3.900% Senior Notes due 2022

This issuance resulted in proceeds (net of discounts) of $3,458.9 million. These notes were issued through our

subsidiary, Aristotle Holding, Inc., which was organized for the purpose of effecting the transactions contemplated under

the Merger Agreement with Medco. The net proceeds may be used to pay a portion of the cash consideration to be paid in

the Medco Transaction and to pay related fees and expenses. In the event the merger with Medco is not consummated, we

would be required to redeem the February 2012 Senior Notes issued at a redemption price equal to 101% of the aggregate

principal amount of such notes, plus accrued and unpaid interest, prior to their original maturities. This issuance reduces the

amount available for withdrawal under the bridge facility discussed in Note 7 – Financing to $2.4 billion.

Our current maturities of long term debt include approximately $1.0 billion of senior notes that will mature in June

2012. We anticipate that our current cash balances, cash flows from operations and our revolving credit facility will be

sufficient to meet our cash needs and make scheduled payments for our contractual obligations and current capital

commitments. However, if needs arise, we may decide to secure external capital to provide additional liquidity. New

sources of liquidity may include additional lines of credit, term loans, or issuance of notes or common stock, all of which

are allowable, with certain limitations, under our existing credit agreement. While our ability to secure debt financing in the

short term at rates favorable to us may be moderated due to various factors, including the financing incurred in connection

with the Transaction, market conditions or other factors, we believe our liquidity options discussed above are sufficient to

meet our cash flow needs.

ACQUISITIONS AND RELATED TRANSACTIONS

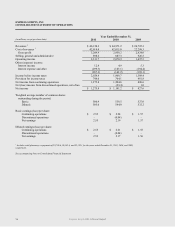

On July 20, 2011, we entered into the Merger Agreement with Medco, which was amended by Amendment No. 1

thereto on November 7, 2011, as discussed above. The Merger Agreement provides that, upon the terms and subject to the

conditions set forth in the Merger Agreement, Medco shareholders will receive total consideration of $25.9 billion

composed of $65.00 per share in cash and stock (valued based on the closing price of our stock on December 31, 2011),

including $28.80 in cash and 0.81 shares for each Medco share owned. As discussed below, we intend to finance all or a

portion of the cash component of the merger consideration with debt financing. We have obtained bridge financing in an

amount which we believe would be sufficient to allow us to complete the Transaction. In the period leading up to the

closing of the Transaction, we may pursue other financing opportunities to replace all or portions of the bridge facility, or,

in the event that we draw upon the bridge facility, we may refinance all or a portion of the bridge facility at a later date. We

anticipate the transaction will close in the first half of 2012. The Transaction was approved by Express Scripts’ and

Medco’s shareholders in December 2011. The consummation of the Transaction is subject to regulatory clearance and other

customary closing conditions, and will be accounted for under the authoritative guidance for business combinations. Based

on the estimated number of Medco shares outstanding at December 31, 2011, cash consideration transferred in connection

with the merger would be approximately $11.2 billion. We estimate approximately $160.0 million of additional cash

expenditures in connection with the closing of the Transaction.

On December 1, 2009, we completed the purchase of 100% of WellPoint’s NextRx PBM Business in exchange for

total consideration of $4,675.0 million paid in cash. The working capital adjustment was finalized during the second quarter

of 2010 and reduced the purchase price by $8.3 million, resulting in a final purchase price of $4,666.7 million. The NextRx

PBM Business is a national provider of PBM services, and we believe the acquisition will enhance our ability to achieve

cost savings, innovations, and operational efficiencies which will benefit our customers and stockholders. The purchase

price was primarily funded through the offering of senior notes and common stock. Our PBM operating results include

those of the NextRx PBM Business beginning on December 1, 2009, the date of acquisition (see Note 3 – Changes in

business).

We regularly review potential acquisitions and affiliation opportunities. We believe available cash resources, bank

financing or the issuance of additional common stock could be used to finance future acquisitions or affiliations. There can

be no assurance we will make new acquisitions or establish new affiliations in 2012 or thereafter.